Filing taxes can be a daunting task, especially when dealing with complex forms and paperwork. The DA Form 5960 is one such form that is used by the United States Department of the Army to report certain types of income and expenses. In this article, we will take a closer look at the DA Form 5960, its editable version, and provide a step-by-step guide on how to fill it out and file it correctly.

Understanding the DA Form 5960

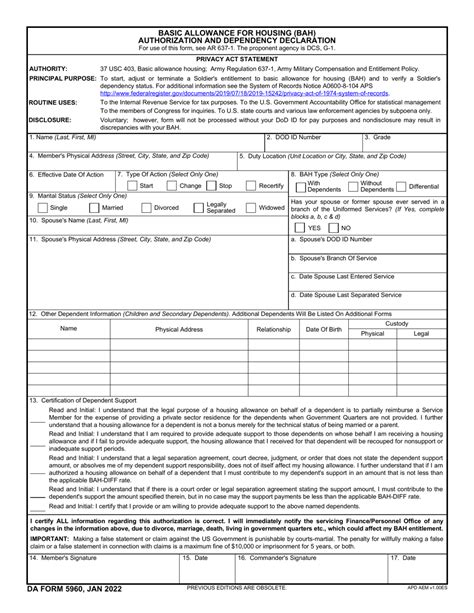

The DA Form 5960 is a tax-related form used by the US Department of the Army to report income and expenses related to military personnel's travel and relocation expenses. The form is used to calculate the taxable amount of travel and relocation allowances, and to determine the amount of taxes owed or refunded.

Editable Version of DA Form 5960

The DA Form 5960 is available in an editable version, which can be downloaded from the US Army's official website or other government websites. The editable version of the form allows users to fill out the form electronically, making it easier to complete and submit.

Step-by-Step Guide to Filing DA Form 5960

Filing the DA Form 5960 requires careful attention to detail and accuracy. Here is a step-by-step guide to help you fill out and file the form correctly:

Step 1: Gather Required Documents and Information

Before starting to fill out the DA Form 5960, gather all required documents and information, including:

- Travel orders and receipts

- Relocation expense receipts

- Pay stubs and W-2 forms

- Social Security number or Individual Taxpayer Identification Number (ITIN)

Step 2: Fill Out the Form Accurately

Fill out the DA Form 5960 accurately and completely, making sure to:

- Use black ink or type in the required information

- Complete all required fields and sections

- Use the correct dates and amounts

- Sign and date the form

Step 3: Calculate Taxable Amounts

Calculate the taxable amounts of travel and relocation allowances, using the instructions provided on the form. Make sure to:

- Use the correct tax tables and rates

- Calculate the taxable amount correctly

- Round the taxable amount to the nearest dollar

Step 4: Submit the Form

Submit the completed DA Form 5960 to the address provided on the form, making sure to:

- Use certified mail or a trackable shipping method

- Keep a copy of the form for your records

- Submit the form by the required deadline

Common Mistakes to Avoid

When filling out and filing the DA Form 5960, avoid common mistakes, such as:

- Incomplete or inaccurate information

- Incorrect calculations or tax rates

- Missing or incomplete documentation

- Late or incomplete submission

Tips for Filing DA Form 5960

Here are some tips for filing the DA Form 5960:

- Use the editable version of the form to make it easier to complete and submit.

- Double-check your calculations and information for accuracy.

- Keep a copy of the form and supporting documentation for your records.

- Submit the form on time to avoid penalties or delays.

Conclusion

Filing the DA Form 5960 requires careful attention to detail and accuracy. By following the step-by-step guide and tips provided in this article, you can ensure that you fill out and file the form correctly. Remember to avoid common mistakes and submit the form on time to avoid penalties or delays.

If you have any questions or concerns about filing the DA Form 5960, please leave a comment below. Share this article with others who may find it helpful.

What is the purpose of the DA Form 5960?

+The DA Form 5960 is used to report income and expenses related to military personnel's travel and relocation expenses.

Where can I find the editable version of the DA Form 5960?

+The editable version of the DA Form 5960 can be downloaded from the US Army's official website or other government websites.

What are the common mistakes to avoid when filing the DA Form 5960?

+Common mistakes to avoid include incomplete or inaccurate information, incorrect calculations or tax rates, missing or incomplete documentation, and late or incomplete submission.