As a taxpayer, it's essential to understand the various tax forms and their purposes to ensure accurate and timely filing of your tax returns. One such form is the TR 205 form, which plays a crucial role in the tax filing process. In this article, we will delve into the world of TR 205 forms, exploring their importance, benefits, and a step-by-step guide on how to fill them out correctly.

Understanding the TR 205 Form

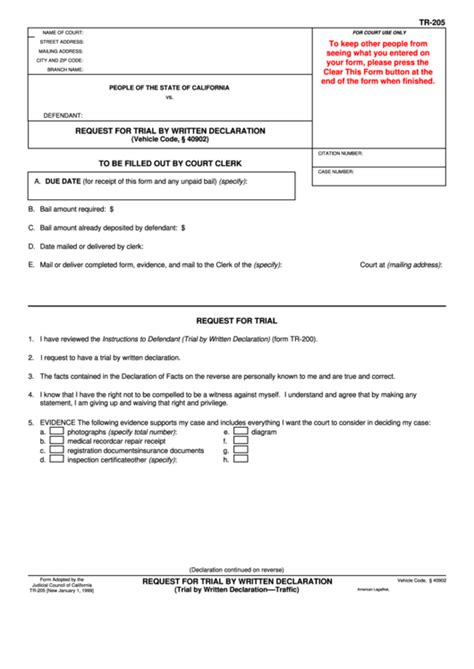

The TR 205 form is a tax form used by taxpayers to report specific types of income, deductions, and credits. It's an essential document that helps the tax authorities assess an individual's tax liability accurately. The form is typically used by individuals who have earned income from various sources, such as employment, self-employment, or investments.

Benefits of the TR 205 Form

The TR 205 form offers several benefits to taxpayers, including:

- Accurate Tax Assessment: The form helps taxpayers report their income and deductions accurately, ensuring that their tax liability is assessed correctly.

- Convenience: The TR 205 form provides a structured format for reporting income and deductions, making it easier for taxpayers to organize their financial information.

- Reduced Errors: By using the TR 205 form, taxpayers can minimize errors and omissions that may lead to delays or penalties in the tax filing process.

Step-by-Step Guide to Filling Out the TR 205 Form

Filling out the TR 205 form can be a straightforward process if you follow these steps:

- Gather Required Documents: Before starting to fill out the form, ensure you have all the necessary documents, including your income statements, receipts for deductions, and any other relevant financial records.

- Fill Out Personal Details: Start by filling out your personal details, including your name, address, and tax identification number.

- Report Income: Report all your income from various sources, including employment, self-employment, and investments.

- Claim Deductions: Claim all eligible deductions, such as charitable donations, medical expenses, and mortgage interest.

- Calculate Tax Liability: Calculate your tax liability based on your income and deductions.

- Review and Submit: Review the form carefully and submit it to the tax authorities before the deadline.

Common Mistakes to Avoid When Filling Out the TR 205 Form

When filling out the TR 205 form, it's essential to avoid common mistakes that can lead to delays or penalties. Some of the most common mistakes include:

- Inaccurate Income Reporting: Ensure that you report your income accurately, including all sources of income.

- Missing Deductions: Don't miss out on eligible deductions, as this can increase your tax liability.

- Math Errors: Double-check your calculations to avoid math errors that can affect your tax liability.

Tips for Filing the TR 205 Form

Here are some tips to keep in mind when filing the TR 205 form:

- File Electronically: Consider filing the form electronically, as this can speed up the processing time and reduce errors.

- Seek Professional Help: If you're unsure about filling out the form, consider seeking help from a tax professional.

- Keep Records: Keep all your financial records, including receipts and income statements, to support your tax return.

TR 205 Form FAQs

Here are some frequently asked questions about the TR 205 form:

- What is the TR 205 form used for?: The TR 205 form is used to report specific types of income, deductions, and credits.

- Who needs to file the TR 205 form?: Individuals who have earned income from various sources need to file the TR 205 form.

- What is the deadline for filing the TR 205 form?: The deadline for filing the TR 205 form varies depending on the tax year and the tax authority's requirements.

What is the TR 205 form used for?

+The TR 205 form is used to report specific types of income, deductions, and credits.

Who needs to file the TR 205 form?

+Individuals who have earned income from various sources need to file the TR 205 form.

What is the deadline for filing the TR 205 form?

+The deadline for filing the TR 205 form varies depending on the tax year and the tax authority's requirements.

By following the steps outlined in this article and avoiding common mistakes, you can ensure that you fill out the TR 205 form accurately and efficiently. If you have any further questions or concerns, don't hesitate to reach out to a tax professional or the tax authorities for guidance.