Navigating the world of tax exemptions can be a daunting task, especially for those who are new to the process. In New York, the exemption claim form is a crucial document for individuals and businesses looking to claim exemptions from certain taxes. However, understanding the process and filing the form correctly can be overwhelming. In this article, we will explore the top 5 ways to file your NY exemption claim form, ensuring that you take advantage of the exemptions available to you.

Understanding the NY Exemption Claim Form

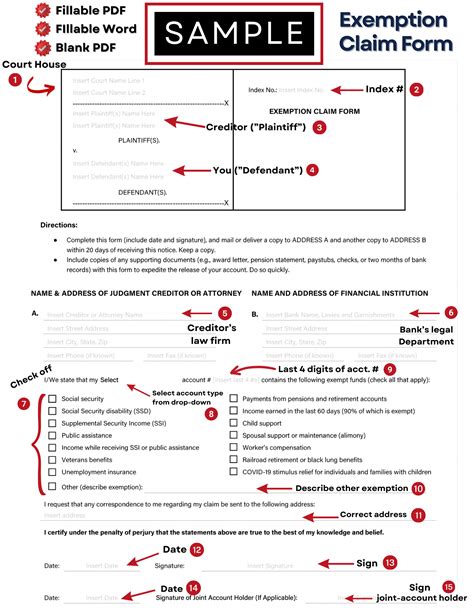

Before we dive into the ways to file your NY exemption claim form, it's essential to understand what the form is and why it's necessary. The NY exemption claim form is a document that individuals and businesses must file to claim exemptions from certain taxes, such as sales and use taxes, property taxes, or income taxes. The form requires you to provide detailed information about the exemption you're claiming, including the type of exemption, the amount of tax owed, and supporting documentation.

Types of Exemptions Available in New York

New York offers various exemptions to individuals and businesses, including:

- Sales and use tax exemptions for certain goods and services

- Property tax exemptions for senior citizens, veterans, and people with disabilities

- Income tax exemptions for certain types of income, such as Social Security benefits

5 Ways to File Your NY Exemption Claim Form

Now that we've covered the basics, let's explore the top 5 ways to file your NY exemption claim form.

1. E-File through the New York State Department of Taxation and Finance Website

The New York State Department of Taxation and Finance website allows you to e-file your exemption claim form online. This method is quick, easy, and convenient. Simply create an account, fill out the form, and submit it electronically. You'll receive an email confirmation once your form is processed.

2. Mail Your Form to the New York State Department of Taxation and Finance

If you prefer to file your exemption claim form by mail, you can download the form from the New York State Department of Taxation and Finance website or pick one up from a local tax office. Fill out the form carefully, attach supporting documentation, and mail it to the address listed on the form.

3. File in Person at a Local Tax Office

Filing your exemption claim form in person at a local tax office is another option. This method allows you to get immediate assistance from tax professionals and ensures that your form is processed quickly. Simply bring the completed form, supporting documentation, and identification to the tax office.

4. Use a Tax Professional or Accountant

If you're unsure about how to file your exemption claim form or need assistance with the process, consider hiring a tax professional or accountant. They can help you navigate the process, ensure that your form is completed correctly, and represent you in case of an audit.

5. Utilize a Tax Preparation Software

Tax preparation software, such as TurboTax or H&R Block, can also help you file your exemption claim form. These programs guide you through the process, ensure that you're taking advantage of all available exemptions, and e-file your form for you.

Tips for Filing Your NY Exemption Claim Form

When filing your NY exemption claim form, keep the following tips in mind:

- Ensure that you have all required supporting documentation

- Double-check your form for accuracy and completeness

- File your form on time to avoid penalties and interest

- Keep a copy of your form and supporting documentation for your records

Wrapping Up

Filing your NY exemption claim form is a crucial step in taking advantage of the exemptions available to you. By understanding the process and following the top 5 ways to file your form, you can ensure that you're getting the most out of your exemptions. Remember to keep your form and supporting documentation accurate and complete, and don't hesitate to seek help if you need it. Happy filing!

What is the NY exemption claim form?

+The NY exemption claim form is a document that individuals and businesses must file to claim exemptions from certain taxes, such as sales and use taxes, property taxes, or income taxes.

How do I file my NY exemption claim form?

+You can file your NY exemption claim form online through the New York State Department of Taxation and Finance website, by mail, in person at a local tax office, using a tax professional or accountant, or through tax preparation software.

What types of exemptions are available in New York?

+New York offers various exemptions, including sales and use tax exemptions, property tax exemptions, and income tax exemptions.