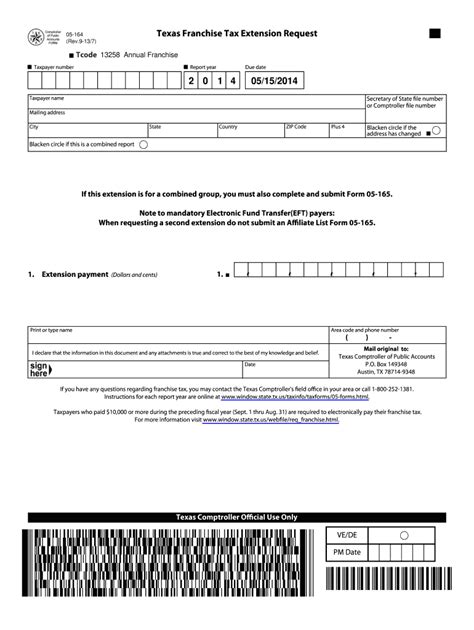

The Texas Form 05-164, also known as the Texas Comptroller's Form 05-164, is a crucial document for individuals and businesses in the state of Texas. This form is used to report and pay the Texas franchise tax, which is a tax imposed on businesses operating in the state. In this article, we will delve into the details of the Texas Form 05-164, its importance, and provide a step-by-step guide on how to complete and file it.

Understanding the Texas Franchise Tax

The Texas franchise tax is a tax imposed on businesses operating in the state of Texas. It is also known as the "margin tax" or "privilege tax." The tax is calculated based on a business's total revenue, minus certain deductions and exemptions. The franchise tax rate is 0.75% for most businesses, but some businesses, such as retailers and wholesalers, may be subject to a lower rate of 0.375%.

Who Needs to File the Texas Form 05-164?

Not all businesses in Texas are required to file the Texas Form 05-164. However, most businesses that operate in the state are subject to the franchise tax and must file this form. Some examples of businesses that may need to file the Texas Form 05-164 include:

- Corporations

- Limited liability companies (LLCs)

- Partnerships

- S corporations

- Limited partnerships

- Limited liability partnerships

How to Complete the Texas Form 05-164

Completing the Texas Form 05-164 requires careful attention to detail and accuracy. Here are the steps to follow:

- Determine your business's tax year: The Texas Form 05-164 is filed annually, and the tax year is typically the same as the business's fiscal year.

- Gather required documents: You will need to gather your business's financial statements, including the balance sheet and income statement.

- Calculate your total revenue: Calculate your business's total revenue for the tax year.

- Calculate your cost of goods sold: Calculate your business's cost of goods sold for the tax year.

- Calculate your total deductions: Calculate your business's total deductions for the tax year.

- Calculate your franchise tax liability: Calculate your business's franchise tax liability using the formula: (Total Revenue - Cost of Goods Sold - Total Deductions) x Franchise Tax Rate.

- Complete the form: Complete the Texas Form 05-164, including the business's name, address, and tax ID number.

Deadlines and Penalties

The deadline for filing the Texas Form 05-164 is May 15th of each year. If you fail to file the form on time, you may be subject to penalties and interest.

Filing Options for the Texas Form 05-164

There are several filing options for the Texas Form 05-164:

- E-file: You can e-file the Texas Form 05-164 through the Texas Comptroller's website.

- Mail: You can mail the Texas Form 05-164 to the Texas Comptroller's office.

- Fax: You can fax the Texas Form 05-164 to the Texas Comptroller's office.

Common Mistakes to Avoid

When completing the Texas Form 05-164, there are several common mistakes to avoid:

- Inaccurate calculations: Double-check your calculations to ensure accuracy.

- Missing documents: Make sure you have all required documents, including financial statements and receipts.

- Incorrect filing status: Ensure you are filing the correct form for your business type.

Amending the Texas Form 05-164

If you need to amend the Texas Form 05-164, you can file an amended return using Form 05-164-A. You will need to explain the reason for the amendment and provide supporting documentation.

Record Keeping and Audits

It is essential to maintain accurate records and documentation for your business, including financial statements and receipts. The Texas Comptroller's office may conduct audits to ensure compliance with the franchise tax law.

Conclusion and Next Steps

In conclusion, the Texas Form 05-164 is a critical document for businesses operating in the state of Texas. By following the steps outlined in this article, you can ensure accurate completion and timely filing of the form. Remember to maintain accurate records and documentation, and be prepared for potential audits.

If you have any questions or concerns about the Texas Form 05-164, please don't hesitate to comment below. We encourage you to share your experiences and tips for completing the form.

FAQ Section:

Who is required to file the Texas Form 05-164?

+Most businesses operating in the state of Texas are required to file the Texas Form 05-164, including corporations, LLCs, partnerships, and S corporations.

What is the deadline for filing the Texas Form 05-164?

+The deadline for filing the Texas Form 05-164 is May 15th of each year.

Can I amend the Texas Form 05-164?

+Yes, you can amend the Texas Form 05-164 by filing Form 05-164-A and providing supporting documentation.