Filing taxes can be a daunting task, especially for individuals who are new to the process. The New York State Department of Taxation and Finance requires certain individuals to file the IT-203-B form, also known as the Non-Resident and Part-Year Resident Income Tax Return. In this article, we will provide a step-by-step guide on how to complete the IT-203-B form, making it easier for you to navigate the process.

What is the IT-203-B Form?

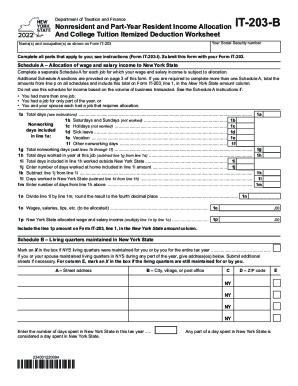

The IT-203-B form is used by non-resident and part-year resident individuals who have income sourced from New York State. This form is used to report income earned from New York State sources, such as employment, self-employment, and investments. The form is also used to claim credits and deductions that may be available to non-resident and part-year resident individuals.

Who Needs to File the IT-203-B Form?

Not everyone needs to file the IT-203-B form. Generally, you need to file this form if you are a:

- Non-resident individual with income sourced from New York State

- Part-year resident individual with income sourced from New York State

- Individual who has made estimated tax payments to New York State

- Individual who has had New York State income tax withheld from their income

What Income is Subject to New York State Tax?

Not all income is subject to New York State tax. Generally, the following types of income are subject to tax:

- Wages and salaries earned in New York State

- Self-employment income earned in New York State

- Interest and dividends earned from New York State sources

- Capital gains from the sale of New York State property

Step-by-Step Guide to Completing the IT-203-B Form

Now that we have discussed who needs to file the IT-203-B form and what income is subject to tax, let's move on to the step-by-step guide on how to complete the form.

Step 1: Gather Required Documents

Before you start filling out the form, make sure you have all the required documents. These documents may include:

- W-2 forms from your employer

- 1099 forms for self-employment income

- Interest and dividend statements

- Capital gains statements

- Estimated tax payment records

Step 2: Complete the Form Header

The form header includes your name, address, and social security number. Make sure to complete this section accurately.

Step 3: Report Your Income

Report all your income sourced from New York State. This includes wages, self-employment income, interest, dividends, and capital gains. Make sure to report the correct amount of income and attach supporting documentation.

Step 4: Claim Credits and Deductions

Claim any credits and deductions you are eligible for. These may include credits for taxes paid to other states, deductions for charitable donations, and deductions for mortgage interest.

Step 5: Calculate Your Tax Liability

Calculate your tax liability based on your income and credits/deductions. Make sure to use the correct tax rates and tables.

Step 6: Sign and Date the Form

Sign and date the form. Make sure to sign the form in ink and date it correctly.

Additional Requirements

In addition to completing the IT-203-B form, you may also need to complete additional schedules and forms. These may include:

- Schedule A: Itemized Deductions

- Schedule B: Interest and Dividend Income

- Schedule C: Business Income and Expenses

- Schedule D: Capital Gains and Losses

Common Mistakes to Avoid

When completing the IT-203-B form, there are several common mistakes to avoid. These include:

- Failing to report all income sourced from New York State

- Failing to claim eligible credits and deductions

- Failing to calculate tax liability correctly

- Failing to sign and date the form correctly

FAQs

Who needs to file the IT-203-B form?

+Non-resident and part-year resident individuals with income sourced from New York State need to file the IT-203-B form.

What income is subject to New York State tax?

+Wages, self-employment income, interest, dividends, and capital gains earned from New York State sources are subject to tax.

Can I file the IT-203-B form electronically?

+Yes, you can file the IT-203-B form electronically through the New York State Department of Taxation and Finance website.

Conclusion

Filing the IT-203-B form can be a complex process, but with this step-by-step guide, you should be able to navigate it with ease. Remember to gather all required documents, report all income sourced from New York State, claim eligible credits and deductions, and calculate your tax liability correctly. If you have any questions or concerns, don't hesitate to reach out to the New York State Department of Taxation and Finance for assistance.