As a Fedex employee, understanding your W2 form is crucial for tax purposes and other financial planning. The W2 form, also known as the Wage and Tax Statement, is a document that employers are required to provide to their employees and the Social Security Administration (SSA) by the end of January each year. In this article, we will delve into the details of the Fedex W2 form, including what it is, how to access it, and what information it contains.

What is a W2 Form?

A W2 form is a tax document that reports an employee's income, taxes withheld, and other relevant information to the SSA and the IRS. Employers are required to provide a W2 form to each employee by January 31st of each year, showing the employee's earnings and taxes withheld for the previous tax year. The W2 form is used to report income, Social Security, and Medicare taxes withheld, as well as other taxes and benefits.

Why is the W2 Form Important?

The W2 form is essential for several reasons:

- It provides employees with a record of their income and taxes withheld, which is necessary for filing tax returns.

- It helps employees verify their income and taxes withheld for tax purposes.

- It is used by the SSA to calculate Social Security benefits and to determine eligibility for other benefits.

- It is used by the IRS to verify income and taxes withheld for tax purposes.

How to Access Your Fedex W2 Form

Fedex employees can access their W2 form in several ways:

-

Online Access

Fedex employees can access their W2 form online through the Fedex Employee Service Center (ESC) website. To access the ESC website, employees need to log in with their Fedex employee ID and password. -

Mail

Fedex employees can also receive their W2 form by mail. The W2 form will be mailed to the employee's address on file with Fedex by January 31st of each year. -

HR Department

Employees can also contact their HR department to request a copy of their W2 form.

What Information is Included on the Fedex W2 Form?

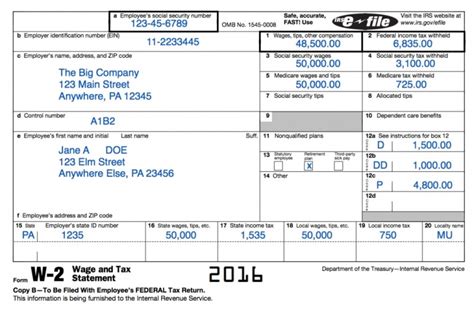

The Fedex W2 form includes the following information:

-

Employee Information

The employee's name, address, and Social Security number. -

Employer Information

The employer's name, address, and Employer Identification Number (EIN). -

Wages and Taxes

The employee's total wages and taxes withheld, including: + Box 1: Wages, tips, and other compensation + Box 2: Federal income tax withheld + Box 3: Social Security wages + Box 4: Social Security tax withheld + Box 5: Medicare wages and tips + Box 6: Medicare tax withheld -

Other Benefits and Taxes

Other benefits and taxes, including: + Box 10: Dependent care benefits + Box 11: Non-qualified plans + Box 12: Other benefits and taxes

Fedex W2 Form Deadline

The deadline for employers to provide W2 forms to employees is January 31st of each year. This deadline applies to all employers, including Fedex.

What Happens if I Don't Receive My W2 Form?

If an employee does not receive their W2 form by January 31st, they should contact their HR department or the Fedex Employee Service Center to request a copy. If the employee is unable to obtain a copy of their W2 form, they can contact the SSA or the IRS for assistance.

Common Issues with the Fedex W2 Form

Some common issues that employees may experience with their W2 form include:

-

Incorrect Information

If an employee finds an error on their W2 form, they should contact their HR department or the Fedex Employee Service Center to request a correction. -

Missing W2 Form

If an employee does not receive their W2 form, they should contact their HR department or the Fedex Employee Service Center to request a copy. -

Delayed W2 Form

If an employee's W2 form is delayed, they should contact their HR department or the Fedex Employee Service Center to request an update on the status of their W2 form.

Conclusion

In conclusion, the Fedex W2 form is an essential document that provides employees with a record of their income and taxes withheld. Employees can access their W2 form online, by mail, or through their HR department. The W2 form includes important information, including employee and employer information, wages and taxes, and other benefits and taxes. If an employee experiences any issues with their W2 form, they should contact their HR department or the Fedex Employee Service Center for assistance.

We hope this article has provided you with a comprehensive understanding of the Fedex W2 form. If you have any questions or comments, please feel free to share them below.

What is the deadline for employers to provide W2 forms to employees?

+The deadline for employers to provide W2 forms to employees is January 31st of each year.

How can I access my Fedex W2 form?

+You can access your Fedex W2 form online through the Fedex Employee Service Center (ESC) website, by mail, or through your HR department.

What information is included on the Fedex W2 form?

+The Fedex W2 form includes employee and employer information, wages and taxes, and other benefits and taxes.