The world of mortgage insurance can be complex and overwhelming, especially for those who are new to the process. One crucial document in this process is the HUD 9250 form, also known as the Mortgage Insurance Endorsement. In this article, we will delve into the details of the HUD 9250 form, its purpose, and its significance in the mortgage insurance process.

Understanding the HUD 9250 Form

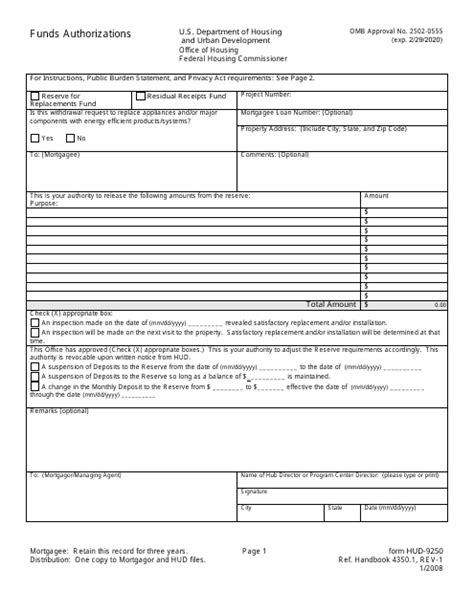

The HUD 9250 form is a crucial document that is used to endorse mortgage insurance policies. It is a standardized form that is used by the Department of Housing and Urban Development (HUD) to ensure that mortgage insurance policies meet the necessary requirements. The form is used to verify that the borrower has obtained mortgage insurance that meets the requirements of the Federal Housing Administration (FHA).

Purpose of the HUD 9250 Form

Purpose of the HUD 9250 Form

The primary purpose of the HUD 9250 form is to endorse mortgage insurance policies. The form is used to verify that the borrower has obtained mortgage insurance that meets the requirements of the FHA. The form is typically completed by the mortgage insurance company and is submitted to the lender as part of the mortgage application process.

Benefits of the HUD 9250 Form

Benefits of the HUD 9250 Form

The HUD 9250 form provides several benefits to both the borrower and the lender. Some of the benefits include:

- Verification of mortgage insurance: The form verifies that the borrower has obtained mortgage insurance that meets the requirements of the FHA.

- Standardization: The form provides a standardized way of endorsing mortgage insurance policies, which makes it easier for lenders to verify the information.

- Reduced risk: The form helps to reduce the risk of default by verifying that the borrower has obtained adequate mortgage insurance.

How to Complete the HUD 9250 Form

How to Complete the HUD 9250 Form

Completing the HUD 9250 form requires careful attention to detail. The form must be completed accurately and thoroughly to ensure that the mortgage insurance policy meets the requirements of the FHA. Here are the steps to complete the form:

- Section 1: Borrower Information: This section requires the borrower's name, address, and other identifying information.

- Section 2: Property Information: This section requires information about the property, including the address, property type, and value.

- Section 3: Mortgage Insurance Information: This section requires information about the mortgage insurance policy, including the policy number, premium amount, and effective date.

- Section 4: Endorsement: This section requires the mortgage insurance company to endorse the policy and verify that it meets the requirements of the FHA.

Common Mistakes to Avoid

<h3/Common Mistakes to Avoid

When completing the HUD 9250 form, it is essential to avoid common mistakes that can delay the mortgage application process. Some common mistakes to avoid include:

- Incomplete or inaccurate information

- Failure to sign and date the form

- Failure to include required documentation

Frequently Asked Questions

Frequently Asked Questions

Here are some frequently asked questions about the HUD 9250 form:

- Q: What is the purpose of the HUD 9250 form? A: The purpose of the HUD 9250 form is to endorse mortgage insurance policies and verify that they meet the requirements of the FHA.

- Q: Who completes the HUD 9250 form? A: The mortgage insurance company completes the HUD 9250 form.

- Q: What information is required on the HUD 9250 form? A: The form requires borrower information, property information, mortgage insurance information, and endorsement.

Conclusion

The HUD 9250 form is a crucial document in the mortgage insurance process. It verifies that the borrower has obtained mortgage insurance that meets the requirements of the FHA. By understanding the purpose and benefits of the HUD 9250 form, borrowers and lenders can ensure a smooth and efficient mortgage application process.

FAQ Section

What is the HUD 9250 form used for?

+The HUD 9250 form is used to endorse mortgage insurance policies and verify that they meet the requirements of the FHA.

Who completes the HUD 9250 form?

+The mortgage insurance company completes the HUD 9250 form.

What information is required on the HUD 9250 form?

+The form requires borrower information, property information, mortgage insurance information, and endorsement.