The Alabama Department of Revenue requires employers to file an annual withholding tax reconciliation form, also known as the AKA EC CI form. This form is a crucial document that employers must submit to report the total amount of Alabama state income tax withheld from their employees' wages throughout the year.

Filing the AKA EC CI form is a mandatory requirement for all employers who have withheld Alabama state income tax from their employees' wages. The form provides the Alabama Department of Revenue with the necessary information to verify the accuracy of the tax withheld and ensure that employers are in compliance with the state's tax laws.

In this article, we will delve deeper into the AKA EC CI form, its purpose, and the information required to complete it. We will also provide guidance on how to file the form and the consequences of non-compliance.

Why is the AKA EC CI Form Important?

The AKA EC CI form is essential for several reasons:

- It helps the Alabama Department of Revenue verify the accuracy of the tax withheld from employees' wages.

- It ensures that employers are in compliance with the state's tax laws and regulations.

- It provides the Alabama Department of Revenue with the necessary information to process employers' withholding tax returns.

- It helps prevent errors and discrepancies in tax withholding and reporting.

Who Must File the AKA EC CI Form?

All employers who have withheld Alabama state income tax from their employees' wages are required to file the AKA EC CI form. This includes:

- Employers who have employees who are Alabama residents or non-residents who work in Alabama.

- Employers who have withheld Alabama state income tax from employees' wages.

- Employers who have made payments to independent contractors or other entities that are subject to Alabama state income tax withholding.

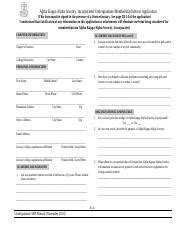

What Information is Required to Complete the AKA EC CI Form?

To complete the AKA EC CI form, employers will need to provide the following information:

- Employer identification number (EIN)

- Business name and address

- Total amount of Alabama state income tax withheld from employees' wages

- Total amount of wages paid to employees

- Number of employees

- Payment information, including payment dates and amounts

How to File the AKA EC CI Form

The AKA EC CI form can be filed electronically or by mail. Employers can file the form electronically through the Alabama Department of Revenue's website or by mailing it to the address listed on the form.

Consequences of Non-Compliance

Failure to file the AKA EC CI form or providing inaccurate information can result in penalties and fines. Employers who fail to comply with the filing requirements may be subject to:

- Penalties and fines

- Interest on unpaid taxes

- Loss of business licenses and permits

- Other administrative actions

Conclusion

In conclusion, the AKA EC CI form is a critical document that employers must file to report the total amount of Alabama state income tax withheld from their employees' wages. The form provides the Alabama Department of Revenue with the necessary information to verify the accuracy of the tax withheld and ensure that employers are in compliance with the state's tax laws.

Employers must ensure that they file the form accurately and on time to avoid penalties and fines. By understanding the purpose and requirements of the AKA EC CI form, employers can ensure compliance with the state's tax laws and regulations.

We hope this article has provided you with a comprehensive understanding of the AKA EC CI form and its importance. If you have any further questions or concerns, please do not hesitate to comment below.

Share this article with others who may find it useful, and don't forget to subscribe to our blog for more informative content!

What is the AKA EC CI form?

+The AKA EC CI form is an annual withholding tax reconciliation form required by the Alabama Department of Revenue. It is used to report the total amount of Alabama state income tax withheld from employees' wages.

Who must file the AKA EC CI form?

+All employers who have withheld Alabama state income tax from their employees' wages are required to file the AKA EC CI form.

What information is required to complete the AKA EC CI form?

+To complete the AKA EC CI form, employers will need to provide their employer identification number (EIN), business name and address, total amount of Alabama state income tax withheld from employees' wages, total amount of wages paid to employees, number of employees, and payment information.