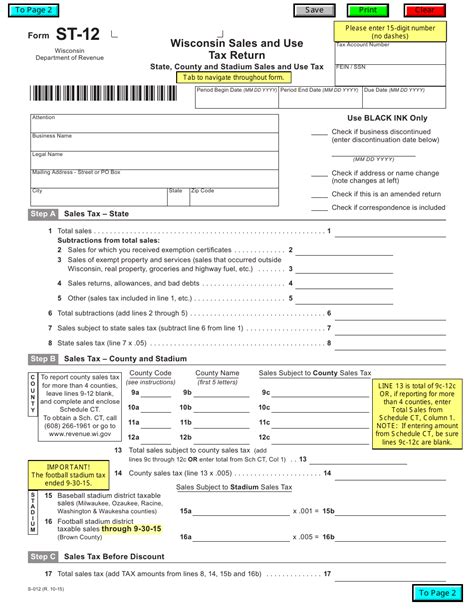

As a business owner in Wisconsin, it's essential to understand the sales and use tax return form, also known as the Wisconsin St-12 form. This form is used to report and pay sales and use taxes to the Wisconsin Department of Revenue. In this article, we will guide you through the process of completing the Wisconsin St-12 form, highlighting the key sections, and providing tips to ensure accuracy and compliance.

Understanding the Wisconsin St-12 Form

The Wisconsin St-12 form is a quarterly return that must be filed by businesses that collect sales tax or owe use tax. The form is used to report the total amount of sales tax collected, use tax owed, and any deductions or credits claimed. The form consists of multiple sections, each with its own set of instructions and requirements.

Who Needs to File the Wisconsin St-12 Form?

Businesses that meet the following criteria must file the Wisconsin St-12 form:

- Businesses that collect sales tax on behalf of the state

- Businesses that owe use tax on purchases made without paying sales tax

- Businesses that have a sales tax permit or use tax certificate

How to Complete the Wisconsin St-12 Form

Completing the Wisconsin St-12 form requires careful attention to detail and accurate record-keeping. Here's a step-by-step guide to help you complete the form:

Section 1: Business Information

In this section, you'll need to provide your business name, address, and tax account number. Make sure to double-check your business information to ensure accuracy.

Section 2: Sales Tax

In this section, you'll report the total amount of sales tax collected during the quarter. You'll need to calculate the total sales tax collected and enter the amount on line 2.

Section 3: Use Tax

In this section, you'll report the total amount of use tax owed on purchases made without paying sales tax. You'll need to calculate the total use tax owed and enter the amount on line 3.

Section 4: Deductions and Credits

In this section, you'll claim any deductions or credits you're eligible for. This may include deductions for exempt sales or credits for overpaid taxes.

Wisconsin St-12 Form Filing Requirements

The Wisconsin St-12 form must be filed quarterly, with the following due dates:

- January 31st for the fourth quarter (October 1 - December 31)

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

Wisconsin St-12 Form Filing Options

You can file the Wisconsin St-12 form electronically or by mail. Electronic filing is recommended, as it's faster and more secure.

Electronic Filing

To file electronically, you'll need to create an account on the Wisconsin Department of Revenue's website. Once you've created an account, you can log in and file your return.

Mail Filing

To file by mail, you'll need to print and complete the Wisconsin St-12 form, then mail it to the address listed on the form.

Wisconsin St-12 Form Penalties and Interest

Failure to file the Wisconsin St-12 form on time or failure to pay the full amount of tax due can result in penalties and interest.

- Late filing penalty: 5% of the tax due

- Late payment penalty: 5% of the tax due

- Interest: 12% per year

Tips for Completing the Wisconsin St-12 Form

Here are some tips to help you complete the Wisconsin St-12 form accurately and on time:

- Keep accurate records of sales tax collected and use tax owed

- Review the form carefully to ensure accuracy

- File electronically to avoid mail delays

- Pay the full amount of tax due to avoid penalties and interest

Wisconsin St-12 Form Frequently Asked Questions

Here are some frequently asked questions about the Wisconsin St-12 form:

What is the Wisconsin St-12 form?

The Wisconsin St-12 form is a quarterly return used to report and pay sales and use taxes to the Wisconsin Department of Revenue.

Who needs to file the Wisconsin St-12 form?

Businesses that collect sales tax or owe use tax must file the Wisconsin St-12 form.

How do I file the Wisconsin St-12 form?

You can file the Wisconsin St-12 form electronically or by mail.

What are the penalties for late filing or payment?

The penalties for late filing or payment include a 5% late filing penalty, a 5% late payment penalty, and 12% interest per year.

What is the deadline for filing the Wisconsin St-12 form?

+The deadline for filing the Wisconsin St-12 form is the last day of the month following the end of the quarter.

Can I amend a previously filed Wisconsin St-12 form?

+Yes, you can amend a previously filed Wisconsin St-12 form by filing an amended return.

What is the contact information for the Wisconsin Department of Revenue?

+You can contact the Wisconsin Department of Revenue by phone at (608) 266-2772 or by email at .

By following this guide, you'll be able to complete the Wisconsin St-12 form accurately and on time. Remember to keep accurate records, review the form carefully, and file electronically to avoid penalties and interest. If you have any questions or concerns, don't hesitate to reach out to the Wisconsin Department of Revenue.

We hope this article has been helpful in guiding you through the process of completing the Wisconsin St-12 form. If you have any further questions or need additional assistance, please don't hesitate to comment below or share this article with others who may find it helpful.