Receiving health insurance coverage can be a costly affair, especially for individuals who are between jobs, self-employed, or have certain other qualifications. However, the US government offers a Health Coverage Tax Credit (HCTC) to help eligible individuals and families offset the costs of health insurance premiums. If you're one of the lucky ones who qualify for this credit, you'll need to file Form 8885 to claim it. In this article, we'll walk you through the five ways to claim the Health Coverage Tax Credit using Form 8885.

Understanding the Health Coverage Tax Credit (HCTC)

The HCTC is a tax credit designed to help eligible individuals and families pay for health insurance premiums. This credit is refundable, meaning that even if you don't owe taxes, you can still receive the credit as a refund. The HCTC can cover up to 72.5% of qualified health insurance premiums, depending on your income and family size.

Who is Eligible for the HCTC?

To qualify for the HCTC, you must meet certain requirements. These include:

- Being enrolled in a qualified health insurance plan

- Receiving Trade Adjustment Assistance (TAA) benefits or being eligible for Alternative Trade Adjustment Assistance (ATAA)

- Being a beneficiary of the Pension Benefit Guaranty Corporation (PBGC)

- Having a qualified family member who is a beneficiary of the PBGC

- Being a retiree age 55-64 and receiving benefits from the PBGC

What is a Qualified Health Insurance Plan?

A qualified health insurance plan is a plan that meets certain requirements, including:

- Being a private health insurance plan (not a group plan)

- Providing comprehensive coverage (not just limited to specific services, like dental or vision)

- Being purchased through a qualified insurance provider

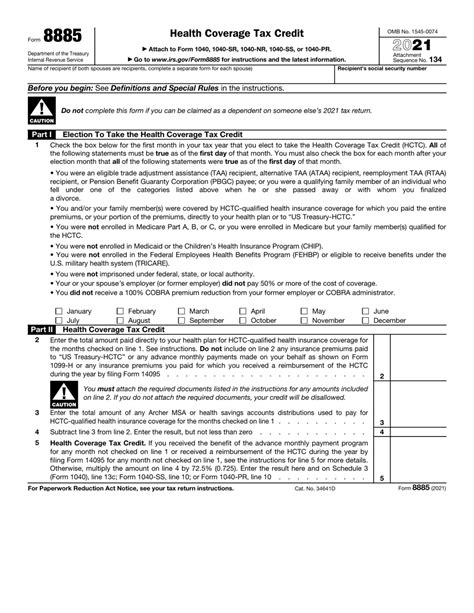

5 Ways to Claim the Health Coverage Tax Credit Form 8885

Now that we've covered the basics of the HCTC, let's dive into the five ways to claim the credit using Form 8885:

1. Claim the HCTC on Your Tax Return

To claim the HCTC on your tax return, you'll need to file Form 8885 along with your Form 1040. You'll report the credit on Line 70 of Form 1040.

2. Claim the HCTC as an Advance Payment

If you're eligible for the HCTC, you can also claim it as an advance payment. This means that you'll receive the credit in advance, rather than waiting until you file your tax return. To do this, you'll need to file Form 1099-H with your insurance provider.

3. Claim the HCTC for a Qualifying Family Member

If you have a qualifying family member who is a beneficiary of the PBGC, you may be able to claim the HCTC on their behalf. You'll need to file Form 8885 and attach it to your tax return.

4. Claim the HCTC for a Retiree Age 55-64

If you're a retiree age 55-64 and receiving benefits from the PBGC, you may be eligible for the HCTC. You'll need to file Form 8885 and attach it to your tax return.

5. Claim the HCTC for a Beneficiary of the PBGC

If you're a beneficiary of the PBGC, you may be eligible for the HCTC. You'll need to file Form 8885 and attach it to your tax return.

How to Complete Form 8885

To complete Form 8885, you'll need to follow these steps:

- Enter your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN) at the top of the form.

- Check the box that indicates the type of credit you're claiming (e.g., HCTC for yourself, a qualifying family member, or a retiree age 55-64).

- Enter the amount of qualified health insurance premiums you paid during the tax year.

- Calculate the credit amount using the worksheet provided in the instructions.

- Enter the credit amount on Line 1 of Form 8885.

- Attach Form 8885 to your tax return (Form 1040).

FAQs

Who is eligible for the Health Coverage Tax Credit?

+To be eligible for the HCTC, you must be enrolled in a qualified health insurance plan and meet certain requirements, such as receiving TAA benefits or being a beneficiary of the PBGC.

How do I claim the HCTC on my tax return?

+To claim the HCTC on your tax return, you'll need to file Form 8885 along with your Form 1040. You'll report the credit on Line 70 of Form 1040.

Can I claim the HCTC for a qualifying family member?

+Yes, you can claim the HCTC for a qualifying family member who is a beneficiary of the PBGC. You'll need to file Form 8885 and attach it to your tax return.

By following these steps and understanding the eligibility requirements, you can claim the Health Coverage Tax Credit using Form 8885. Remember to attach the form to your tax return and report the credit on Line 70 of Form 1040. If you have any further questions or concerns, don't hesitate to reach out to a tax professional or the IRS for guidance.