The world of tax deductions can be a complex and confusing one, especially for those with significant investments or business ventures. One often-overlooked aspect of tax law is the concept of at-risk limitations and deductions, specifically as it relates to Form 6198. In this article, we'll delve into the world of at-risk limitations, explore how they impact your tax obligations, and provide a comprehensive guide on how to navigate Form 6198.

Understanding At-Risk Limitations

At-risk limitations are a crucial aspect of tax law that affects individuals with investments or business ventures that involve some level of risk. The Internal Revenue Service (IRS) defines "at-risk" as the amount of money you could lose if your investment or business were to fail. This can include loans, investments, or other financial obligations that put your personal assets at risk.

The at-risk rules are designed to prevent taxpayers from claiming excessive losses on investments or business ventures that are not truly at risk. By limiting the amount of losses that can be claimed, the IRS aims to prevent taxpayers from abusing the tax system and claiming unwarranted deductions.

Form 6198: At-Risk Limitations and Deductions Explained

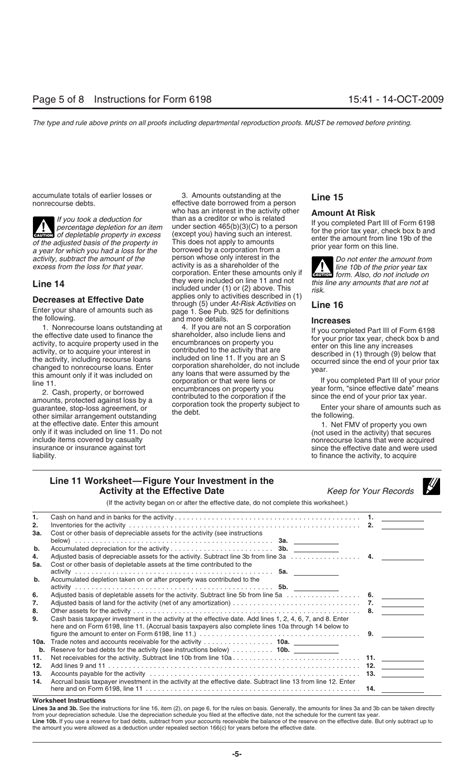

Form 6198 is the At-Risk Limitations form used by the IRS to calculate and report at-risk limitations and deductions. The form is typically filed by individuals with investments or business ventures that involve some level of risk, such as real estate investments, limited partnerships, or S corporations.

The form is used to calculate the amount of losses that can be claimed on your tax return, taking into account the at-risk limitations. The form requires you to report the following information:

- The amount of your at-risk investment or business venture

- The amount of losses incurred by the investment or business venture

- The amount of at-risk limitations that apply to the investment or business venture

How to Complete Form 6198

Completing Form 6198 can be a complex process, requiring careful calculation and attention to detail. Here's a step-by-step guide to help you navigate the form:

- Determine your at-risk amount: Calculate the amount of your investment or business venture that is truly at risk. This can include loans, investments, or other financial obligations.

- Calculate your losses: Determine the amount of losses incurred by your investment or business venture.

- Apply at-risk limitations: Apply the at-risk limitations to your losses, using the calculations provided on Form 6198.

- Report your at-risk limitations and deductions: Report your at-risk limitations and deductions on Form 6198, taking into account the calculations from steps 1-3.

Benefits of At-Risk Limitations and Deductions

While at-risk limitations and deductions may seem like a complex and confusing aspect of tax law, they can provide significant benefits for taxpayers. Here are some of the benefits:

- Reduced tax liability: By limiting the amount of losses that can be claimed, at-risk limitations can help reduce your tax liability and prevent excessive losses from being claimed.

- Prevention of tax abuse: At-risk limitations help prevent taxpayers from abusing the tax system and claiming unwarranted deductions.

- Encouragement of responsible investing: By limiting the amount of losses that can be claimed, at-risk limitations encourage taxpayers to make responsible investment decisions and take calculated risks.

Common Mistakes to Avoid

When completing Form 6198, there are several common mistakes to avoid:

- Failure to calculate at-risk limitations: Failing to calculate at-risk limitations can result in excessive losses being claimed, leading to penalties and fines.

- Inaccurate reporting: Inaccurate reporting of at-risk limitations and deductions can result in errors and delays in processing your tax return.

- Failure to maintain records: Failing to maintain accurate records of your investments and business ventures can make it difficult to complete Form 6198 and support your claims.

Practical Examples and Statistical Data

Here are some practical examples and statistical data to illustrate the concept of at-risk limitations and deductions:

- Example 1: John invests $100,000 in a limited partnership that involves a high level of risk. If the partnership fails, John could lose the entire investment. In this case, John's at-risk amount is $100,000.

- Example 2: Jane invests $50,000 in a real estate investment trust (REIT) that involves a moderate level of risk. If the REIT fails, Jane could lose up to 50% of her investment. In this case, Jane's at-risk amount is $25,000.

According to the IRS, the at-risk rules apply to a wide range of investments and business ventures, including:

- Limited partnerships

- S corporations

- Real estate investments

- Oil and gas investments

- Farming and ranching operations

Tips and Strategies for Navigating Form 6198

Here are some tips and strategies for navigating Form 6198:

- Seek professional advice: Consult with a tax professional or accountant to ensure accurate completion of Form 6198.

- Maintain accurate records: Keep accurate records of your investments and business ventures to support your claims.

- Understand the at-risk rules: Take the time to understand the at-risk rules and how they apply to your specific situation.

Get Involved and Take Action

Now that you have a better understanding of at-risk limitations and deductions, it's time to take action. If you're an individual with investments or business ventures that involve some level of risk, it's essential to understand how the at-risk rules apply to your specific situation.

Take the time to review Form 6198 and seek professional advice if necessary. By understanding the at-risk rules and accurately completing Form 6198, you can ensure that you're taking advantage of the deductions and limitations available to you.

What is Form 6198 used for?

+Form 6198 is used to calculate and report at-risk limitations and deductions.

Who is required to file Form 6198?

+Individuals with investments or business ventures that involve some level of risk are required to file Form 6198.

What are the benefits of at-risk limitations and deductions?

+The benefits of at-risk limitations and deductions include reduced tax liability, prevention of tax abuse, and encouragement of responsible investing.