Filing taxes can be a daunting task, especially for small business owners and employers who are responsible for reporting employment taxes to the Internal Revenue Service (IRS). One of the most critical forms for employers is Form 940, also known as the Employer's Annual Federal Unemployment (FUTA) Tax Return. This form is used to report and pay federal unemployment taxes, which fund state unemployment benefits for workers who lose their jobs. In this article, we will provide 7 tips for filing Form 940 correctly to help employers avoid mistakes and ensure compliance with IRS regulations.

Understanding Form 940

Before we dive into the tips, it's essential to understand the purpose of Form 940 and who needs to file it. Form 940 is used to report and pay federal unemployment taxes, which are used to fund state unemployment benefits. Employers who pay wages of $1,500 or more in a calendar quarter or have one or more employees who work at least some part of a day in 20 or more weeks in a calendar year are required to file Form 940.

Tip 1: Determine Your FUTA Tax Rate

The first step in filing Form 940 correctly is to determine your FUTA tax rate. The FUTA tax rate is 6% of the first $7,000 of wages paid to each employee during the calendar year. However, employers who pay state unemployment taxes on time can receive a credit of up to 5.4% of the FUTA tax, which reduces the effective FUTA tax rate to 0.6%. To determine your FUTA tax rate, you need to know the total wages paid to each employee and the state unemployment tax rate.

FUTA Tax Rate Calculation

- Total wages paid to each employee: $10,000

- State unemployment tax rate: 3.5%

- FUTA tax rate: 6% (before credit)

- Credit: 5.4% (maximum credit)

- Effective FUTA tax rate: 0.6% (after credit)

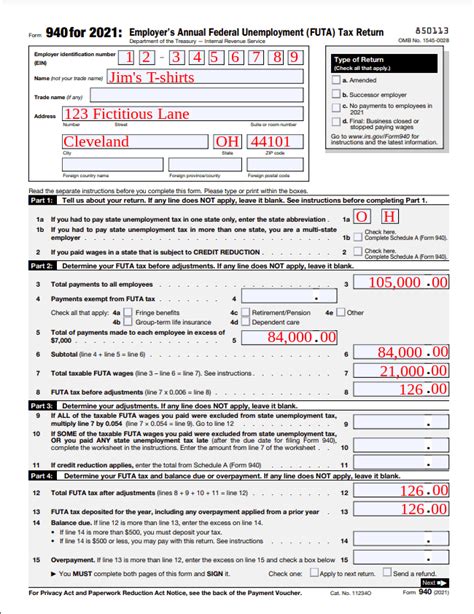

Tip 2: Complete Form 940 Accurately

To file Form 940 correctly, you need to complete the form accurately and thoroughly. The form requires you to provide information about your business, including your Employer Identification Number (EIN), business name, and address. You also need to report the total wages paid to each employee, the FUTA tax rate, and the total FUTA tax due.

Tip 3: Report Wages Correctly

Reporting wages correctly is critical when filing Form 940. You need to report the total wages paid to each employee, including tips, bonuses, and overtime pay. However, you do not need to report wages paid to employees who are exempt from FUTA tax, such as employees who work for the federal government or employees who are covered by a union contract.

Wages Reporting Example

- Employee A: $50,000 (wages)

- Employee B: $20,000 (wages) + $5,000 (tips) = $25,000 (total wages)

- Employee C: $30,000 (wages) + $10,000 (bonuses) = $40,000 (total wages)

Tip 4: Calculate FUTA Tax Due

To calculate the FUTA tax due, you need to multiply the total wages paid to each employee by the FUTA tax rate. However, you only need to pay FUTA tax on the first $7,000 of wages paid to each employee.

FUTA Tax Due Calculation

- Employee A: $50,000 (wages) x 0.6% (FUTA tax rate) = $300 (FUTA tax due)

- Employee B: $25,000 (wages) x 0.6% (FUTA tax rate) = $150 (FUTA tax due)

- Employee C: $40,000 (wages) x 0.6% (FUTA tax rate) = $240 (FUTA tax due)

Tip 5: File Form 940 On Time

To avoid penalties and interest, you need to file Form 940 on time. The deadline for filing Form 940 is January 31 of each year, and you can file electronically or by mail.

Tip 6: Make Timely Payments

To avoid penalties and interest, you need to make timely payments of FUTA tax. You can make payments electronically or by mail, and you need to make payments by the due date to avoid penalties.

FUTA Tax Payment Example

- FUTA tax due: $300

- Payment due date: January 31

- Payment method: Electronic Federal Tax Payment System (EFTPS)

Tip 7: Keep Accurate Records

Finally, it's essential to keep accurate records of your FUTA tax payments and filings. You need to keep records of your FUTA tax returns, payments, and correspondence with the IRS.

By following these 7 tips, you can ensure that you file Form 940 correctly and avoid mistakes and penalties. Remember to determine your FUTA tax rate, complete Form 940 accurately, report wages correctly, calculate FUTA tax due, file Form 940 on time, make timely payments, and keep accurate records.

We hope this article has provided you with valuable information and insights on how to file Form 940 correctly. If you have any questions or comments, please feel free to share them below.

Who needs to file Form 940?

+Employers who pay wages of $1,500 or more in a calendar quarter or have one or more employees who work at least some part of a day in 20 or more weeks in a calendar year are required to file Form 940.

What is the deadline for filing Form 940?

+The deadline for filing Form 940 is January 31 of each year.

How do I calculate FUTA tax due?

+To calculate FUTA tax due, you need to multiply the total wages paid to each employee by the FUTA tax rate. However, you only need to pay FUTA tax on the first $7,000 of wages paid to each employee.