The 701-6 form is a critical document for businesses operating in the United States, particularly those involved in importing and exporting goods. However, understanding the requirements of this form can be daunting, especially for those new to international trade. In this article, we will delve into the world of 701-6 forms, exploring what they are, their purpose, and most importantly, how to navigate their requirements.

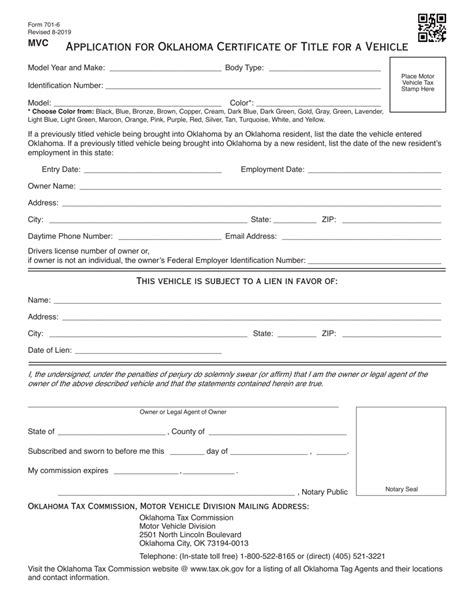

The 701-6 form, also known as the Certificate of Delivery (Bonded Warehouse), is a document used to verify the delivery of imported goods from a bonded warehouse to a buyer. A bonded warehouse is a secure facility where imported goods are stored until customs duties are paid or the goods are exported. The 701-6 form serves as proof that the goods have been delivered to the buyer, allowing the warehouse to release the goods from its custody.

Understanding the 701-6 form requirements is crucial for businesses to ensure compliance with customs regulations and avoid potential penalties or delays. In this article, we will explore five ways to understand the requirements of the 701-6 form.

1. Familiarize Yourself with the Form's Purpose and Structure

The first step to understanding the 701-6 form requirements is to familiarize yourself with the form's purpose and structure. The 701-6 form is a standardized document that consists of several sections, including the certificate of delivery, the warehouse entry, and the delivery information. Each section requires specific information, such as the buyer's name and address, the warehouse's name and address, and the description of the goods being delivered.

Key Sections of the 701-6 Form

- Certificate of Delivery: This section certifies that the goods have been delivered to the buyer.

- Warehouse Entry: This section provides information about the warehouse, including its name, address, and entry number.

- Delivery Information: This section provides details about the delivery, including the date, time, and location of delivery.

By understanding the purpose and structure of the 701-6 form, businesses can better navigate the requirements and ensure compliance with customs regulations.

2. Review the Form's Requirements for Accuracy and Completeness

The 701-6 form requires specific information to be accurate and complete. Businesses must ensure that all required fields are filled out correctly and that the information is consistent throughout the form. This includes verifying the buyer's information, the warehouse's information, and the description of the goods being delivered.

Common Errors to Avoid

- Incomplete or inaccurate information

- Missing or incorrect signatures

- Failure to include required documentation

By reviewing the form's requirements for accuracy and completeness, businesses can avoid common errors and ensure that the form is processed correctly.

3. Understand the Form's Filing Requirements

The 701-6 form must be filed with the relevant authorities, typically the U.S. Customs and Border Protection (CBP). Businesses must ensure that the form is filed correctly and on time to avoid delays or penalties.

Filing Requirements

- The form must be filed within 30 days of delivery

- The form must be filed electronically or by mail

- The form must include all required documentation

By understanding the form's filing requirements, businesses can ensure that the form is processed correctly and avoid potential delays or penalties.

4. Know the Form's Record-Keeping Requirements

The 701-6 form requires businesses to maintain accurate and complete records. This includes records of the form itself, as well as supporting documentation such as commercial invoices and packing lists.

Record-Keeping Requirements

- Businesses must maintain records for at least 5 years

- Records must be accurate and complete

- Records must be available for inspection by CBP

By knowing the form's record-keeping requirements, businesses can ensure that they are in compliance with customs regulations and avoid potential penalties or fines.

5. Seek Professional Help When Needed

Finally, businesses should not hesitate to seek professional help when needed. This can include consulting with a customs broker or attorney to ensure that the form is completed correctly and filed on time.

Benefits of Seeking Professional Help

- Ensures compliance with customs regulations

- Avoids potential delays or penalties

- Provides peace of mind for businesses

By seeking professional help when needed, businesses can ensure that they are in compliance with customs regulations and avoid potential delays or penalties.

In conclusion, understanding the 701-6 form requirements is crucial for businesses involved in importing and exporting goods. By familiarizing yourself with the form's purpose and structure, reviewing the form's requirements for accuracy and completeness, understanding the form's filing requirements, knowing the form's record-keeping requirements, and seeking professional help when needed, businesses can ensure compliance with customs regulations and avoid potential delays or penalties.

We invite you to share your thoughts and experiences with the 701-6 form in the comments below. Have you encountered any challenges or difficulties with the form? How have you ensured compliance with customs regulations? Share your insights and help others navigate the complexities of international trade.

What is the purpose of the 701-6 form?

+The 701-6 form, also known as the Certificate of Delivery (Bonded Warehouse), is a document used to verify the delivery of imported goods from a bonded warehouse to a buyer.

What are the common errors to avoid when completing the 701-6 form?

+Common errors to avoid include incomplete or inaccurate information, missing or incorrect signatures, and failure to include required documentation.

How long must businesses maintain records of the 701-6 form?

+Businesses must maintain records of the 701-6 form for at least 5 years.