As an employer in California, it is essential to understand the CA 7a Form, also known as the Employee Withholding Certificate. This form is a critical component of the state's tax withholding system, and its proper use can help you avoid penalties and ensure compliance with state regulations. In this article, we will delve into the details of the CA 7a Form, its purpose, and how to use it correctly.

What is the CA 7a Form?

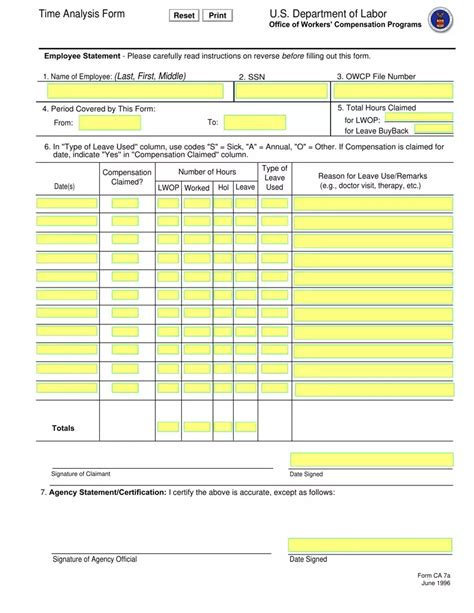

The CA 7a Form is a certificate that employees must complete and submit to their employers to claim a reduction in state income tax withholding. The form is used to determine the correct amount of state income tax to withhold from an employee's wages. The California Employment Development Department (EDD) requires employers to obtain this form from employees to ensure accurate tax withholding.

Purpose of the CA 7a Form

The primary purpose of the CA 7a Form is to allow employees to claim a reduction in state income tax withholding. This form is essential for employees who have had a change in their income or family situation, which may affect their tax liability. By completing the CA 7a Form, employees can ensure that their employer withholds the correct amount of state income tax from their wages.

How to Complete the CA 7a Form

Completing the CA 7a Form is a straightforward process. Employees must provide their personal and employment information, including their name, address, and Social Security number. They must also indicate the number of allowances they claim for state income tax withholding purposes.

Allowances and Withholding

The CA 7a Form allows employees to claim a certain number of allowances, which affects the amount of state income tax withheld from their wages. Allowances are based on the employee's filing status, number of dependents, and other factors. The more allowances an employee claims, the less state income tax will be withheld.

Benefits of the CA 7a Form

The CA 7a Form provides several benefits to employees and employers alike. By accurately determining the correct amount of state income tax withholding, employees can avoid overpayment or underpayment of taxes. This form also helps employers comply with state regulations and avoid penalties for incorrect tax withholding.

Common Mistakes to Avoid

When completing the CA 7a Form, employees and employers must avoid common mistakes that can lead to incorrect tax withholding or penalties. These mistakes include:

- Failing to complete the form accurately and thoroughly

- Not submitting the form to the employer on time

- Claiming too many or too few allowances

- Not updating the form when changes occur in income or family situation

Best Practices for Employers

As an employer, it is essential to follow best practices when handling the CA 7a Form. These practices include:

- Obtaining the completed form from employees on time

- Reviewing the form for accuracy and completeness

- Updating employee records and tax withholding information accordingly

- Providing employees with guidance on completing the form correctly

Conclusion and Next Steps

In conclusion, the CA 7a Form is a critical component of California's tax withholding system. By understanding the purpose and proper use of this form, employees and employers can ensure accurate tax withholding and avoid penalties. If you have any questions or concerns about the CA 7a Form, we encourage you to comment below or share this article with others who may find it helpful.

What is the purpose of the CA 7a Form?

+The CA 7a Form is used to determine the correct amount of state income tax to withhold from an employee's wages.

How do I complete the CA 7a Form?

+Employees must provide their personal and employment information, including their name, address, and Social Security number, and indicate the number of allowances they claim for state income tax withholding purposes.

What are the benefits of the CA 7a Form?

+The CA 7a Form provides several benefits, including accurate tax withholding, avoidance of overpayment or underpayment of taxes, and compliance with state regulations.