Maintaining good credit health is crucial for individuals and businesses alike. One way to ensure this is by keeping track of credit accounts and making timely payments. However, unforeseen circumstances can sometimes lead to missed payments or account closures. If you're a Citibank customer facing this situation, understanding the process of reinstating a closed account can be invaluable. In this article, we'll delve into the Citibank reinstatement form and the essential steps to follow.

Being proactive about managing your credit can significantly impact your financial stability and opportunities. Whether you're trying to rectify a past mistake or navigate a challenging financial period, knowing the options available to you can provide peace of mind. For Citibank customers, the reinstatement process offers a pathway to restore a closed account to good standing. This not only helps in repairing credit scores but also in maintaining a positive relationship with the bank.

The importance of understanding the reinstatement process cannot be overstated. It's a chance to rectify past issues and move forward with improved financial management strategies. Moreover, the process itself can serve as a learning experience, helping individuals and businesses avoid similar situations in the future. By navigating the reinstatement process effectively, you're not only resolving immediate issues but also investing in your long-term financial well-being.

Understanding the Citibank Reinstatement Process

Before diving into the steps for the Citibank reinstatement form, it's essential to grasp the overall process. The reinstatement process is essentially a request to the bank to reopen a closed account. This could be due to various reasons such as a missed payment, bankruptcy, or other financial difficulties. The goal is to demonstrate to Citibank that you're now in a better financial position to manage the account responsibly.

Eligibility for Reinstatement

Not all accounts are eligible for reinstatement. Citibank typically considers accounts that were closed due to missed payments or other minor infractions. However, accounts closed due to more serious issues, such as fraud or severe financial delinquency, might not be eligible. It's crucial to check with Citibank directly to determine the eligibility of your account.

Step 1: Gather Required Documents

The first step in the reinstatement process involves gathering all the necessary documents. These typically include:

- Identification: Valid government-issued ID (driver's license, passport, etc.)

- Proof of Income: Recent pay stubs, tax returns, or other income verification documents

- Account Details: The closed account number and any other relevant account information

- Payment History: Records of payments made towards the account (if applicable)

- Explanation Letter: A written explanation detailing the reasons for the account closure and how you plan to manage the account moving forward

Ensure all documents are up-to-date and accurate to avoid any delays in the process.

Importance of the Explanation Letter

The explanation letter is a critical component of the reinstatement request. It should clearly outline the circumstances that led to the account closure, acknowledge any mistakes made, and provide a detailed plan for how you intend to manage the account responsibly going forward. This letter is your opportunity to tell your side of the story and demonstrate your commitment to rectifying past issues.

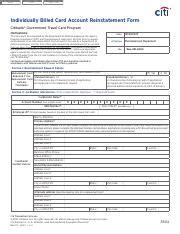

Step 2: Fill Out the Reinstatement Form

Once you've gathered all the necessary documents, the next step is to fill out the Citibank reinstatement form. This form can usually be obtained from the Citibank website, by contacting their customer service, or by visiting a local branch. Ensure you fill out the form accurately and completely, as any errors or omissions can delay the process.

The form will likely require detailed information about the account, the reasons for the closure, and your financial situation. Be honest and transparent in your responses, as Citibank will review this information carefully in considering your reinstatement request.

Step 3: Submit the Request

After completing the form and gathering all the necessary documents, the next step is to submit your reinstatement request. This can usually be done online, by mail, or in person at a Citibank branch. Make sure to follow the submission guidelines provided by Citibank to ensure your request is processed efficiently.

Tracking Your Request

Once you've submitted your request, it's essential to keep track of its status. Citibank will review your application and may contact you for additional information or clarification. Be responsive to any communications from the bank, as this can impact the processing time of your request.

Step 4: Review and Response

After submitting your reinstatement request, Citibank will review your application. This process can take several weeks to a few months, depending on the complexity of the case and the bank's workload. During this time, it's essential to be patient and responsive to any inquiries from the bank.

Citibank will consider various factors in reviewing your request, including your payment history, current financial situation, and the reasons for the account closure. If your request is approved, you will be notified, and the account will be reinstated. However, if your request is denied, you will receive a notification outlining the reasons for the denial.

Step 5: Moving Forward

If your reinstatement request is approved, it's crucial to use this as an opportunity to move forward positively. This includes making timely payments, keeping your credit utilization ratio low, and monitoring your credit report for any errors.

On the other hand, if your request is denied, don't despair. Use this as a learning experience to improve your financial management strategies. You may want to consider seeking advice from a financial advisor or credit counselor to help you navigate your financial situation.

Building a Better Financial Future

Regardless of the outcome of your reinstatement request, the most important step is moving forward with a plan to improve your financial health. This includes setting realistic financial goals, creating a budget, and avoiding debt. By taking proactive steps towards financial stability, you're not only rebuilding your credit but also securing a better financial future.

What is the Citibank reinstatement form used for?

+The Citibank reinstatement form is used by customers to request the reinstatement of a closed account. This process allows individuals to rectify past financial issues and restore a positive credit standing with the bank.

How long does the reinstatement process typically take?

+The reinstatement process can vary in duration but typically takes several weeks to a few months. The exact timeframe depends on the complexity of the case and Citibank's current workload.

What are the chances of getting a reinstatement request approved?

+The approval rate for reinstatement requests varies. Citibank considers several factors, including payment history, current financial situation, and the reasons for account closure. Demonstrating a clear plan for managing the account responsibly can improve the chances of approval.

Navigating the Citibank reinstatement form and process can seem daunting, but with the right approach and understanding, it's a viable pathway to restoring a closed account. By following the essential steps outlined above and maintaining a proactive stance towards financial management, you're not only rectifying past issues but also investing in a healthier financial future. Remember, every step towards financial stability is a step in the right direction.