The probate process in California can be complex and overwhelming, especially for those who are dealing with the loss of a loved one. One of the key documents required in this process is California Probate Form 13100, also known as the "Inventory and Appraisal" form. In this article, we will provide a step-by-step guide to help you understand and complete this form accurately.

What is California Probate Form 13100?

California Probate Form 13100 is a court-required document that must be filed with the probate court as part of the probate process. The form is used to inventory the decedent's assets and provide an appraisal of their value. This information is crucial in determining the distribution of the estate's assets among the beneficiaries.

Who Needs to File California Probate Form 13100?

The executor or personal representative of the estate is responsible for filing California Probate Form 13100. This person is typically named in the decedent's will or appointed by the court.

Step-by-Step Guide to Completing California Probate Form 13100

Completing California Probate Form 13100 requires careful attention to detail and accuracy. Here's a step-by-step guide to help you complete the form:

Step 1: Gather Required Information

Before starting the form, gather all the necessary information about the decedent's assets, including:

- Real property (e.g., homes, land, etc.)

- Personal property (e.g., cars, jewelry, etc.)

- Financial accounts (e.g., bank accounts, investments, etc.)

- Business interests

- Other assets (e.g., art, collectibles, etc.)

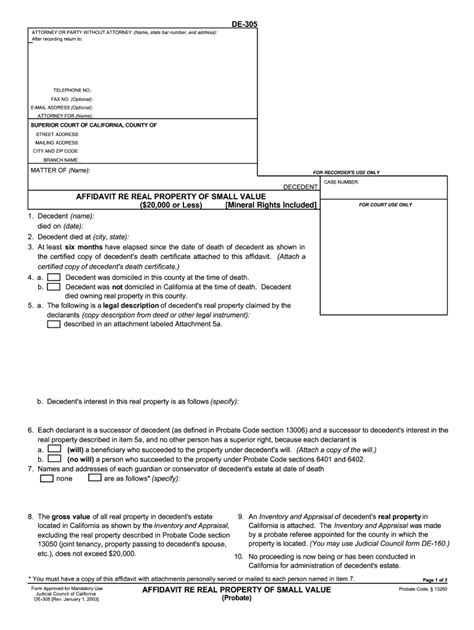

Step 2: Complete the Header Section

The header section of the form requires you to provide basic information about the estate, including:

- Estate name

- Decedent's name

- Case number

- Court name

Step 3: List the Assets

In this section, you will list all the decedent's assets, including their description, value, and location. Be sure to include:

- Real property: provide the address, value, and any outstanding mortgage or lien information

- Personal property: provide a detailed description, value, and location

- Financial accounts: provide the account number, balance, and institution name

- Business interests: provide the business name, ownership percentage, and value

- Other assets: provide a detailed description and value

Step 4: Provide Appraisal Information

For each asset listed, you will need to provide appraisal information, including:

- Date of appraisal

- Appraiser's name and contact information

- Appraisal value

Step 5: Sign and Date the Form

Once you have completed the form, sign and date it. Make sure to keep a copy for your records.

Common Mistakes to Avoid

When completing California Probate Form 13100, it's essential to avoid common mistakes that can lead to delays or even court rejection. Here are some mistakes to avoid:

- Inaccurate or incomplete information

- Failure to provide required documentation

- Missing signatures or dates

- Failure to file the form on time

Consequences of Not Filing California Probate Form 13100

Failure to file California Probate Form 13100 can result in significant consequences, including:

- Delayed distribution of assets

- Increased court costs and fees

- Potential penalties or fines

Additional Resources

For more information on California Probate Form 13100, you can refer to the following resources:

- California Probate Code

- California Courts website

- Professional probate attorney or estate planning expert

Conclusion

Completing California Probate Form 13100 requires attention to detail and accuracy. By following this step-by-step guide, you can ensure that you complete the form correctly and avoid common mistakes. Remember to seek professional help if you're unsure about any aspect of the process.

We hope this article has been informative and helpful. If you have any questions or comments, please feel free to share them below.

What is the purpose of California Probate Form 13100?

+The purpose of California Probate Form 13100 is to inventory the decedent's assets and provide an appraisal of their value.

Who is responsible for filing California Probate Form 13100?

+The executor or personal representative of the estate is responsible for filing California Probate Form 13100.

What are the consequences of not filing California Probate Form 13100?

+Failure to file California Probate Form 13100 can result in delayed distribution of assets, increased court costs and fees, and potential penalties or fines.