The Form SH-13, also known as the Notice of Conversion of a Private Company into a One Person Company, is a crucial document that needs to be filed with the Registrar of Companies (ROC) when a private company wants to convert into a One Person Company (OPC). In this article, we will provide a step-by-step guide on how to fill the Sample Form SH-13, highlighting the importance of each section and providing examples to make the process easier.

Understanding the Importance of Form SH-13

Form SH-13 is a critical document that needs to be filed with the ROC to notify the conversion of a private company into a One Person Company. The form requires the company to provide detailed information about the conversion, including the reason for conversion, the date of conversion, and the details of the sole member and director of the OPC.

Benefits of Converting a Private Company into a One Person Company

Before we dive into the step-by-step guide, let's take a look at the benefits of converting a private company into a One Person Company:

- Simplified Management Structure: A One Person Company has a simpler management structure compared to a private company, with only one member and director.

- Reduced Compliance Burden: OPCs have reduced compliance burden compared to private companies, with fewer filing requirements and no requirement for a minimum number of directors.

- Limited Liability: The liability of the sole member of an OPC is limited to the extent of their shareholding, providing protection for personal assets.

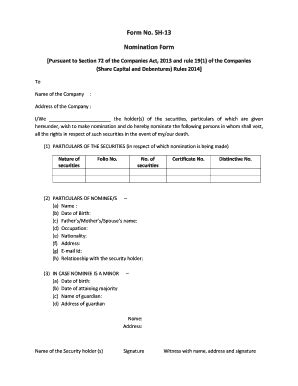

Step-by-Step Guide to Fill Sample Form SH-13

Now that we have understood the importance of Form SH-13 and the benefits of converting a private company into a One Person Company, let's move on to the step-by-step guide to fill the sample form.

Section 1: Company Details

In this section, the company needs to provide its details, including:

- Company Name: The name of the private company that is being converted into a One Person Company.

- Company Registration Number: The registration number of the private company.

- Date of Incorporation: The date of incorporation of the private company.

Example:

| Company Name | Company Registration Number | Date of Incorporation |

|---|---|---|

| ABC Private Limited | U123456789 | 01/01/2010 |

Section 2: Reason for Conversion

In this section, the company needs to provide the reason for converting into a One Person Company. The reason can be:

- Simplified Management Structure: The company wants to simplify its management structure.

- Reduced Compliance Burden: The company wants to reduce its compliance burden.

- Other: The company can specify any other reason for conversion.

Example:

| Reason for Conversion |

|---|

| Simplified Management Structure |

Section 3: Date of Conversion

In this section, the company needs to provide the date of conversion, which is the date on which the private company is being converted into a One Person Company.

Example:

| Date of Conversion |

|---|

| 01/04/2023 |

Section 4: Details of Sole Member and Director

In this section, the company needs to provide the details of the sole member and director of the One Person Company, including:

- Name: The name of the sole member and director.

- Address: The address of the sole member and director.

- DIN: The Director Identification Number (DIN) of the sole member and director.

Example:

| Name | Address | DIN |

|---|---|---|

| John Doe | 123, Main Street, New York | 001234567 |

Section 5: Declaration

In this section, the company needs to provide a declaration that the information provided in the form is true and correct.

Example:

I, John Doe, being the sole member and director of ABC Private Limited, hereby declare that the information provided in this form is true and correct.

Submission of Form SH-13

Once the form is filled, it needs to be submitted to the ROC along with the required documents and fees.

Conclusion

Converting a private company into a One Person Company can be a great way to simplify the management structure and reduce the compliance burden. However, it requires careful planning and execution. By following the step-by-step guide to fill Sample Form SH-13, companies can ensure that they provide accurate and complete information to the ROC.

What's Next?

If you are planning to convert your private company into a One Person Company, we recommend that you:

- Consult a Professional: Consult a chartered accountant or a company secretary to ensure that you comply with all the requirements.

- Review the Form: Review the form carefully before submission to ensure that all the information is accurate and complete.

- Submit the Form: Submit the form to the ROC along with the required documents and fees.

We hope this article has provided you with a comprehensive guide to filling Sample Form SH-13. If you have any questions or need further clarification, please feel free to ask.

FAQs

What is Form SH-13?

+Form SH-13 is a notice of conversion of a private company into a One Person Company that needs to be filed with the Registrar of Companies (ROC).

Why should I convert my private company into a One Person Company?

+Converting a private company into a One Person Company can simplify the management structure and reduce the compliance burden.

How do I submit Form SH-13?

+Form SH-13 needs to be submitted to the ROC along with the required documents and fees.