The Federal Communications Commission (FCC) plays a vital role in regulating the telecommunications industry in the United States. One of the key tools the FCC uses to monitor and analyze the industry is Form 499-A, the Annual Telecommunications Reporting Requirement. This form is a critical component of the FCC's efforts to ensure that telecommunications providers are contributing their fair share to the Universal Service Fund (USF) and other federal programs.

The importance of Form 499-A cannot be overstated. The data collected through this form helps the FCC to allocate funds for various programs, such as the Connect America Fund, the Lifeline Program, and the Schools and Libraries Program. These programs are designed to promote universal access to telecommunications services, particularly in rural and low-income areas. By submitting accurate and timely Form 499-A reports, telecommunications providers help to ensure that these programs are funded adequately and that the FCC can make informed decisions about the allocation of resources.

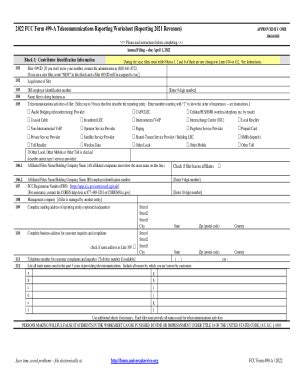

What is Form 499-A?

Form 499-A is an annual report that must be filed by all telecommunications providers that are required to contribute to the USF. The form requires providers to report their revenues from telecommunications services, as well as other information related to their business operations. The data collected through Form 499-A is used to calculate each provider's contribution to the USF, which is based on a percentage of their telecommunications revenues.

Who Must File Form 499-A?

The FCC requires all telecommunications providers that are subject to the USF contribution requirement to file Form 499-A. This includes:

- Wireline and wireless telecommunications carriers

- Voice over Internet Protocol (VoIP) providers

- Cable television providers that offer telecommunications services

- Satellite telecommunications providers

- Other entities that provide telecommunications services, such as resellers and private carriers

What Information Must be Reported on Form 499-A?

Form 499-A requires telecommunications providers to report a range of information related to their business operations and revenues. This includes:

- Total telecommunications revenues

- Revenues from specific types of telecommunications services, such as voice, data, and video

- Information about the provider's business operations, including their corporate structure and affiliations

- Information about the provider's telecommunications services, including the types of services offered and the geographic areas served

How is Form 499-A Used?

The data collected through Form 499-A is used by the FCC to calculate each provider's contribution to the USF. The FCC uses this data to allocate funds for various programs, such as the Connect America Fund, the Lifeline Program, and the Schools and Libraries Program. The data is also used to monitor compliance with FCC regulations and to track trends in the telecommunications industry.

Consequences of Non-Compliance

Failure to file Form 499-A or providing inaccurate information can result in significant penalties and fines. The FCC may impose fines of up to $10,000 per day for non-compliance, and may also require providers to pay interest on any unpaid contributions to the USF.

Best Practices for Filing Form 499-A

To avoid penalties and ensure compliance with FCC regulations, telecommunications providers should follow best practices when filing Form 499-A. This includes:

- Ensuring that all required information is reported accurately and completely

- Filing the form on time, as required by the FCC

- Reviewing the form carefully to ensure that all information is accurate and consistent

- Seeking guidance from the FCC or a qualified consultant if there are questions or concerns about the filing process

Conclusion

Form 499-A is a critical component of the FCC's efforts to regulate the telecommunications industry and ensure that providers are contributing their fair share to the USF. By understanding the requirements and best practices for filing Form 499-A, telecommunications providers can ensure compliance with FCC regulations and avoid significant penalties and fines.

If you have any questions or concerns about Form 499-A or the FCC's reporting requirements, we encourage you to comment below. We also invite you to share this article with others who may be interested in learning more about the FCC's telecommunications reporting requirements.

What is the purpose of Form 499-A?

+Form 499-A is used by the FCC to calculate each provider's contribution to the Universal Service Fund (USF) and to monitor compliance with FCC regulations.

Who must file Form 499-A?

+All telecommunications providers that are subject to the USF contribution requirement must file Form 499-A, including wireline and wireless telecommunications carriers, VoIP providers, cable television providers, and satellite telecommunications providers.

What information must be reported on Form 499-A?

+Form 499-A requires telecommunications providers to report their total telecommunications revenues, revenues from specific types of telecommunications services, and information about their business operations and affiliations.