The IRS Form 8862 is a crucial document for individuals who are claiming the Earned Income Tax Credit (EITC) or the Child Tax Credit. Completing this form accurately is essential to avoid delays or even denial of your tax credit. In this article, we will guide you through the 7 steps to complete IRS Form 8862.

The importance of completing Form 8862 correctly cannot be overstated. The IRS uses this form to verify your eligibility for the EITC and Child Tax Credit. Any mistakes or omissions can lead to a delay in processing your tax return or even a denial of your tax credit.

Understanding the purpose and requirements of Form 8862 is essential before we dive into the steps to complete it. The form is designed to help the IRS verify your identity, income, and eligibility for the EITC and Child Tax Credit.

Step 1: Gather Required Documents

Before you start filling out Form 8862, make sure you have all the necessary documents and information. You will need:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's Social Security number or ITIN (if applicable)

- Your qualifying child's Social Security number or ITIN (if applicable)

- Your employment documents, such as W-2 forms and 1099 forms

- Your income statements, such as interest statements and dividend statements

- Your expense records, such as receipts for childcare expenses

Organizing Your Documents

Organizing your documents and information before starting to fill out Form 8862 will save you time and reduce the risk of errors. Make sure you have all the necessary documents and information before proceeding to the next step.

Step 2: Identify Your Filing Status

Your filing status will determine which sections of Form 8862 you need to complete. You can file as single, married filing jointly, married filing separately, head of household, or qualifying widow(er). Make sure you choose the correct filing status to avoid delays or errors.

Understanding Filing Status

Understanding your filing status is crucial to completing Form 8862 accurately. If you are unsure about your filing status, you can consult the IRS website or seek advice from a tax professional.

Step 3: Report Your Income

Reporting your income accurately is essential to determine your eligibility for the EITC and Child Tax Credit. You will need to report your income from all sources, including employment, self-employment, and investments.

Types of Income

Make sure you report all types of income, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividend income

- Capital gains and losses

- Unemployment benefits

Step 4: Claim Your Qualifying Child

If you are claiming the EITC or Child Tax Credit, you will need to claim your qualifying child on Form 8862. You will need to provide the child's Social Security number or ITIN, as well as their relationship to you.

Qualifying Child Requirements

To qualify for the EITC or Child Tax Credit, your child must meet the following requirements:

- Be under the age of 19 (or under the age of 24 if a full-time student)

- Be a U.S. citizen, national, or resident

- Live with you for more than six months of the tax year

Step 5: Calculate Your EITC and Child Tax Credit

Once you have completed the previous steps, you can calculate your EITC and Child Tax Credit. You will need to use the IRS's EITC and Child Tax Credit calculators to determine your credit amount.

EITC and Child Tax Credit Limits

Make sure you understand the EITC and Child Tax Credit limits to avoid errors. The credit amounts vary based on your income, filing status, and number of qualifying children.

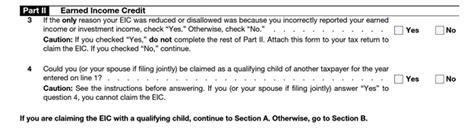

Step 6: Complete the Additional Questions

Form 8862 includes additional questions to help the IRS verify your identity and eligibility for the EITC and Child Tax Credit. Make sure you answer these questions accurately and truthfully.

Importance of Accurate Answers

Answering the additional questions accurately is crucial to avoid delays or errors. Make sure you understand the questions and provide truthful answers.

Step 7: Review and Sign Your Form

Once you have completed Form 8862, review it carefully for accuracy and completeness. Make sure you sign and date the form to avoid delays or errors.

Final Check

Before submitting your Form 8862, make a final check to ensure accuracy and completeness. This will help you avoid delays or errors and ensure you receive your tax credit promptly.

In conclusion, completing Form 8862 requires attention to detail and accuracy. By following these 7 steps, you can ensure you complete the form correctly and avoid delays or errors. Remember to review and sign your form carefully before submitting it to the IRS.

We hope this article has been helpful in guiding you through the process of completing Form 8862. If you have any further questions or concerns, please feel free to comment below.

What is IRS Form 8862?

+IRS Form 8862 is used to verify an individual's eligibility for the Earned Income Tax Credit (EITC) and Child Tax Credit.

Who needs to file Form 8862?

+Individuals who are claiming the EITC or Child Tax Credit need to file Form 8862.

What documents do I need to complete Form 8862?

+You will need your Social Security number or ITIN, employment documents, income statements, and expense records.