As a small business owner, managing your finances effectively is crucial for the success and growth of your company. One important aspect of financial management is depreciation, which can have a significant impact on your business's tax liability and overall profitability. In this article, we will delve into the world of Form 4562 depreciation, a crucial document for small business owners to understand and master.

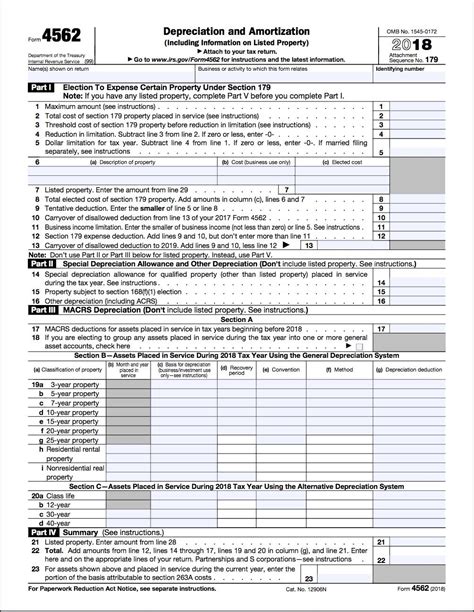

Depreciation is a complex and often misunderstood concept, but it is essential for businesses to claim the correct amount of depreciation on their tax returns. The Internal Revenue Service (IRS) provides Form 4562, also known as the Depreciation and Amortization form, to help businesses calculate and report their depreciation expenses. In this guide, we will walk you through the process of completing Form 4562, explain the different types of depreciation, and provide tips on how to maximize your depreciation deductions.

Understanding Depreciation

Before we dive into the specifics of Form 4562, it's essential to understand the concept of depreciation. Depreciation is the process of allocating the cost of a tangible asset over its useful life. Tangible assets, such as buildings, equipment, and vehicles, lose their value over time due to wear and tear, obsolescence, or other factors. Depreciation allows businesses to claim a portion of the asset's cost as an expense each year, which can help reduce their taxable income.

Types of Depreciation

There are several types of depreciation, including:

- Straight-Line Method: This is the most common method of depreciation, where the asset's cost is divided by its useful life to determine the annual depreciation expense.

- Declining Balance Method: This method uses a percentage of the asset's remaining balance to calculate the depreciation expense, resulting in higher depreciation expenses in the early years of the asset's life.

- Modified Accelerated Cost Recovery System (MACRS): This method is used for most business assets and provides a set of predetermined depreciation rates based on the asset's class life.

- Alternative Depreciation System (ADS): This method is used for certain assets, such as real estate, and provides a longer recovery period than MACRS.

Form 4562: Depreciation and Amortization

Form 4562 is used to calculate and report depreciation and amortization expenses for business assets. The form consists of several sections, including:

- Section 1: Assets Placed in Service: This section requires businesses to list all assets placed in service during the tax year, including the asset's description, cost, and date placed in service.

- Section 2: Depreciation: This section requires businesses to calculate their depreciation expenses using the methods described above.

- Section 3: Amortization: This section requires businesses to calculate their amortization expenses for intangible assets, such as patents and copyrights.

- Section 4: Summary: This section requires businesses to summarize their total depreciation and amortization expenses for the tax year.

Tips for Maximizing Depreciation Deductions

To maximize your depreciation deductions, follow these tips:

- Keep accurate records: Keep accurate records of all business assets, including their cost, date placed in service, and depreciation expenses.

- Use the correct depreciation method: Choose the depreciation method that provides the largest depreciation expense for your business.

- Claim bonus depreciation: Claim bonus depreciation for eligible assets, which can provide an additional 100% depreciation deduction in the first year.

- Consider a cost segregation study: Consider hiring a professional to conduct a cost segregation study, which can help identify additional depreciation expenses.

Common Mistakes to Avoid

When completing Form 4562, avoid the following common mistakes:

- Inaccurate asset information: Ensure that all asset information, including cost and date placed in service, is accurate and complete.

- Incorrect depreciation method: Ensure that the correct depreciation method is used for each asset.

- Insufficient documentation: Ensure that all depreciation expenses are supported by sufficient documentation, including receipts and invoices.

Conclusion

Form 4562 depreciation is a complex but essential part of small business tax planning. By understanding the different types of depreciation, completing Form 4562 accurately, and following the tips outlined above, businesses can maximize their depreciation deductions and reduce their taxable income. Remember to keep accurate records, use the correct depreciation method, and claim bonus depreciation to ensure that your business is taking advantage of all available depreciation deductions.

Take Action

Take the time to review your business's depreciation expenses and ensure that you are taking advantage of all available deductions. Consult with a tax professional or accountant to ensure that your business is in compliance with all tax laws and regulations. By doing so, you can help reduce your business's tax liability and improve its overall profitability.

What is depreciation, and how does it affect my business?

+Depreciation is the process of allocating the cost of a tangible asset over its useful life. It affects your business by reducing your taxable income and providing a tax deduction for the asset's cost.

What is Form 4562, and how do I complete it?

+Form 4562 is used to calculate and report depreciation and amortization expenses for business assets. To complete it, you will need to list all assets placed in service, calculate depreciation expenses using the correct method, and summarize your total depreciation and amortization expenses.

What are the different types of depreciation, and which one should I use?

+There are several types of depreciation, including straight-line, declining balance, MACRS, and ADS. The correct method to use depends on the type of asset and its useful life. Consult with a tax professional or accountant to determine the best method for your business.