The 5106 form is a crucial document for shipping packages with FedEx, especially for international shipments. Understanding the purpose, requirements, and benefits of this form can help streamline your shipping process and avoid potential issues.

What is a 5106 Form FedEx?

A 5106 form, also known as a Commercial Invoice, is a document required by FedEx for international shipments. It serves as a declaration of the shipment's contents, value, and country of origin. The form provides essential information for customs clearance, duty calculation, and compliance with regulations.

Benefits of Using a 5106 Form FedEx

Using a 5106 form can help ensure a smooth shipping process and provide several benefits, including:

- Compliance with regulations: The form helps ensure that your shipment complies with relevant laws, regulations, and customs requirements.

- Accurate duty calculation: The form provides essential information for accurate duty calculation, reducing the risk of unexpected charges or delays.

- Streamlined customs clearance: The form helps expedite customs clearance, reducing the time and effort required to process your shipment.

- Reduced risk of shipment delays: By providing accurate and complete information, you can minimize the risk of shipment delays or returns.

Key Information Required on a 5106 Form FedEx

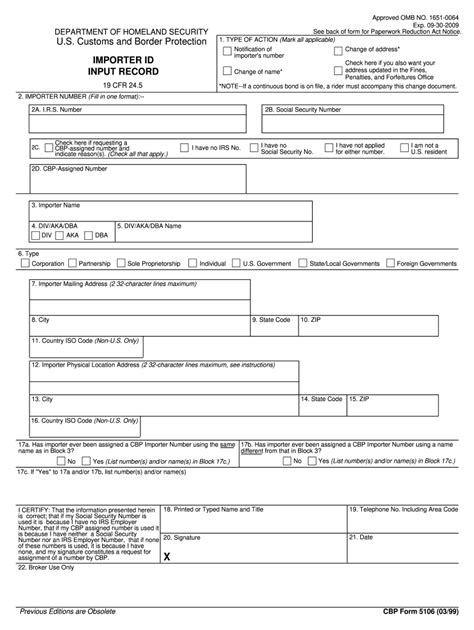

To complete a 5106 form, you'll need to provide the following key information:

- Shipper's and consignee's details: Include the shipper's and consignee's names, addresses, and contact information.

- Shipment details: Provide the shipment's weight, dimensions, and packaging type.

- Commodity information: Include a detailed description of the commodities being shipped, including their country of origin and value.

- Harmonized System (HS) codes: Assign the correct HS codes to each commodity, which are used to classify goods for customs purposes.

How to Complete a 5106 Form FedEx

To complete a 5106 form, follow these steps:

- Download the form: Obtain a copy of the 5106 form from the FedEx website or by contacting their customer service.

- Fill in the required information: Complete the form with the required information, ensuring accuracy and completeness.

- Assign HS codes: Assign the correct HS codes to each commodity, which can be found in the Harmonized System Tariff Schedule.

- Sign and date the form: Sign and date the form, indicating that the information provided is accurate and true.

Common Mistakes to Avoid When Using a 5106 Form FedEx

To avoid potential issues, be aware of the following common mistakes:

- Inaccurate or incomplete information: Ensure that all information provided is accurate and complete.

- Incorrect HS codes: Assign the correct HS codes to each commodity to avoid delays or penalties.

- Failure to sign and date the form: Sign and date the form to indicate that the information provided is accurate and true.

By understanding the purpose, requirements, and benefits of a 5106 form FedEx, you can ensure a smooth shipping process and avoid potential issues. Remember to complete the form accurately and carefully, and avoid common mistakes to ensure a successful international shipment.

Invite readers to comment, share their experiences, or ask questions about using a 5106 form FedEx in the comments section below.

What is the purpose of a 5106 form FedEx?

+A 5106 form, also known as a Commercial Invoice, is a document required by FedEx for international shipments. It serves as a declaration of the shipment's contents, value, and country of origin.

What information is required on a 5106 form FedEx?

+To complete a 5106 form, you'll need to provide shipper's and consignee's details, shipment details, commodity information, and Harmonized System (HS) codes.

How do I complete a 5106 form FedEx?

+To complete a 5106 form, download the form from the FedEx website or contact their customer service, fill in the required information, assign HS codes, and sign and date the form.