The IRS Form 8453-C, also known as the Electronically Filed Return Data Sheet, is a crucial document used by the Internal Revenue Service (IRS) to verify the accuracy and authenticity of electronically filed tax returns. In this article, we will delve into the importance of Form 8453-C, its components, and the benefits of using it.

What is Form 8453-C?

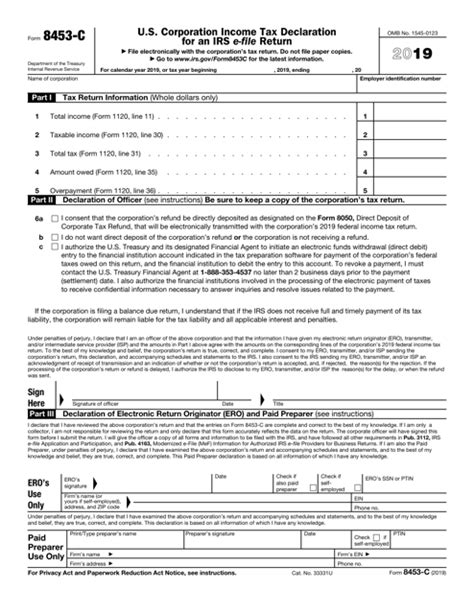

Form 8453-C is a supplemental document that accompanies an electronically filed tax return. It is used to verify the identity of the taxpayer and to authenticate the tax return. The form contains important information about the taxpayer, including their name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN). This information is used by the IRS to match the electronically filed return with the taxpayer's paper return, if one is filed.

Components of Form 8453-C

Form 8453-C consists of several key components, including:

- Taxpayer's name and address: This information is used to verify the taxpayer's identity and to match the electronically filed return with the paper return, if one is filed.

- Social Security number or ITIN: This information is used to verify the taxpayer's identity and to match the electronically filed return with the paper return, if one is filed.

- Tax year: This information is used to verify the tax year for which the return is being filed.

- Return type: This information is used to verify the type of return being filed (e.g., Form 1040, Form 1120, etc.).

- Electronic filing information: This information is used to verify the authenticity of the electronically filed return.

Benefits of Using Form 8453-C

Using Form 8453-C offers several benefits, including:

- Improved accuracy: By verifying the taxpayer's identity and authenticating the tax return, Form 8453-C helps to reduce errors and improve the accuracy of electronically filed returns.

- Increased security: Form 8453-C helps to prevent identity theft and other forms of tax-related fraud by verifying the taxpayer's identity and authenticating the tax return.

- Faster processing: By verifying the taxpayer's identity and authenticating the tax return, Form 8453-C helps to speed up the processing of electronically filed returns.

- Reduced paperwork: Form 8453-C eliminates the need for taxpayers to mail a paper copy of their return to the IRS, reducing paperwork and saving time.

Who Needs to File Form 8453-C?

Form 8453-C is required for all electronically filed tax returns, including:

- Individual tax returns: Form 1040, Form 1040A, and Form 1040EZ.

- Business tax returns: Form 1120, Form 1120S, and Form 1065.

- Other tax returns: Form 941, Form 944, and Form 990.

How to File Form 8453-C

Form 8453-C can be filed electronically through the IRS's Electronic Filing System (EFS) or by mailing a paper copy to the IRS. To file electronically, taxpayers can use tax preparation software or work with a tax professional. To file by mail, taxpayers can download and print Form 8453-C from the IRS website or obtain a copy from a local IRS office.

Common Errors to Avoid When Filing Form 8453-C

When filing Form 8453-C, taxpayers should avoid the following common errors:

- Incorrect taxpayer information: Make sure to enter the correct name, address, and Social Security number or ITIN.

- Incorrect tax year: Make sure to enter the correct tax year for which the return is being filed.

- Incorrect return type: Make sure to enter the correct type of return being filed (e.g., Form 1040, Form 1120, etc.).

- Missing or incomplete information: Make sure to complete all required fields and attach any necessary supporting documentation.

Conclusion

Form 8453-C is an important document used by the IRS to verify the accuracy and authenticity of electronically filed tax returns. By understanding the components and benefits of Form 8453-C, taxpayers can ensure that their electronically filed returns are processed quickly and accurately. Remember to file Form 8453-C electronically or by mail, and avoid common errors to ensure a smooth filing process.

What is the purpose of Form 8453-C?

+Form 8453-C is used to verify the accuracy and authenticity of electronically filed tax returns.

Who needs to file Form 8453-C?

+Form 8453-C is required for all electronically filed tax returns, including individual and business tax returns.

How do I file Form 8453-C?

+Form 8453-C can be filed electronically through the IRS's Electronic Filing System (EFS) or by mailing a paper copy to the IRS.