Navigating the complexities of the OTC 901 form can be a daunting task, especially for those who are new to the world of workers' compensation. The OTC 901 form, also known as the "Certificate of Independent Contractor Status," plays a crucial role in determining the status of workers in the state of Oklahoma. In this article, we will delve into the world of the OTC 901 form, exploring its purpose, benefits, and providing a step-by-step guide on how to complete it accurately.

The OTC 901 form is a vital document that helps to establish whether a worker is an independent contractor or an employee. This distinction is essential, as it affects the worker's eligibility for workers' compensation benefits, tax obligations, and other employment-related rights. By understanding the OTC 901 form, businesses and workers can ensure compliance with Oklahoma's workers' compensation laws and avoid potential penalties.

What is the Purpose of the OTC 901 Form?

The primary purpose of the OTC 901 form is to certify the independent contractor status of a worker. This form is typically required for workers who provide services to businesses in Oklahoma, particularly in industries such as construction, transportation, and healthcare. By completing the OTC 901 form, workers can demonstrate their independence from the businesses they serve, which can impact their tax obligations, workers' compensation eligibility, and other employment-related benefits.

Benefits of Completing the OTC 901 Form

Completing the OTC 901 form offers several benefits to both workers and businesses. Some of the advantages include:

- Clarifies worker status: The OTC 901 form helps to establish whether a worker is an independent contractor or an employee, which can impact their eligibility for workers' compensation benefits and tax obligations.

- Reduces liability: By certifying a worker's independent contractor status, businesses can reduce their liability for workers' compensation claims and other employment-related expenses.

- Simplifies tax compliance: The OTC 901 form helps to determine the tax obligations of workers and businesses, ensuring compliance with Oklahoma's tax laws.

- Enhances transparency: The OTC 901 form provides a clear understanding of the worker's status, which can promote transparency and trust between workers and businesses.

A Step-by-Step Guide to Completing the OTC 901 Form

Completing the OTC 901 form requires careful attention to detail and an understanding of the worker's status. Here's a step-by-step guide to help you complete the form accurately:

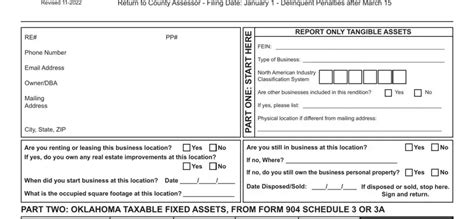

- Gather required information: Before starting the form, gather all necessary information, including the worker's name, address, social security number, and business information.

- Section 1: Worker Information: Complete Section 1 by providing the worker's name, address, and social security number.

- Section 2: Business Information: Complete Section 2 by providing the business's name, address, and federal tax identification number.

- Section 3: Certification: In Section 3, the worker must certify their independent contractor status by checking the appropriate box.

- Section 4: Signature: The worker and business representative must sign and date the form in Section 4.

Common Mistakes to Avoid When Completing the OTC 901 Form

When completing the OTC 901 form, it's essential to avoid common mistakes that can lead to delays or rejection. Here are some mistakes to avoid:

- Inaccurate information: Ensure that all information provided is accurate and up-to-date.

- Incomplete sections: Complete all sections of the form, including the certification and signature sections.

- Missing signatures: Ensure that both the worker and business representative sign and date the form.

- Incorrect certification: Ensure that the worker certifies their independent contractor status correctly.

Consequences of Not Completing the OTC 901 Form

Failing to complete the OTC 901 form can have serious consequences for both workers and businesses. Some of the consequences include:

- Penalties and fines: Businesses may face penalties and fines for non-compliance with Oklahoma's workers' compensation laws.

- Delayed benefits: Workers may experience delayed benefits or eligibility for workers' compensation claims.

- Tax complications: Inaccurate or incomplete forms can lead to tax complications and potential audits.

Conclusion

In conclusion, the OTC 901 form is a critical document that plays a vital role in determining the status of workers in Oklahoma. By understanding the purpose, benefits, and completing the form accurately, workers and businesses can ensure compliance with Oklahoma's workers' compensation laws and avoid potential penalties. Remember to avoid common mistakes and take the necessary steps to complete the form correctly.

We hope this article has provided you with a comprehensive understanding of the OTC 901 form. If you have any questions or concerns, please don't hesitate to comment below. Share this article with others who may benefit from this information, and subscribe to our blog for more informative content.

What is the purpose of the OTC 901 form?

+The primary purpose of the OTC 901 form is to certify the independent contractor status of a worker.

Who is required to complete the OTC 901 form?

+Workers who provide services to businesses in Oklahoma, particularly in industries such as construction, transportation, and healthcare, are typically required to complete the OTC 901 form.

What are the consequences of not completing the OTC 901 form?

+Failing to complete the OTC 901 form can result in penalties and fines, delayed benefits, and tax complications.