As an employee in the state of Virginia, it is essential to understand the importance of filing the correct tax forms to ensure that you are not overpaying or underpaying your taxes. One crucial form that you may need to file is the Virginia Form VA-4, also known as the Employer Withholding Exemption Certificate. In this article, we will delve into the details of this form, its purpose, and how to complete it accurately.

What is the Virginia Form VA-4?

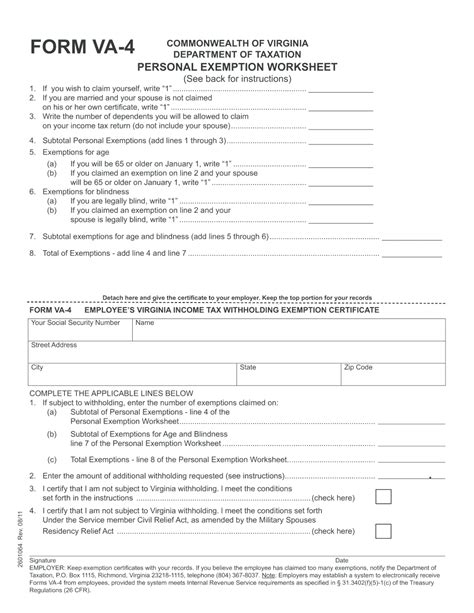

The Virginia Form VA-4 is a tax form that is used by employees to certify their exemption from Virginia state income tax withholding. This form is typically completed by employees who are exempt from state income tax or who have a reduced tax liability due to their income level or other factors. By filing this form, employees can ensure that their employer withholds the correct amount of state income tax from their wages.

Who Needs to File the Virginia Form VA-4?

Not all employees in Virginia need to file the VA-4 form. However, if you meet any of the following criteria, you may need to complete this form:

- You are exempt from Virginia state income tax

- You have a reduced tax liability due to your income level or other factors

- You are a resident of Virginia and have income that is not subject to Virginia state income tax

- You are a non-resident of Virginia and have income that is subject to Virginia state income tax

How to Complete the Virginia Form VA-4

Completing the VA-4 form is a relatively straightforward process. Here are the steps you need to follow:

- Download the form from the Virginia Department of Taxation website or obtain a copy from your employer.

- Read the instructions carefully to ensure you understand the requirements.

- Complete the form by providing your personal and employment information, including your name, address, social security number, and employer's name and address.

- Certify your exemption from Virginia state income tax by checking the applicable box.

- Sign and date the form.

Types of Exemptions

There are several types of exemptions that may apply to you, including:

- Exemption from Virginia state income tax due to low income

- Exemption from Virginia state income tax due to age or disability

- Exemption from Virginia state income tax due to military service

- Exemption from Virginia state income tax due to other factors, such as being a non-resident of Virginia

Benefits of Filing the Virginia Form VA-4

Filing the VA-4 form can have several benefits, including:

- Reducing the amount of state income tax withheld from your wages

- Increasing your take-home pay

- Ensuring that you are not overpaying or underpaying your taxes

Common Mistakes to Avoid

When completing the VA-4 form, it is essential to avoid common mistakes, such as:

- Failing to sign and date the form

- Providing incorrect or incomplete information

- Failing to certify your exemption correctly

What to Do After Filing the Virginia Form VA-4

After completing and signing the VA-4 form, you should:

- Give the form to your employer

- Ensure that your employer withholds the correct amount of state income tax from your wages

- Review your pay stubs to ensure that the correct amount of state income tax is being withheld

Conclusion

In conclusion, the Virginia Form VA-4 is an essential tax form that can help you ensure that you are not overpaying or underpaying your taxes. By understanding the purpose and requirements of this form, you can take control of your tax withholding and ensure that you are in compliance with Virginia state tax laws. Remember to complete the form accurately and submit it to your employer to avoid any potential issues.

Additional Resources

For more information on the Virginia Form VA-4, you can visit the Virginia Department of Taxation website or consult with a tax professional. Additionally, you can find more resources and information on tax forms and tax laws on our website.

What is the purpose of the Virginia Form VA-4?

+The Virginia Form VA-4 is used by employees to certify their exemption from Virginia state income tax withholding.

Who needs to file the Virginia Form VA-4?

+Employees who are exempt from Virginia state income tax or who have a reduced tax liability due to their income level or other factors need to file the VA-4 form.

How do I complete the Virginia Form VA-4?

+Complete the form by providing your personal and employment information, certifying your exemption, signing, and dating the form.