As an investor, it's essential to understand the tax implications of your investments to minimize your tax liability and maximize your returns. One crucial aspect of tax planning for investors is the at-risk limitation, which is reported on IRS Form 6198. In this article, we'll delve into the world of at-risk limitations, explaining what they are, how they work, and how to complete Form 6198.

Investing in partnerships, S corporations, or other pass-through entities can provide tax benefits, but it also comes with risks. The at-risk limitation is designed to prevent investors from claiming losses that exceed their actual investment. This limitation ensures that investors can only deduct losses up to the amount they have at risk in the investment. In this section, we'll explore the importance of understanding at-risk limitations and how they impact your tax obligations.

The at-risk limitation is a critical concept for investors, as it affects the amount of losses that can be deducted on their tax return. The IRS requires investors to complete Form 6198 to calculate their at-risk limitation and report it on their tax return. Failure to comply with the at-risk limitation rules can result in penalties and interest on underpaid taxes. Therefore, it's crucial to understand how to calculate your at-risk limitation and complete Form 6198 accurately.

What is the At-Risk Limitation?

The at-risk limitation is a tax rule that limits the amount of losses that can be deducted by an investor in a pass-through entity, such as a partnership or S corporation. The limitation is designed to prevent investors from claiming losses that exceed their actual investment in the entity. The at-risk limitation is calculated based on the investor's amount at risk in the entity, which includes their initial investment, loans to the entity, and other contributions.

How Does the At-Risk Limitation Work?

The at-risk limitation works by limiting the amount of losses that can be deducted by an investor in a pass-through entity. The limitation is calculated based on the investor's amount at risk in the entity, which includes:

- Initial investment: The amount invested in the entity, including cash, property, and services.

- Loans to the entity: Loans made by the investor to the entity, including recourse and non-recourse loans.

- Other contributions: Other contributions made by the investor to the entity, such as guarantees or indemnifications.

The at-risk limitation is calculated by adding up the investor's initial investment, loans to the entity, and other contributions. The resulting amount is the investor's total amount at risk in the entity.

Completing Form 6198

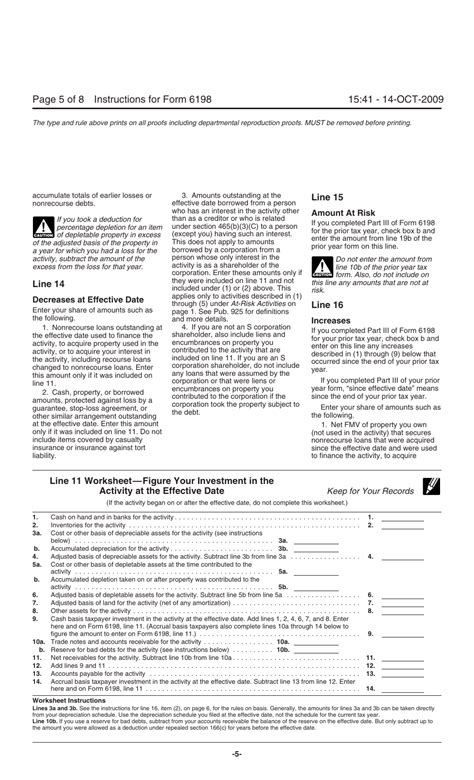

Form 6198 is used to calculate the at-risk limitation and report it on the investor's tax return. The form consists of two parts: Part I and Part II.

- Part I: This part requires the investor to provide information about their initial investment, loans to the entity, and other contributions.

- Part II: This part requires the investor to calculate their at-risk limitation based on the information provided in Part I.

To complete Form 6198, the investor must follow these steps:

- Provide information about their initial investment, including the date and amount of the investment.

- Provide information about loans to the entity, including the date and amount of the loan.

- Provide information about other contributions, including guarantees or indemnifications.

- Calculate the at-risk limitation by adding up the initial investment, loans to the entity, and other contributions.

- Report the at-risk limitation on the investor's tax return.

Example of Completing Form 6198

Let's consider an example of completing Form 6198.

John invests $100,000 in a partnership and loans the partnership $50,000. John also guarantees a loan of $20,000 made by the partnership. John's at-risk limitation would be calculated as follows:

- Initial investment: $100,000

- Loans to the entity: $50,000

- Other contributions: $20,000 (guarantee)

- Total amount at risk: $170,000

John would report the at-risk limitation of $170,000 on his tax return.

Common Mistakes to Avoid

When completing Form 6198, investors should avoid the following common mistakes:

- Failing to include all contributions, including loans and guarantees.

- Failing to calculate the at-risk limitation correctly.

- Failing to report the at-risk limitation on the tax return.

These mistakes can result in penalties and interest on underpaid taxes. Therefore, it's crucial to seek the advice of a tax professional to ensure accurate completion of Form 6198.

Conclusion

In conclusion, the at-risk limitation is a critical concept for investors, as it affects the amount of losses that can be deducted on their tax return. Form 6198 is used to calculate the at-risk limitation and report it on the investor's tax return. By understanding how to complete Form 6198, investors can ensure accurate reporting of their at-risk limitation and avoid penalties and interest on underpaid taxes.

We hope this article has provided valuable insights into the world of at-risk limitations and Form 6198. If you have any questions or need further clarification, please don't hesitate to comment below.

What is the at-risk limitation?

+The at-risk limitation is a tax rule that limits the amount of losses that can be deducted by an investor in a pass-through entity, such as a partnership or S corporation.

How is the at-risk limitation calculated?

+The at-risk limitation is calculated by adding up the investor's initial investment, loans to the entity, and other contributions.

What is Form 6198 used for?

+Form 6198 is used to calculate the at-risk limitation and report it on the investor's tax return.