Filing taxes can be a daunting task, especially for those who are new to the process or have complex financial situations. One form that can be particularly confusing is the 1040-PR form, which is used by individuals who are residents of Puerto Rico. In this article, we will break down six essential things to know about the 1040-PR form, including its purpose, who needs to file it, and how to fill it out correctly.

What is the 1040-PR Form?

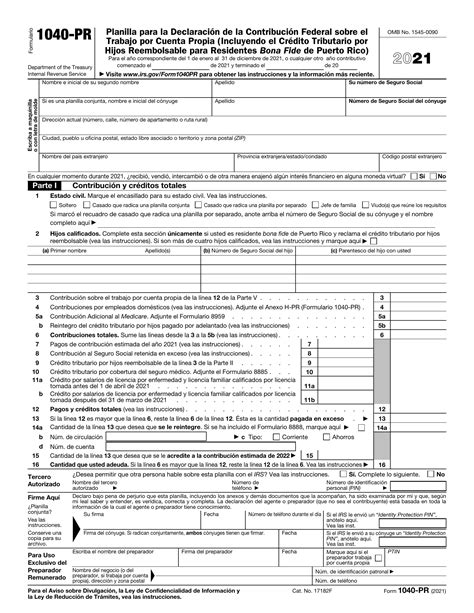

The 1040-PR form, also known as the "Planilla para la Declaracion de la Renta" in Spanish, is a tax return form used by individuals who are residents of Puerto Rico. It is similar to the standard 1040 form used by U.S. citizens, but has some key differences. The 1040-PR form is used to report income, deductions, and credits, and to calculate the amount of tax owed or refund due.

Who Needs to File the 1040-PR Form?

The 1040-PR form is required to be filed by individuals who are residents of Puerto Rico, including:

- U.S. citizens who live in Puerto Rico

- Resident aliens who live in Puerto Rico

- Non-resident aliens who have income from Puerto Rico sources

Individuals who are not residents of Puerto Rico, but have income from Puerto Rico sources, may also need to file the 1040-PR form.

Who is Considered a Resident of Puerto Rico?

To be considered a resident of Puerto Rico, an individual must meet one of the following tests:

- Be a U.S. citizen or resident alien who has been present in Puerto Rico for at least 183 days during the tax year

- Have a home or business in Puerto Rico and spend at least 30 days in Puerto Rico during the tax year

- Have a closer connection to Puerto Rico than to the United States or any other country

What is the Difference Between the 1040-PR Form and the Standard 1040 Form?

The 1040-PR form is similar to the standard 1040 form, but has some key differences. The main differences are:

- The 1040-PR form is used by residents of Puerto Rico, while the standard 1040 form is used by U.S. citizens and resident aliens who live in the United States

- The 1040-PR form has different income reporting requirements, as Puerto Rico has its own tax laws and rates

- The 1040-PR form has different deductions and credits available, such as the Puerto Rico earned income tax credit

How to Fill Out the 1040-PR Form

Filling out the 1040-PR form can be complex, but here are some general steps to follow:

- Gather all necessary documents, including W-2 forms, 1099 forms, and other income statements

- Determine your filing status and number of dependents

- Report all income from Puerto Rico sources, including wages, salaries, and tips

- Claim deductions and credits available to Puerto Rico residents

- Calculate your total tax liability or refund due

Common Mistakes to Avoid When Filling Out the 1040-PR Form

Some common mistakes to avoid when filling out the 1040-PR form include:

- Failing to report all income from Puerto Rico sources

- Claiming deductions and credits that are not available to Puerto Rico residents

- Failing to sign and date the form

- Failing to include all required documentation

What are the Deadlines for Filing the 1040-PR Form?

The deadline for filing the 1040-PR form is typically April 15th of each year, but this deadline may be extended if the individual is serving in the military or is living outside of the United States.

How to Get Help with Filing the 1040-PR Form

If you need help with filing the 1040-PR form, there are several resources available, including:

- The IRS website, which has a section dedicated to Puerto Rico tax information

- The Puerto Rico Treasury Department, which offers tax assistance and guidance

- Tax professionals, such as certified public accountants or enrolled agents

In conclusion, the 1040-PR form is an essential tax return form for individuals who are residents of Puerto Rico. It is used to report income, deductions, and credits, and to calculate the amount of tax owed or refund due. By understanding the purpose, who needs to file it, and how to fill it out correctly, individuals can ensure that they are in compliance with Puerto Rico tax laws and avoid any potential penalties.

If you have any questions or concerns about the 1040-PR form, please don't hesitate to ask. Share this article with others who may be interested in learning more about Puerto Rico tax laws.

FAQ:

Who needs to file the 1040-PR form?

+The 1040-PR form is required to be filed by individuals who are residents of Puerto Rico, including U.S. citizens who live in Puerto Rico, resident aliens who live in Puerto Rico, and non-resident aliens who have income from Puerto Rico sources.

What is the difference between the 1040-PR form and the standard 1040 form?

+The 1040-PR form is used by residents of Puerto Rico, while the standard 1040 form is used by U.S. citizens and resident aliens who live in the United States. The 1040-PR form has different income reporting requirements, deductions, and credits available.

What is the deadline for filing the 1040-PR form?

+The deadline for filing the 1040-PR form is typically April 15th of each year, but this deadline may be extended if the individual is serving in the military or is living outside of the United States.