Cuyahoga County Homestead Exemption Form: Save On Property Taxes

For many homeowners in Cuyahoga County, Ohio, the Homestead Exemption program is a valuable resource that can help reduce their property tax burden. In this article, we will delve into the details of the Cuyahoga County Homestead Exemption Form, exploring what it is, how it works, and how eligible homeowners can benefit from it.

The Cuyahoga County Homestead Exemption is a tax reduction program designed to help senior citizens, disabled individuals, and low-income homeowners save on their property taxes. By filling out the Cuyahoga County Homestead Exemption Form, eligible homeowners can claim a significant exemption on their property taxes, resulting in substantial savings.

The Homestead Exemption program has been in place since 1970, with the goal of providing financial assistance to those who need it most. Over the years, the program has undergone several changes and updates to ensure that it remains effective and accessible to eligible homeowners.

Who is Eligible for the Cuyahoga County Homestead Exemption?

To qualify for the Cuyahoga County Homestead Exemption, homeowners must meet certain eligibility requirements. These requirements include:

- Being at least 65 years old or permanently and totally disabled

- Owning and occupying the property as their primary residence

- Having a total income of $31,400 or less for the previous year

- Not having a significant increase in income in the previous year

In addition to these requirements, homeowners must also meet certain property ownership and occupancy requirements.

How to Apply for the Cuyahoga County Homestead Exemption

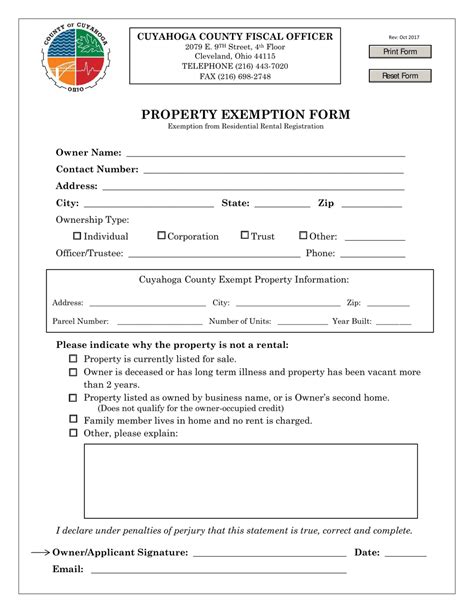

To apply for the Cuyahoga County Homestead Exemption, homeowners must complete the Cuyahoga County Homestead Exemption Form. This form can be obtained from the Cuyahoga County Auditor's office or downloaded from their website.

The form requires homeowners to provide detailed information about their income, property ownership, and occupancy. They must also provide documentation to support their application, including proof of age, disability, or income.

Once the form is completed and submitted, it will be reviewed by the Cuyahoga County Auditor's office. If approved, the homeowner will receive a notification indicating the amount of their exemption.

Benefits of the Cuyahoga County Homestead Exemption

The Cuyahoga County Homestead Exemption provides several benefits to eligible homeowners. These benefits include:

- Reduced property taxes: The exemption can result in significant savings on property taxes, helping homeowners to reduce their financial burden.

- Increased disposable income: By reducing property taxes, homeowners can free up more money in their budget for other essential expenses.

- Improved financial stability: The exemption can provide financial stability for homeowners who may be struggling to make ends meet.

In addition to these benefits, the Homestead Exemption program also helps to promote homeownership and community development in Cuyahoga County.

Common Questions and Answers

Q: What is the deadline for applying for the Cuyahoga County Homestead Exemption?

A: The deadline for applying for the Cuyahoga County Homestead Exemption is typically June 1st of each year.Q: Can I apply for the Homestead Exemption online?

A: No, the Cuyahoga County Homestead Exemption Form must be completed and submitted in person or by mail.Q: How long does it take to process the Homestead Exemption application?

A: The processing time for the Homestead Exemption application can vary, but it typically takes several weeks to several months.Q: Can I appeal if my application is denied?

A: Yes, if your application is denied, you can appeal the decision to the Cuyahoga County Auditor's office.Q: How often do I need to reapply for the Homestead Exemption?

A: Once you are approved for the Homestead Exemption, you do not need to reapply every year. However, you may need to provide updated information to the Cuyahoga County Auditor's office if your income or property ownership status changes.What are the income limits for the Cuyahoga County Homestead Exemption?

+The income limits for the Cuyahoga County Homestead Exemption are $31,400 or less for the previous year.

Can I apply for the Homestead Exemption if I am not a senior citizen or disabled?

+No, the Cuyahoga County Homestead Exemption is only available to senior citizens, disabled individuals, and low-income homeowners.

How much can I save on my property taxes with the Homestead Exemption?

+The amount of savings on property taxes with the Homestead Exemption varies depending on the homeowner's income and property value.

In conclusion, the Cuyahoga County Homestead Exemption Form is a valuable resource for eligible homeowners in Cuyahoga County, Ohio. By completing and submitting the form, homeowners can claim a significant exemption on their property taxes, resulting in substantial savings. We encourage all eligible homeowners to take advantage of this program and start saving on their property taxes today.

We hope you found this article informative and helpful. If you have any further questions or concerns, please do not hesitate to reach out to us. Additionally, we invite you to share your thoughts and experiences with the Cuyahoga County Homestead Exemption program in the comments section below.