In the insurance industry, the ACORD forms are a crucial part of the underwriting process, enabling insurers to gather the necessary information to provide accurate quotes and policies. Among these forms, ACORD 125, 126, and 140 are particularly important, serving as the foundation for property and casualty insurance applications. In this article, we will delve into the specifics of each form, exploring their purposes, key sections, and the information they require.

Understanding ACORD Forms

Before diving into the specifics of ACORD 125, 126, and 140, it's essential to understand the broader context of ACORD forms. The Association for Cooperative Operations Research and Development (ACORD) is a non-profit organization that develops standardized forms for the insurance industry. These forms aim to streamline the application process, reducing errors and inconsistencies while ensuring that insurers receive the necessary information to provide accurate quotes and policies.

Benefits of Standardization

The standardization of ACORD forms offers numerous benefits, including:

• Improved Efficiency: Standardized forms reduce the time and effort required to complete insurance applications, enabling insurers to process applications more quickly. • Enhanced Accuracy: ACORD forms minimize errors and inconsistencies, ensuring that insurers receive accurate information to inform their underwriting decisions. • Increased Transparency: Standardized forms promote transparency, enabling applicants to understand the information required and insurers to provide clear, consistent quotes and policies.

ACORD 125: Commercial Insurance Application

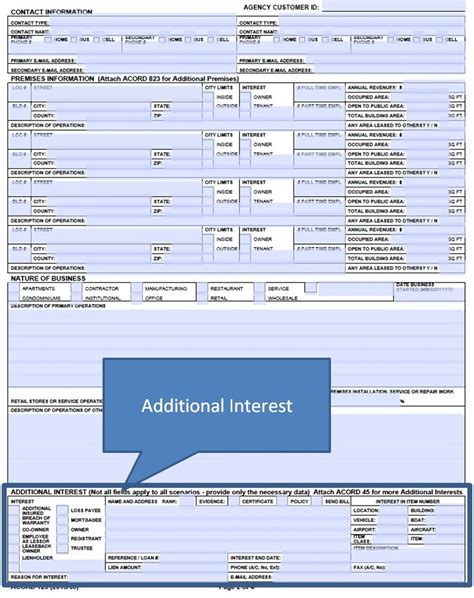

The ACORD 125 is a comprehensive commercial insurance application form used to gather information about a business's operations, assets, and risks. This form is essential for insurers to assess the applicant's eligibility for commercial insurance coverage.

Key Sections:

- General Information: This section requires the applicant's business name, address, and contact information.

- Business Operations: Insurers need to understand the nature of the applicant's business, including their products, services, and revenue streams.

- Location and Property: This section asks about the applicant's business locations, property values, and ownership structures.

- Liability and Workers' Compensation: Insurers require information about the applicant's liability exposures, workers' compensation coverage, and employee details.

Completing ACORD 125

When completing the ACORD 125, applicants should ensure that they provide accurate and detailed information about their business operations, assets, and risks. This includes:

• Business Description: Clearly outline the applicant's business activities, products, and services. • Location Details: Provide accurate information about the applicant's business locations, including addresses and property values. • Employee Information: Ensure that the applicant provides detailed information about their employees, including numbers, roles, and compensation.

ACORD 126: Insurance Coverage and Limits

The ACORD 126 is used to gather information about the applicant's desired insurance coverage and limits. This form helps insurers understand the applicant's risk tolerance and coverage requirements.

Key Sections:

- Coverage Types: Insurers require information about the types of coverage the applicant is seeking, such as liability, property, or workers' compensation.

- Coverage Limits: This section asks about the applicant's desired coverage limits, including deductible amounts and policy limits.

- Additional Coverage: Insurers need to understand if the applicant requires additional coverage, such as umbrella or cyber insurance.

Completing ACORD 126

When completing the ACORD 126, applicants should ensure that they provide clear information about their desired insurance coverage and limits. This includes:

• Coverage Selection: Clearly indicate the types of coverage the applicant is seeking. • Limit Selection: Ensure that the applicant provides accurate information about their desired coverage limits. • Additional Coverage Requirements: Clearly outline any additional coverage requirements, including umbrella or cyber insurance.

ACORD 140: Property Schedule

The ACORD 140 is used to gather information about the applicant's properties, including their locations, values, and ownership structures. This form is essential for insurers to assess the applicant's property risks.

Key Sections:

- Property Details: Insurers require information about the applicant's properties, including addresses, values, and ownership structures.

- Building Information: This section asks about the applicant's building types, ages, and conditions.

- Personal Property: Insurers need to understand the applicant's personal property, including equipment, inventory, and other assets.

Completing ACORD 140

When completing the ACORD 140, applicants should ensure that they provide accurate and detailed information about their properties. This includes:

• Property Description: Clearly outline the applicant's properties, including addresses and values. • Building Details: Provide accurate information about the applicant's building types, ages, and conditions. • Personal Property Details: Ensure that the applicant provides detailed information about their personal property, including equipment, inventory, and other assets.

What is the purpose of ACORD forms?

+ACORD forms are standardized insurance application forms used to gather information from applicants. Their purpose is to streamline the application process, reduce errors, and ensure that insurers receive accurate information to inform their underwriting decisions.

What information is required on the ACORD 125?

+The ACORD 125 requires information about the applicant's business operations, assets, and risks. This includes general information, business operations, location and property, liability and workers' compensation, and other relevant details.

What is the difference between ACORD 126 and ACORD 140?

+ACORD 126 is used to gather information about the applicant's desired insurance coverage and limits, while ACORD 140 is used to gather information about the applicant's properties, including their locations, values, and ownership structures.