Understanding Form F625-109-000: A Key to Unlocking Benefits

Form F625-109-000 is a crucial document for individuals seeking to access various benefits, including social security and other government programs. Despite its importance, many people struggle to navigate the complexities of this form. In this article, we'll provide you with five essential filing tips to help you unlock the benefits associated with Form F625-109-000.

The Importance of Accurate Filing

Accurate filing is critical when it comes to Form F625-109-000. Small mistakes can lead to delays or even rejection of your application. To avoid these issues, it's essential to understand the form's requirements and follow the instructions carefully.

Tip 1: Gather Required Documents

Before starting the filing process, make sure you have all the necessary documents. These may include:

- Identification documents (e.g., driver's license, passport)

- Proof of income (e.g., pay stubs, tax returns)

- Proof of residency (e.g., utility bills, lease agreement)

- Social Security number or Individual Taxpayer Identification Number (ITIN)

Having these documents readily available will save you time and reduce the risk of errors.

Understanding the Filing Process

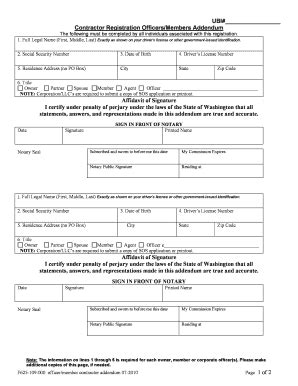

The filing process for Form F625-109-000 involves several steps, including:

- Downloading and printing the form

- Filling out the form accurately and completely

- Signing and dating the form

- Submitting the form to the relevant authority

It's essential to follow these steps carefully to avoid any issues with your application.

Tip 2: Fill Out the Form Accurately

When filling out Form F625-109-000, make sure to provide accurate and complete information. This includes:

- Correct spelling of names and addresses

- Accurate income and employment information

- Correct Social Security number or ITIN

Double-check your information to ensure accuracy and avoid errors.

Common Filing Mistakes to Avoid

Common filing mistakes can lead to delays or rejection of your application. Some of the most common mistakes include:

- Incomplete or inaccurate information

- Missing signatures or dates

- Failure to submit required documents

Be aware of these common mistakes and take steps to avoid them.

Tip 3: Submit Required Documents

When submitting Form F625-109-000, make sure to include all required documents. These may include:

- Proof of income and employment

- Proof of residency and identification

- Social Security number or ITIN documentation

Failure to submit required documents can lead to delays or rejection of your application.

What to Expect After Filing

After filing Form F625-109-000, you can expect to receive a response from the relevant authority. This may include:

- Approval or denial of benefits

- Request for additional information or documentation

- Notification of any issues or errors with your application

Be patient and follow up with the relevant authority if you have any questions or concerns.

Tip 4: Follow Up on Your Application

After filing Form F625-109-000, it's essential to follow up on your application. This may include:

- Contacting the relevant authority to check on the status of your application

- Providing additional information or documentation as requested

- Addressing any issues or errors with your application

Following up on your application can help ensure a smooth and efficient process.

Additional Tips and Resources

In addition to the tips provided above, here are some additional resources to help you with the filing process:

- Official government websites and resources

- Form instructions and guidelines

- Professional assistance and guidance

Take advantage of these resources to ensure a successful filing experience.

Tip 5: Seek Professional Assistance

If you're unsure about any aspect of the filing process, consider seeking professional assistance. This may include:

- Consulting with a qualified attorney or tax professional

- Seeking guidance from a social security expert

- Using online resources and tools to help with the filing process

Professional assistance can help ensure accuracy and completeness, reducing the risk of errors or delays.

What is Form F625-109-000 used for?

+Form F625-109-000 is used to apply for various benefits, including social security and other government programs.

What documents do I need to submit with Form F625-109-000?

+You may need to submit identification documents, proof of income and employment, proof of residency, and Social Security number or ITIN documentation.

How long does it take to process Form F625-109-000?

+The processing time for Form F625-109-000 may vary depending on the relevant authority and the complexity of your application.

By following these five essential filing tips, you can unlock the benefits associated with Form F625-109-000. Remember to gather required documents, fill out the form accurately, submit required documents, follow up on your application, and seek professional assistance if needed. Don't hesitate to reach out if you have any questions or concerns – we're here to help!