Designating beneficiaries is an essential step in estate planning, allowing individuals to ensure that their assets are distributed according to their wishes after their passing. For Merrill Lynch account holders, completing a beneficiary designation form is a straightforward process that can provide peace of mind and help avoid potential disputes or complications. In this article, we will provide a step-by-step guide on how to complete a Merrill Lynch beneficiary designation form.

Understanding the Importance of Beneficiary Designation

Beneficiary designation is a critical aspect of estate planning, as it allows individuals to specify who will inherit their assets, such as retirement accounts, life insurance policies, and other investments. By designating beneficiaries, individuals can ensure that their assets are distributed according to their wishes, rather than being subject to the laws of intestacy, which can lead to unintended consequences.

Why is beneficiary designation important? Here are a few reasons:

- Control over asset distribution: By designating beneficiaries, individuals can ensure that their assets are distributed according to their wishes, rather than being subject to the laws of intestacy.

- Avoiding probate: Beneficiary designation can help avoid probate, which can be a time-consuming and costly process.

- Reducing taxes: Beneficiary designation can also help reduce taxes, as beneficiaries may be eligible for tax benefits or exemptions.

Who Can Be a Beneficiary?

When it comes to designating beneficiaries, individuals have a range of options to choose from. Here are some common types of beneficiaries:

- Individuals: Spouses, children, parents, siblings, and other relatives can be designated as beneficiaries.

- Trusts: Trusts can be designated as beneficiaries, providing an additional layer of control and flexibility in asset distribution.

- Charities: Charitable organizations can also be designated as beneficiaries, allowing individuals to leave a lasting legacy.

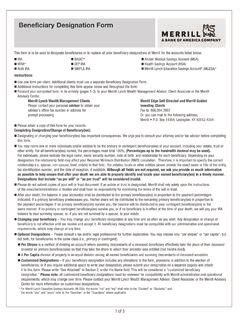

How to Complete a Merrill Lynch Beneficiary Designation Form

Completing a Merrill Lynch beneficiary designation form is a straightforward process that can be completed in a few steps. Here's a step-by-step guide:

- Gather required information: Before starting the form, gather the required information, including:

- Name and address of the account holder

- Name and address of the beneficiary(ies)

- Social Security number or tax identification number of the beneficiary(ies)

- Percentage of assets to be distributed to each beneficiary

- Download the form: Download the Merrill Lynch beneficiary designation form from the company's website or obtain a copy from a financial advisor.

- Complete the form: Complete the form by providing the required information, including the name and address of the account holder and the beneficiary(ies).

- Sign and date the form: Sign and date the form, making sure to follow any specific instructions or requirements.

- Submit the form: Submit the form to Merrill Lynch, either by mail or online, depending on the company's instructions.

Types of Beneficiary Designations

When it comes to beneficiary designations, there are several types to choose from, each with its own advantages and disadvantages. Here are some common types of beneficiary designations:

- Primary beneficiary: The primary beneficiary is the first in line to inherit the assets.

- Contingent beneficiary: The contingent beneficiary is the second in line to inherit the assets, in the event that the primary beneficiary predeceases the account holder.

- Revocable beneficiary: A revocable beneficiary is a beneficiary who can be changed or removed at any time.

- Irrevocable beneficiary: An irrevocable beneficiary is a beneficiary who cannot be changed or removed once designated.

Tips for Designating Beneficiaries

Designating beneficiaries can be a complex process, but here are some tips to keep in mind:

- Review and update beneficiary designations regularly: Beneficiary designations should be reviewed and updated regularly to ensure that they remain accurate and up-to-date.

- Consider using a trust: Using a trust can provide an additional layer of control and flexibility in asset distribution.

- Seek professional advice: Seeking professional advice from a financial advisor or attorney can help ensure that beneficiary designations are completed correctly and in accordance with the individual's wishes.

Common Mistakes to Avoid

When it comes to designating beneficiaries, there are several common mistakes to avoid. Here are a few:

- Failing to designate beneficiaries: Failing to designate beneficiaries can lead to unintended consequences, such as assets being distributed according to the laws of intestacy.

- Not reviewing or updating beneficiary designations: Failing to review or update beneficiary designations can lead to inaccuracies or outdated information.

- Not seeking professional advice: Failing to seek professional advice can lead to errors or omissions in the beneficiary designation process.

Best Practices for Beneficiary Designation

Here are some best practices for beneficiary designation:

- Use clear and concise language: Use clear and concise language when completing the beneficiary designation form to avoid any confusion or misinterpretation.

- Provide accurate information: Provide accurate information, including names, addresses, and Social Security numbers or tax identification numbers.

- Review and update beneficiary designations regularly: Review and update beneficiary designations regularly to ensure that they remain accurate and up-to-date.

Conclusion

Designating beneficiaries is an essential step in estate planning, allowing individuals to ensure that their assets are distributed according to their wishes after their passing. By following the steps outlined in this guide, individuals can complete a Merrill Lynch beneficiary designation form with confidence. Remember to review and update beneficiary designations regularly, seek professional advice, and use clear and concise language to avoid any confusion or misinterpretation.

What's your experience with beneficiary designation? Share your thoughts and questions in the comments below!

Share this article with friends and family who may benefit from this information.

What is a beneficiary designation form?

+A beneficiary designation form is a document used to specify who will inherit assets, such as retirement accounts, life insurance policies, and other investments, after the account holder's passing.

Why is beneficiary designation important?

+Beneficiary designation is important because it allows individuals to control over asset distribution, avoid probate, and reduce taxes.

Who can be a beneficiary?

+Individuals, trusts, and charities can be designated as beneficiaries.