Filing taxes can be a daunting task, especially when dealing with complex forms like the Treaty-Based Return Position Disclosure Statement, Form 8833. This form is required for taxpayers who claim a reduced rate of withholding under a tax treaty or claim an exemption from withholding on income that is subject to the provisions of a tax treaty. In this article, we will provide you with 5 tips for filing Form 8833 on TurboTax, making the process easier and less overwhelming.

Understanding Form 8833 and Its Requirements

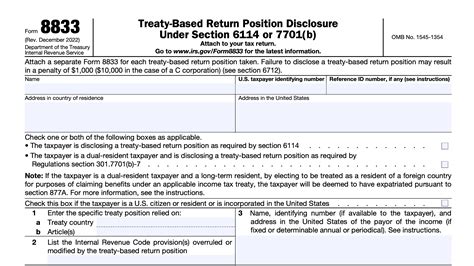

Before we dive into the tips, it's essential to understand what Form 8833 is and why it's necessary. Form 8833 is used to disclose certain treaty-based return positions that are taken on a taxpayer's return. This form is typically filed by individuals who are residents of the United States and have income from foreign sources, such as interest, dividends, or royalties. The form requires taxpayers to provide detailed information about the tax treaty and the specific provisions that apply to their situation.

Tip 1: Gather All Necessary Documents and Information

Before starting the filing process, make sure you have all the necessary documents and information. This includes:

- A copy of the tax treaty between the United States and the foreign country

- A statement explaining the taxpayer's position and the treaty provisions that apply

- The taxpayer's name, address, and taxpayer identification number

- The type and amount of income subject to the treaty provisions

- The applicable treaty article and paragraph numbers

Having all the necessary documents and information will make the filing process much smoother and reduce the risk of errors or omissions.

Tip 2: Use TurboTax's Form 8833 Wizard

TurboTax offers a Form 8833 wizard that guides you through the filing process. This wizard will ask you a series of questions and provide you with the necessary forms and instructions. To access the Form 8833 wizard, follow these steps:

- Log in to your TurboTax account

- Click on the "Federal" tab

- Select "Other Forms" from the drop-down menu

- Click on "Form 8833"

- Follow the on-screen instructions to complete the form

Using the Form 8833 wizard can help ensure that you complete the form accurately and efficiently.

Tip 3: Complete Form 8833 Accurately and Thoroughly

When completing Form 8833, it's essential to be accurate and thorough. Make sure you:

- Provide all required information, including the taxpayer's name, address, and taxpayer identification number

- Clearly explain the taxpayer's position and the treaty provisions that apply

- Include all required attachments, such as a copy of the tax treaty

- Sign and date the form

Inaccurate or incomplete information can lead to delays or even audits. Take your time and make sure you complete the form correctly.

Tip 4: Attach All Required Documents and Statements

Form 8833 requires you to attach certain documents and statements, including:

- A copy of the tax treaty between the United States and the foreign country

- A statement explaining the taxpayer's position and the treaty provisions that apply

- Any other supporting documentation, such as receipts or invoices

Make sure you attach all required documents and statements to Form 8833. This will help ensure that your return is processed efficiently and accurately.

Tip 5: Review and Edit Form 8833 Carefully

Before submitting Form 8833, review and edit it carefully. Make sure:

- All information is accurate and complete

- All required documents and statements are attached

- The form is signed and dated

Reviewing and editing Form 8833 can help ensure that it is accurate and complete, reducing the risk of errors or omissions.

By following these 5 tips, you can ensure that you file Form 8833 accurately and efficiently using TurboTax. Remember to gather all necessary documents and information, use the Form 8833 wizard, complete the form accurately and thoroughly, attach all required documents and statements, and review and edit the form carefully.

We hope this article has been helpful in guiding you through the process of filing Form 8833 on TurboTax. If you have any questions or concerns, please don't hesitate to comment below. We'd be happy to help!

What is Form 8833?

+Form 8833 is a tax form used to disclose certain treaty-based return positions that are taken on a taxpayer's return.

Who needs to file Form 8833?

+Form 8833 is typically filed by individuals who are residents of the United States and have income from foreign sources.

How do I access the Form 8833 wizard on TurboTax?

+To access the Form 8833 wizard on TurboTax, log in to your account, click on the "Federal" tab, select "Other Forms" from the drop-down menu, and click on "Form 8833".