In the world of finance and investments, understanding the intricacies of various forms and documents is crucial for making informed decisions. One such document that plays a significant role in the management of investments, particularly those related to U.S. Treasury securities, is the Treasury Direct Form 5511. This form, also known as the "Treasury Direct Application for an Online Account," is essential for investors who wish to purchase, manage, and redeem U.S. Treasury securities online through the TreasuryDirect system. In this article, we will delve into the details of Treasury Direct Form 5511, exploring its importance, benefits, and providing a step-by-step guide on how to complete it.

Understanding Treasury Direct Form 5511

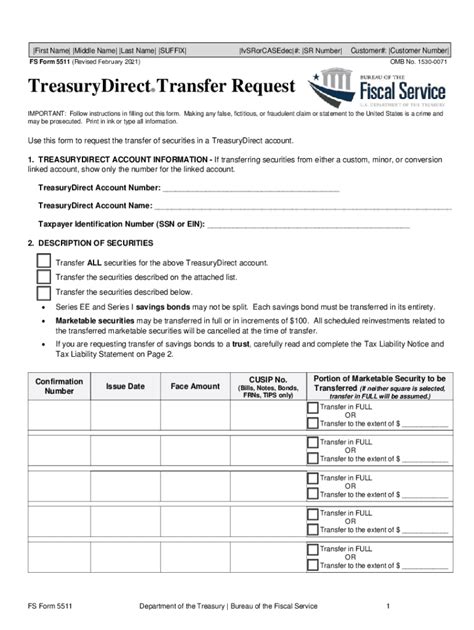

Treasury Direct Form 5511 is designed for individuals, corporations, and other entities to establish an online account in the TreasuryDirect system. This system, managed by the U.S. Department of the Treasury, Bureau of the Fiscal Service, allows users to buy, sell, and manage U.S. Treasury securities, including bills, notes, bonds, and Treasury Inflation-Protected Securities (TIPS), in a convenient and secure online environment.

Benefits of Using Treasury Direct Form 5511

- Convenience: With a TreasuryDirect account, you can manage your U.S. Treasury securities portfolio online, 24/7, from the comfort of your home or office.

- Security: The TreasuryDirect system is highly secure, ensuring that your transactions and account information are protected.

- Flexibility: You can purchase securities directly through the TreasuryDirect website, eliminating the need for intermediaries.

- Cost-Effective: Direct purchases through TreasuryDirect can save you money on commissions and fees associated with traditional investment channels.

Completing Treasury Direct Form 5511: A Step-by-Step Guide

The process of completing Treasury Direct Form 5511 is straightforward, requiring basic personal and financial information. Here’s a step-by-step guide to help you through the application process:

Step 1: Gather Required Information

Before you start filling out the form, ensure you have all the necessary information readily available. This includes:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your full name as it appears on your Social Security card or ITIN document

- Your date of birth

- Your current mailing address

- Your email address

Step 2: Create Your Account Online

- Visit the TreasuryDirect Website: Go to the official TreasuryDirect website ().

- Select the Account Type: Choose the type of account you wish to open (Individual, Corporate, or Other Entity).

- Fill Out the Online Application: Enter your personal and financial information in the designated fields. Ensure accuracy and completeness to avoid delays in the processing of your application.

Step 3: Verify Your Identity

After submitting your online application, you will need to verify your identity. This step is crucial for the security of your account. You will receive an email with instructions on how to complete the verification process.

Step 4: Fund Your Account

Once your account is activated, you can fund it using various payment methods, including electronic debit from your checking or savings account, wire transfer, or by mailing a check.

Tips for Filling Out Treasury Direct Form 5511

- Accuracy is Key: Ensure that all the information you provide is accurate and matches your identification documents.

- Use Secure Internet: When accessing the TreasuryDirect website, use a secure internet connection to protect your data.

- Save Your Account Information: Keep a record of your account number and login information in a safe place.

Frequently Asked Questions About Treasury Direct Form 5511

Q: Can I Open a TreasuryDirect Account for a Minor?

A: Yes, you can open a minor account for a child under 18 years old. However, you must provide the required documentation, including the minor's Social Security number and your relationship to the minor.

Q: How Long Does It Take to Open a TreasuryDirect Account?

A: The online application process typically takes a few minutes. After submitting your application, it may take a few days for the verification process to complete and for your account to be activated.

Q: Is There a Minimum Purchase Requirement for U.S. Treasury Securities Through TreasuryDirect?

A: Yes, the minimum purchase amount varies by security type, but you can start investing with as little as $25 for some securities.

Conclusion

Opening a TreasuryDirect account through Form 5511 is a straightforward process that unlocks a world of investment opportunities in U.S. Treasury securities. By following the steps outlined in this guide and understanding the benefits and requirements of the process, you can start managing your investments securely and conveniently online. Whether you are a seasoned investor or just starting to build your portfolio, TreasuryDirect provides a unique and accessible way to invest directly in the U.S. Treasury market.

We hope this comprehensive guide has been informative and helpful. If you have any further questions or would like to share your experiences with TreasuryDirect, please feel free to comment below.

What is Treasury Direct Form 5511 used for?

+Treasury Direct Form 5511 is used to apply for an online account in the TreasuryDirect system, allowing users to purchase, manage, and redeem U.S. Treasury securities online.

What information do I need to provide to complete Treasury Direct Form 5511?

+You will need to provide your Social Security number or Individual Taxpayer Identification Number (ITIN), full name, date of birth, current mailing address, and email address.

How do I fund my TreasuryDirect account after opening it with Form 5511?

+You can fund your account through electronic debit from your checking or savings account, wire transfer, or by mailing a check.