Filing taxes can be a daunting task, but with the rise of online services, it has become easier and more convenient. One such service is submitting Form W-4V online. In this article, we will guide you through the process of submitting Form W-4V online in three easy steps.

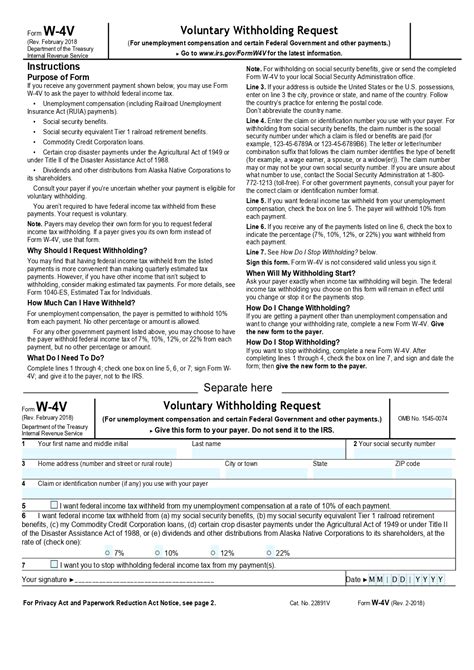

Taxes are an essential part of our civic duty, and it is crucial to file them correctly and on time. The W-4V form is used to voluntarily request federal income tax withholding from Social Security benefits, such as retirement, survivor, or disability benefits. Submitting this form online can save you time and hassle. Before we dive into the steps, let's understand why submitting Form W-4V online is beneficial.

Why Submit Form W-4V Online?

Submitting Form W-4V online offers several benefits, including:

- Convenience: You can submit the form from the comfort of your own home, 24/7.

- Speed: The online process is faster than mailing the form.

- Accuracy: The online system reduces the risk of errors.

- Security: Your information is protected by advanced security measures.

Now, let's move on to the three easy steps to submit Form W-4V online.

Step 1: Gather Required Information

Before you start the online submission process, make sure you have the following information readily available:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your name and address as they appear on your Social Security card

- Your bank account information (if you want to receive your refund via direct deposit)

- Your tax filing status (single, married, head of household, etc.)

What You Need to Know

- Make sure your browser is compatible with the online system.

- Use a secure internet connection to protect your information.

- Have a printer or printer-ready device available to print your confirmation page.

Step 2: Access the Online System

To access the online system, follow these steps:

- Visit the official website of the Social Security Administration (SSA) at .

- Click on the "Benefits" tab at the top of the page.

- Select "Retirement" or "Disability" benefits, depending on your situation.

- Click on the "Tax Withholding" link.

- Select "Voluntary Withholding" and then click on the "Submit Form W-4V Online" button.

Troubleshooting Tips

- If you encounter any issues during the online submission process, try clearing your browser cache and cookies.

- Make sure you have the latest version of your browser installed.

- If you still encounter issues, contact the SSA customer service for assistance.

Step 3: Complete and Submit the Form

Once you access the online system, follow these steps:

- Fill out the online Form W-4V with the required information.

- Review your information carefully to ensure accuracy.

- Click the "Submit" button to complete the process.

- Print or save your confirmation page for your records.

What to Expect Next

- The SSA will review your submission and update your records accordingly.

- You will receive a confirmation email or letter from the SSA.

- Your tax withholding will be adjusted according to your request.

Now that you have completed the three easy steps to submit Form W-4V online, you can rest assured that your tax withholding will be adjusted accordingly. Remember to keep a copy of your confirmation page for your records.

We hope this article has been helpful in guiding you through the process of submitting Form W-4V online. If you have any questions or need further assistance, please don't hesitate to comment below.

What is Form W-4V used for?

+Form W-4V is used to voluntarily request federal income tax withholding from Social Security benefits.

Can I submit Form W-4V online if I don't have a computer?

+How long does it take to process Form W-4V online?

+The online system processes Form W-4V instantly, and you will receive a confirmation page immediately.