Completing tax forms can be a daunting task, especially for those who are new to filing taxes in North Carolina. The NC Form D-400 is a crucial document for residents and non-residents who need to file their state income taxes. With the right guidance, however, completing this form can be a breeze. In this article, we will explore five tips to help you complete the NC Form D-400 with ease.

Understanding the NC Form D-400

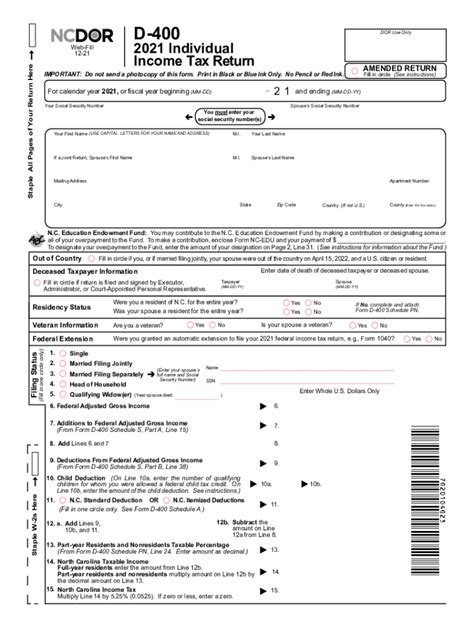

The NC Form D-400 is the standard form used by the North Carolina Department of Revenue to report an individual's state income tax. It is a required document for anyone who has earned income from sources within the state, including wages, salaries, tips, and self-employment income. The form is used to calculate the taxpayer's state income tax liability and to report any tax credits or deductions they may be eligible for.

Tip 1: Gather All Necessary Documents

Before starting to complete the NC Form D-400, it is essential to gather all necessary documents and information. This includes:

- Your federal income tax return (Form 1040)

- W-2 forms from your employer(s)

- 1099 forms for any self-employment income or freelance work

- Any other relevant tax documents, such as interest statements or dividend statements

- Your social security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's social security number or ITIN, if filing jointly

Having all these documents at hand will save you time and reduce the risk of errors when completing the form.

Breaking Down the NC Form D-400

The NC Form D-400 is divided into several sections, each with its own set of instructions and requirements. Understanding the different sections and how they relate to each other is crucial to completing the form accurately.

Tip 2: Understand the Filing Status Options

The filing status section is one of the most critical parts of the NC Form D-400. Your filing status determines your tax rates, deductions, and credits. North Carolina recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Filing Status Options

| Filing Status | Description |

|---|---|

| Single | Unmarried or considered unmarried for tax purposes |

| Married filing jointly | Married couples who file their taxes together |

| Married filing separately | Married couples who file their taxes separately |

| Head of household | Unmarried individuals who are responsible for a qualifying person |

| Qualifying widow(er) | A widow(er) with dependent children |

Choose the correct filing status to ensure you are eligible for the correct tax rates and deductions.

Tip 3: Report All Income

The NC Form D-400 requires you to report all income earned from North Carolina sources. This includes:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains and losses

- Retirement income

Make sure to report all income, regardless of whether you received a W-2 or 1099 form.

Claiming Deductions and Credits

Deductions and credits can significantly reduce your tax liability. The NC Form D-400 allows you to claim various deductions and credits, including:

- Standard deduction

- Itemized deductions

- Child tax credit

- Earned income tax credit (EITC)

Tip 4: Claim All Eligible Deductions and Credits

Take the time to review the deductions and credits you are eligible for. This may include:

- Charitable donations

- Mortgage interest

- Property taxes

- Medical expenses

- Education expenses

Claiming all eligible deductions and credits can significantly reduce your tax liability.

Tip 5: Review and Double-Check Your Return

Once you have completed the NC Form D-400, review your return carefully to ensure accuracy. Check for:

- Mathematical errors

- Missing information

- Incorrect filing status

- Ineligible deductions and credits

Double-checking your return can save you time and hassle in the long run.

Additional Tips and Resources

- Use tax software or consult a tax professional if you are unsure about any part of the form.

- Keep accurate records of your income and expenses.

- File your return electronically to speed up the refund process.

By following these five tips, you can complete the NC Form D-400 with ease and accuracy. Remember to take your time, review your return carefully, and seek help if needed.

We hope this article has been helpful in guiding you through the process of completing the NC Form D-400. If you have any further questions or concerns, please leave a comment below.

What is the deadline for filing the NC Form D-400?

+The deadline for filing the NC Form D-400 is typically April 15th of each year.

Can I file the NC Form D-400 electronically?

+Yes, you can file the NC Form D-400 electronically through the North Carolina Department of Revenue's website.

What is the standard deduction for the NC Form D-400?

+The standard deduction for the NC Form D-400 varies depending on your filing status and income level. Please refer to the NC Form D-400 instructions for more information.