The state of Michigan has its own set of tax requirements, and one of the most important forms you'll need to file is the MI-2210. As a resident or non-resident of Michigan, it's essential to understand what this form entails and how to fill it out accurately to avoid any delays or penalties.

Michigan is one of the many states in the US that has its own income tax system. While the federal government collects income taxes, individual states also have the authority to impose their own taxes on income earned within their borders. In Michigan, the state income tax rate is 4.25%, and residents are required to file their tax returns by April 15th of each year.

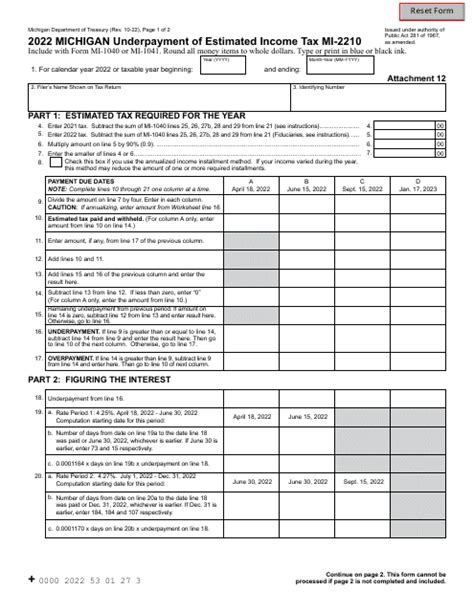

The MI-2210 is an essential form for individuals who need to report their state income tax withholding or make estimated tax payments. In this article, we'll delve into the details of the MI-2210 form, its requirements, and how to fill it out correctly.

Who Needs to File the MI-2210 Form?

The MI-2210 form is required for individuals who need to report their state income tax withholding or make estimated tax payments. This includes:

- Residents of Michigan who have income that is not subject to withholding, such as self-employment income or income from investments

- Non-residents of Michigan who have income from Michigan sources, such as rental income or income from a business located in Michigan

- Individuals who are required to make estimated tax payments

What Information Do I Need to Provide on the MI-2210 Form?

The MI-2210 form requires you to provide the following information:

- Your name and address

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your Michigan income tax withholding or estimated tax payments made during the year

- Your total Michigan income, including income from all sources

- Any credits or deductions you're claiming

How Do I Fill Out the MI-2210 Form?

Filling out the MI-2210 form can seem daunting, but it's relatively straightforward. Here's a step-by-step guide to help you get started:

- Gather your documents: Before you start filling out the form, make sure you have all the necessary documents, including your W-2 forms, 1099 forms, and any other relevant tax documents.

- Enter your personal information: Start by entering your name, address, and Social Security number or ITIN.

- Report your income: Report your total Michigan income, including income from all sources.

- Claim credits and deductions: Claim any credits or deductions you're eligible for, such as the Michigan earned income tax credit or the home heating credit.

- Calculate your tax: Calculate your Michigan income tax liability using the tax tables or the tax calculator provided on the form.

- Make estimated tax payments: If you're required to make estimated tax payments, complete the estimated tax payment schedule and attach it to the form.

MI-2210 Form Schedules and Attachments

The MI-2210 form has several schedules and attachments that you may need to complete, depending on your specific situation. These include:

- Schedule 1: Michigan Income Tax Withholding: Use this schedule to report your Michigan income tax withholding.

- Schedule 2: Estimated Tax Payments: Use this schedule to report your estimated tax payments.

- Schedule 3: Credits and Deductions: Use this schedule to claim any credits or deductions you're eligible for.

MI-2210 Form Deadlines and Penalties

The deadline for filing the MI-2210 form is April 15th of each year. If you're required to make estimated tax payments, the deadlines are:

- April 15th for the first quarter (January 1 - March 31)

- June 15th for the second quarter (April 1 - May 31)

- September 15th for the third quarter (June 1 - August 31)

- January 15th of the following year for the fourth quarter (September 1 - December 31)

Failure to file the MI-2210 form or make estimated tax payments on time can result in penalties and interest. The penalties for late filing or payment can be substantial, so it's essential to meet the deadlines.

MI-2210 Form Amended Return

If you need to make changes to your MI-2210 form after it's been filed, you can file an amended return using Form MI-1040X. This form is used to correct errors or report changes to your original return.

MI-2210 Form Frequently Asked Questions

Here are some frequently asked questions about the MI-2210 form:

- Do I need to file the MI-2210 form if I'm not a resident of Michigan? Yes, if you have income from Michigan sources, you're required to file the MI-2210 form.

- What is the deadline for filing the MI-2210 form? The deadline for filing the MI-2210 form is April 15th of each year.

- Can I file the MI-2210 form electronically? Yes, you can file the MI-2210 form electronically through the Michigan Department of Treasury's website.

Conclusion

The MI-2210 form is an essential part of Michigan's tax system, and it's crucial to understand its requirements and how to fill it out accurately. By following the steps outlined in this article, you can ensure that you're meeting your tax obligations and avoiding any delays or penalties. Remember to file your MI-2210 form on time, and don't hesitate to reach out to the Michigan Department of Treasury if you have any questions or concerns.

What is the MI-2210 form used for?

+The MI-2210 form is used to report Michigan income tax withholding or make estimated tax payments.

Who needs to file the MI-2210 form?

+Residents and non-residents of Michigan who have income that is not subject to withholding, such as self-employment income or income from investments.

What is the deadline for filing the MI-2210 form?

+The deadline for filing the MI-2210 form is April 15th of each year.