As the tax season approaches, many Illinois residents are preparing to file their 2014 IL-1040 tax form. Filing taxes can be a daunting task, especially with the numerous changes to tax laws and regulations. However, with the right guidance, you can navigate the process with ease and ensure you receive the maximum refund you're eligible for. In this article, we will provide you with 5 tips for filing your 2014 IL-1040 tax form, helping you to avoid common mistakes and minimize your tax liability.

Understanding the IL-1040 Tax Form

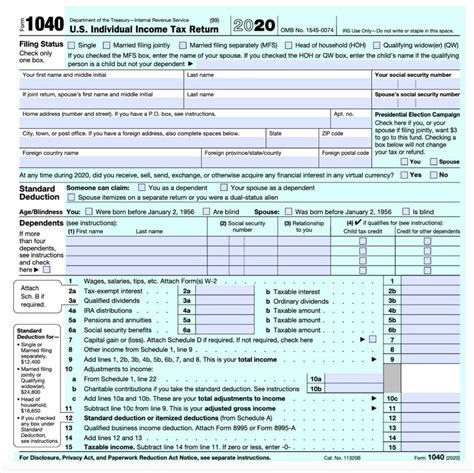

Before we dive into the tips, it's essential to understand the IL-1040 tax form and its requirements. The IL-1040 is the standard form used by Illinois residents to file their state income tax return. The form requires you to report your income, deductions, and credits, as well as calculate your tax liability. You can file the IL-1040 electronically or by mail, and the deadline for filing is typically April 15th of each year.

Tip 1: Gather All Necessary Documents

To ensure a smooth filing process, it's crucial to gather all necessary documents before starting your IL-1040 tax form. These documents may include:

- W-2 forms from your employer(s)

- 1099 forms for freelance work or self-employment income

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Charitable donation receipts

- Medical expense receipts

- Mortgage interest statements (1098)

Having all these documents readily available will save you time and reduce the risk of errors on your tax return.

Filing Status and Exemptions

Tip 2: Choose the Correct Filing Status

Your filing status determines the tax rates and deductions you're eligible for. Illinois recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the correct filing status to ensure you receive the maximum refund. If you're unsure about your filing status, consult with a tax professional or contact the Illinois Department of Revenue.

Tip 3: Claim All Eligible Deductions

Deductions can significantly reduce your tax liability, so it's essential to claim all eligible deductions on your IL-1040 tax form. Some common deductions include:

- Standard deduction or itemized deductions

- Mortgage interest deduction

- Charitable donations deduction

- Medical expenses deduction

- Education expenses deduction

Keep receipts and records for all deductions, as you may need to provide documentation if audited.

Education Expenses Deduction

- You may be eligible for the education expenses deduction if you paid tuition and fees for yourself or a dependent.

- The deduction is limited to $1,500 per student.

Tip 4: Take Advantage of Tax Credits

Tax credits can provide a significant reduction in your tax liability. Illinois offers several tax credits, including:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education expenses credit

- Adoption credit

Research and claim all eligible tax credits to minimize your tax liability.

Tip 5: File Electronically and On Time

Filing your IL-1040 tax form electronically can speed up the processing time and reduce errors. You can file electronically through the Illinois Department of Revenue website or through a tax preparation software. Make sure to file on time to avoid penalties and interest.

E-Filing Benefits

- Faster processing time

- Reduced errors

- Faster refund

- Environmentally friendly

By following these 5 tips, you can ensure a smooth and stress-free tax filing experience. Remember to gather all necessary documents, choose the correct filing status, claim all eligible deductions, take advantage of tax credits, and file electronically and on time.

FAQ Section:

What is the deadline for filing the IL-1040 tax form?

+The deadline for filing the IL-1040 tax form is typically April 15th of each year.

Can I file the IL-1040 tax form electronically?

+Yes, you can file the IL-1040 tax form electronically through the Illinois Department of Revenue website or through a tax preparation software.

What is the standard deduction for the IL-1040 tax form?

+The standard deduction for the IL-1040 tax form varies depending on your filing status. Consult the Illinois Department of Revenue website for the most up-to-date information.