Withdrawing from your KiwiSaver account can be a crucial step in achieving your financial goals, whether it's buying your first home, retiring, or dealing with a significant financial hardship. As a KiwiSaver member, understanding the withdrawal process is essential to ensure a smooth transition. In this article, we will delve into the world of ANZ KiwiSaver withdrawal forms, providing you with a comprehensive guide to help you navigate the process with confidence.

Understanding KiwiSaver Withdrawal Rules

Before we dive into the specifics of the ANZ KiwiSaver withdrawal form, it's essential to understand the rules surrounding KiwiSaver withdrawals. The New Zealand government established KiwiSaver as a voluntary savings scheme to help individuals save for their retirement or first home. As such, there are specific rules and restrictions in place to ensure that members use their KiwiSaver funds for their intended purpose.

- First-home withdrawal: You can withdraw your KiwiSaver funds to purchase your first home, but you must meet specific eligibility criteria, such as having been a KiwiSaver member for at least three years and not having previously withdrawn funds for a first-home purchase.

- Retirement withdrawal: You can access your KiwiSaver funds at the age of 65, but you may be able to withdraw earlier if you're entitled to NZ Super or have reached the age of entitlement.

- Significant financial hardship: In cases of significant financial hardship, you may be eligible to withdraw some or all of your KiwiSaver funds. However, this is subject to meeting strict criteria and requires approval from your KiwiSaver provider.

What You Need to Know About ANZ KiwiSaver Withdrawal Forms

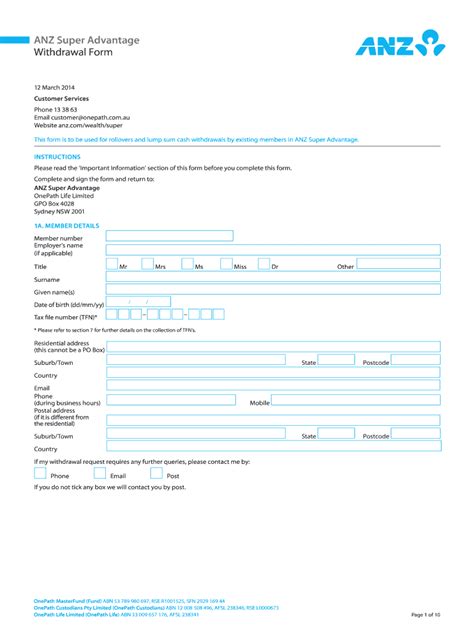

When withdrawing from your ANZ KiwiSaver account, you'll need to complete a withdrawal form. This form will ask for personal and financial information, as well as details about your withdrawal request. Here are some key things to keep in mind when completing an ANZ KiwiSaver withdrawal form:

- Ensure you meet the eligibility criteria: Before submitting your withdrawal form, ensure you meet the eligibility criteria for your chosen withdrawal type.

- Gather required documentation: You may need to provide supporting documentation, such as proof of identity, income, or financial hardship.

- Complete the form accurately: Fill out the form carefully and accurately, as errors or omissions may delay your withdrawal request.

How to Complete an ANZ KiwiSaver Withdrawal Form

Completing an ANZ KiwiSaver withdrawal form requires attention to detail and accuracy. Here's a step-by-step guide to help you through the process:

- Download or obtain the form: You can download the ANZ KiwiSaver withdrawal form from the ANZ website or contact ANZ directly to request a form.

- Read and understand the instructions: Carefully read the instructions and eligibility criteria before starting the form.

- Fill out your personal and account details: Provide your personal and account information, including your name, IRD number, and ANZ KiwiSaver account details.

- Specify your withdrawal type: Choose your withdrawal type (first-home, retirement, or significant financial hardship) and provide relevant supporting documentation.

- Calculate your withdrawal amount: Calculate the amount you wish to withdraw, ensuring you meet the minimum and maximum withdrawal limits.

- Sign and date the form: Sign and date the form, acknowledging that you've read and understood the terms and conditions.

- Submit the form: Return the completed form to ANZ, either by post or online, depending on the submission options available.

Common Mistakes to Avoid When Completing an ANZ KiwiSaver Withdrawal Form

When completing an ANZ KiwiSaver withdrawal form, it's essential to avoid common mistakes that can delay or even reject your withdrawal request. Here are some mistakes to watch out for:

- Inaccurate or incomplete information: Ensure you provide accurate and complete information, as errors or omissions may lead to delays or rejection.

- Insufficient supporting documentation: Failing to provide required supporting documentation may result in your withdrawal request being declined.

- Incorrect withdrawal type: Choosing the wrong withdrawal type or failing to meet the eligibility criteria may lead to your withdrawal request being rejected.

What Happens After You Submit Your ANZ KiwiSaver Withdrawal Form?

After submitting your ANZ KiwiSaver withdrawal form, ANZ will review your request and verify the information provided. Here's what you can expect:

- Review and verification: ANZ will review your withdrawal request and verify the information provided to ensure you meet the eligibility criteria.

- Withdrawal processing: Once your withdrawal request is approved, ANZ will process your withdrawal and transfer the funds to your nominated bank account.

- Notification: ANZ will notify you of the outcome of your withdrawal request, either by email or post, depending on your preferred communication method.

Tips for a Smooth ANZ KiwiSaver Withdrawal Experience

To ensure a smooth ANZ KiwiSaver withdrawal experience, follow these tips:

- Plan ahead: Allow sufficient time for your withdrawal request to be processed, as this may take several weeks.

- Gather supporting documentation: Ensure you have all required supporting documentation ready to avoid delays.

- Contact ANZ: If you have any questions or concerns, don't hesitate to contact ANZ for assistance.

Conclusion

Withdrawing from your ANZ KiwiSaver account can be a significant step in achieving your financial goals. By understanding the rules and regulations surrounding KiwiSaver withdrawals, completing the withdrawal form accurately, and avoiding common mistakes, you can ensure a smooth and successful withdrawal experience. If you have any questions or concerns, don't hesitate to contact ANZ for assistance.