The world of mortgage financing can be complex and overwhelming, especially for those new to the industry. One crucial document that plays a significant role in the mortgage process is the Freddie Mac Form 1000. Also known as the Uniform Residential Appraisal Report, this form is used to provide an objective and unbiased opinion of a property's value. In this article, we will delve into five essential facts about Freddie Mac Form 1000, helping you understand its significance and how it affects the mortgage financing process.

What is Freddie Mac Form 1000?

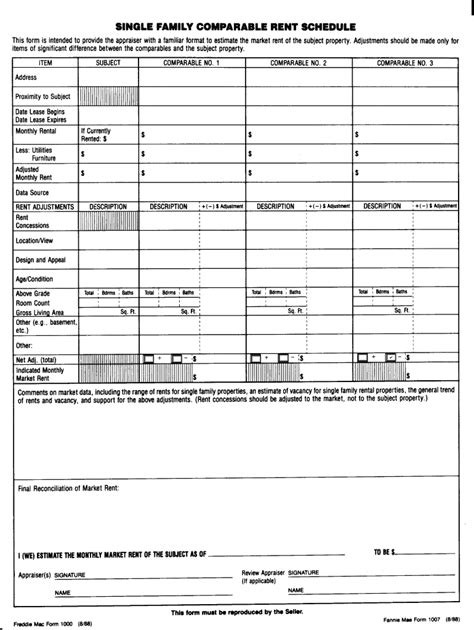

Freddie Mac Form 1000, also known as the Uniform Residential Appraisal Report, is a standardized form used by appraisers to provide an objective and unbiased opinion of a property's value. The form is designed to ensure consistency and accuracy in the appraisal process, making it easier for lenders to evaluate the risk associated with a mortgage loan. The form includes detailed information about the property, including its location, size, condition, and comparable sales data.

Purpose of Freddie Mac Form 1000

The primary purpose of Freddie Mac Form 1000 is to provide an independent and impartial opinion of a property's value. This information is used by lenders to determine the risk associated with a mortgage loan and to ensure that the loan amount is not excessive compared to the property's value. The form helps lenders to make informed decisions about loan approval, interest rates, and loan terms.

Key Components of Freddie Mac Form 1000

Freddie Mac Form 1000 includes several key components, including:

- Property identification information, such as the address and legal description

- Property characteristics, such as the size, age, and condition of the property

- Sales comparison approach, which involves analyzing comparable sales data to estimate the property's value

- Income approach, which involves analyzing the property's potential income to estimate its value

- Cost approach, which involves estimating the cost to replace or reproduce the property

Who Uses Freddie Mac Form 1000?

Freddie Mac Form 1000 is used by various stakeholders in the mortgage financing process, including:

- Appraisers, who complete the form to provide an objective opinion of the property's value

- Lenders, who use the form to evaluate the risk associated with a mortgage loan

- Investors, who use the form to assess the value of mortgage-backed securities

- Regulators, who use the form to monitor compliance with appraisal regulations

Importance of Freddie Mac Form 1000 in the Mortgage Process

Freddie Mac Form 1000 plays a critical role in the mortgage financing process, as it provides an independent and unbiased opinion of a property's value. This information helps lenders to make informed decisions about loan approval, interest rates, and loan terms. The form also helps to ensure that the loan amount is not excessive compared to the property's value, reducing the risk of default and foreclosure.

Benefits of Freddie Mac Form 1000

The use of Freddie Mac Form 1000 provides several benefits, including:

- Improved accuracy and consistency in the appraisal process

- Enhanced transparency and accountability in the mortgage financing process

- Reduced risk of default and foreclosure

- Increased confidence in the mortgage market

Challenges and Limitations of Freddie Mac Form 1000

While Freddie Mac Form 1000 provides several benefits, it is not without its challenges and limitations. Some of the key challenges and limitations include:

- The subjectivity of the appraisal process, which can lead to inconsistencies and biases

- The complexity of the form, which can make it difficult to complete and understand

- The need for ongoing training and education for appraisers to ensure compliance with regulatory requirements

In conclusion, Freddie Mac Form 1000 plays a critical role in the mortgage financing process, providing an independent and unbiased opinion of a property's value. Understanding the importance and benefits of this form can help stakeholders navigate the complex world of mortgage financing. We encourage you to share your thoughts and experiences with Freddie Mac Form 1000 in the comments below.

What is the purpose of Freddie Mac Form 1000?

+The primary purpose of Freddie Mac Form 1000 is to provide an independent and impartial opinion of a property's value.

Who uses Freddie Mac Form 1000?

+Freddie Mac Form 1000 is used by various stakeholders in the mortgage financing process, including appraisers, lenders, investors, and regulators.

What are the benefits of Freddie Mac Form 1000?

+The use of Freddie Mac Form 1000 provides several benefits, including improved accuracy and consistency in the appraisal process, enhanced transparency and accountability in the mortgage financing process, reduced risk of default and foreclosure, and increased confidence in the mortgage market.