Are you about to file for bankruptcy and are required to fill out Form SSA-3380-BK, also known as the Report to the Commissioner of Social Security? This form can be overwhelming, especially if you're not familiar with the process. In this article, we'll provide you with 5 essential answers to help you navigate Form SSA-3380-BK and ensure a smooth bankruptcy filing process.

What is Form SSA-3380-BK and Why is it Required?

Form SSA-3380-BK is a report that must be submitted to the Commissioner of Social Security when an individual files for bankruptcy. This form is used to notify the Social Security Administration (SSA) of the bankruptcy filing and to provide information about the individual's social security benefits. The form is required by law, and failure to submit it may result in delays or complications in the bankruptcy process.

Who Needs to Fill Out Form SSA-3380-BK?

Form SSA-3380-BK is required for individuals who are filing for bankruptcy and are receiving or have received social security benefits in the past. This includes individuals who are receiving:

- Retirement benefits

- Disability benefits

- Supplemental Security Income (SSI)

- Survivor benefits

If you are filing for bankruptcy and are receiving any of these benefits, you will need to fill out Form SSA-3380-BK.

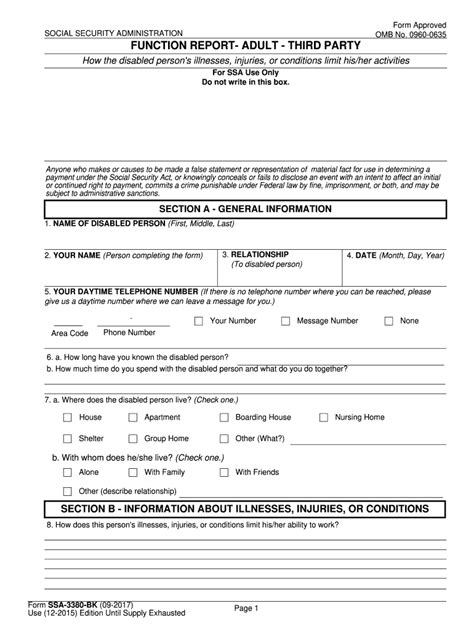

What Information is Required on Form SSA-3380-BK?

Form SSA-3380-BK requires the following information:

- Your name and social security number

- Your bankruptcy case number and filing date

- Information about your social security benefits, including the type of benefit and the amount you receive

- Information about your income and expenses

- A list of your creditors and the amount you owe each one

You will also need to provide documentation, such as:

- A copy of your bankruptcy petition

- A copy of your social security award letter

- Proof of income and expenses

How Do I Fill Out Form SSA-3380-BK?

Filling out Form SSA-3380-BK can be complex, but here are some steps to help you get started:

- Download the form from the SSA website or pick one up from your local SSA office.

- Read the instructions carefully and gather all required documentation.

- Fill out the form accurately and completely, making sure to sign and date it.

- Attach all required documentation to the form.

- Submit the form to the SSA by mail or in person.

What Happens After I Submit Form SSA-3380-BK?

After you submit Form SSA-3380-BK, the SSA will review the information and determine how your social security benefits will be affected by your bankruptcy. In some cases, your benefits may be exempt from the bankruptcy, while in other cases, they may be subject to garnishment or other actions.

What are the Consequences of Not Filing Form SSA-3380-BK?

Failure to file Form SSA-3380-BK can result in serious consequences, including:

- Delays or complications in the bankruptcy process

- Loss of social security benefits

- Penalties or fines

It's essential to fill out Form SSA-3380-BK accurately and on time to avoid these consequences.

Conclusion: Navigating Form SSA-3380-BK with Confidence

Filling out Form SSA-3380-BK can be a complex and overwhelming task, but with the right information and guidance, you can navigate the process with confidence. By understanding what Form SSA-3380-BK is, who needs to fill it out, and what information is required, you can ensure a smooth bankruptcy filing process and avoid any potential consequences.

Don't hesitate to reach out to a qualified bankruptcy attorney or the SSA if you have any questions or concerns about Form SSA-3380-BK. With the right help and guidance, you can get back on track financially and start rebuilding your future.

We encourage you to comment below and share your experiences with Form SSA-3380-BK. Your insights can help others who are going through the same process.

What is the purpose of Form SSA-3380-BK?

+Form SSA-3380-BK is a report that must be submitted to the Commissioner of Social Security when an individual files for bankruptcy. The form is used to notify the SSA of the bankruptcy filing and to provide information about the individual's social security benefits.

Who needs to fill out Form SSA-3380-BK?

+Form SSA-3380-BK is required for individuals who are filing for bankruptcy and are receiving or have received social security benefits in the past.

What information is required on Form SSA-3380-BK?

+Form SSA-3380-BK requires information about your social security benefits, income and expenses, creditors, and bankruptcy case number and filing date.