Filling Out Form NJ 1040NR: A Comprehensive Guide

As a non-resident of New Jersey, you may be required to file a state income tax return using Form NJ 1040NR. This form is used to report income earned from New Jersey sources, such as rental properties, businesses, or investments. Filling out Form NJ 1040NR can be a complex process, but with the right guidance, you can ensure that you complete it accurately and efficiently. In this article, we will discuss five ways to fill out Form NJ 1040NR, including tips and best practices to help you navigate the process.

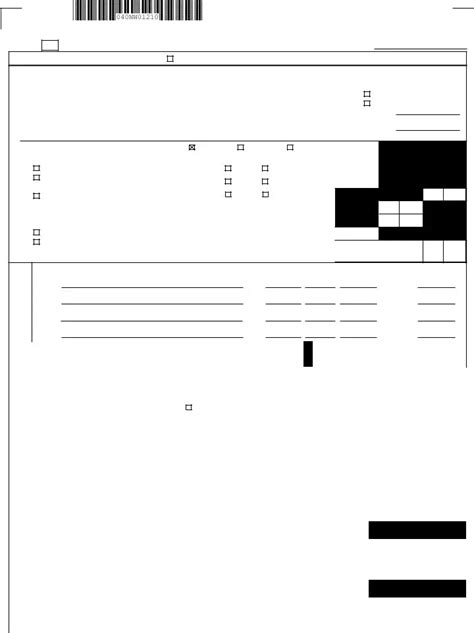

Understanding Form NJ 1040NR

Before we dive into the five ways to fill out Form NJ 1040NR, it's essential to understand the purpose of the form and the types of income that are subject to New Jersey state taxation. Form NJ 1040NR is used to report income earned from New Jersey sources, including:

- Rental income from properties located in New Jersey

- Business income earned from operations in New Jersey

- Investment income earned from New Jersey sources

- Capital gains from the sale of New Jersey properties or assets

Who Needs to File Form NJ 1040NR?

You are required to file Form NJ 1040NR if you are a non-resident of New Jersey and have earned income from New Jersey sources. This includes individuals, businesses, and estates. Even if you don't have a physical presence in New Jersey, you may still be required to file a state income tax return if you have earned income from New Jersey sources.

Method 1: Filing by Mail

One way to fill out Form NJ 1040NR is to file by mail. You can download the form from the New Jersey Division of Taxation website or pick one up from a local tax office. Once you have completed the form, you can mail it to the address listed on the form. Be sure to include all required documentation, such as W-2s and 1099s, and make a copy of the form for your records.

Tips for Filing by Mail

- Make sure to use black ink and write clearly

- Use a paperclip to attach supporting documentation

- Make a copy of the form and supporting documentation for your records

- Use a trackable mail service, such as certified mail, to ensure that your return is received by the state

Method 2: Filing Electronically

Another way to fill out Form NJ 1040NR is to file electronically. You can use tax preparation software, such as TurboTax or H&R Block, to complete and submit your return. Electronic filing is a convenient and efficient way to file your return, and you can receive your refund faster.

Tips for Filing Electronically

- Use a reputable tax preparation software

- Make sure to have all required documentation available

- Review your return carefully before submitting

- Use a secure internet connection to protect your personal and financial information

Method 3: Using a Tax Professional

If you are not comfortable completing Form NJ 1040NR on your own, you can hire a tax professional to help you. A tax professional can guide you through the process and ensure that you take advantage of all eligible deductions and credits.

Tips for Using a Tax Professional

- Research and choose a reputable tax professional

- Make sure to provide all required documentation

- Review your return carefully before signing

- Ask questions if you don't understand something

Method 4: Using a Tax Preparation Service

Another option for filling out Form NJ 1040NR is to use a tax preparation service, such as Jackson Hewitt or Liberty Tax. These services offer a range of options, from basic preparation to more comprehensive services.

Tips for Using a Tax Preparation Service

- Research and choose a reputable tax preparation service

- Make sure to provide all required documentation

- Review your return carefully before signing

- Ask questions if you don't understand something

Method 5: Using Online Resources

Finally, you can use online resources to help you fill out Form NJ 1040NR. The New Jersey Division of Taxation website offers a range of resources, including instructions and FAQs. You can also use online tax preparation software to complete and submit your return.

Tips for Using Online Resources

- Use reputable online resources

- Make sure to have all required documentation available

- Review your return carefully before submitting

- Use a secure internet connection to protect your personal and financial information

Get Help Filing Your NJ 1040NR Form

If you are having trouble filling out Form NJ 1040NR, don't hesitate to seek help. You can contact the New Jersey Division of Taxation or hire a tax professional to guide you through the process. Remember, it's always better to be safe than sorry, and seeking help can ensure that you complete your return accurately and efficiently.

What is Form NJ 1040NR?

+Form NJ 1040NR is the New Jersey non-resident income tax return form. It is used to report income earned from New Jersey sources, such as rental properties, businesses, or investments.

Who needs to file Form NJ 1040NR?

+You are required to file Form NJ 1040NR if you are a non-resident of New Jersey and have earned income from New Jersey sources.

What are the deadlines for filing Form NJ 1040NR?

+The deadline for filing Form NJ 1040NR is typically April 15th, but it may vary depending on your specific situation.

We hope this article has provided you with a comprehensive guide to filling out Form NJ 1040NR. Remember to seek help if you need it, and don't hesitate to reach out to the New Jersey Division of Taxation or a tax professional if you have any questions or concerns.