In the state of Colorado, a beneficiary deed form is a vital document that allows property owners to transfer their real estate to beneficiaries without the need for probate. This type of deed is also known as a "transfer on death" deed. With a beneficiary deed form, you can ensure that your property is distributed according to your wishes after your passing, without the hassle and expense of probate court.

A Colorado beneficiary deed form is a simple and effective way to transfer property to your loved ones. By using this type of deed, you can avoid the costs and delays associated with probate, which can be a significant burden on your family. Additionally, a beneficiary deed form allows you to maintain control over your property during your lifetime, while also providing a clear plan for its distribution after your passing.

What is a Colorado Beneficiary Deed Form?

A Colorado beneficiary deed form is a type of deed that allows you to transfer your real estate to beneficiaries without the need for probate. This type of deed is authorized by Colorado statute and is governed by the Colorado Revised Statutes. With a beneficiary deed form, you can transfer your property to one or more beneficiaries, who will receive the property automatically upon your passing.

How Does a Colorado Beneficiary Deed Form Work?

A Colorado beneficiary deed form works by allowing you to transfer your property to beneficiaries while maintaining control over the property during your lifetime. When you create a beneficiary deed form, you will identify the beneficiaries who will receive the property after your passing. You can name one or more beneficiaries, and you can also specify the percentage of ownership that each beneficiary will receive.

After creating the beneficiary deed form, you will record it with the county recorder's office in the county where the property is located. This will put the public on notice of the transfer and ensure that the property is distributed according to your wishes.

Benefits of Using a Colorado Beneficiary Deed Form

There are several benefits to using a Colorado beneficiary deed form. Some of the most significant advantages include:

• Avoiding Probate: By using a beneficiary deed form, you can avoid the costs and delays associated with probate court. Probate can be a lengthy and expensive process, but with a beneficiary deed form, your property will be transferred to your beneficiaries automatically upon your passing.

• Maintaining Control: A beneficiary deed form allows you to maintain control over your property during your lifetime. You can continue to live in the property, sell it, or mortgage it as you see fit.

• Flexibility: You can name one or more beneficiaries and specify the percentage of ownership that each beneficiary will receive.

• Reducing Taxes: A beneficiary deed form can help reduce taxes by allowing you to transfer property to beneficiaries without incurring gift tax or estate tax.

How to Create a Colorado Beneficiary Deed Form

Creating a Colorado beneficiary deed form is a relatively simple process. Here are the steps to follow:

-

Determine the Type of Property: Identify the type of property you want to transfer, such as a single-family home, condominium, or vacant land.

-

Identify the Beneficiaries: Determine who you want to name as beneficiaries and what percentage of ownership they will receive.

-

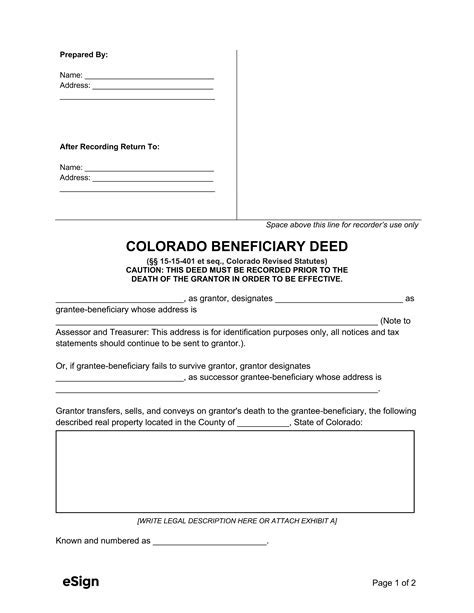

Use a Template or Form: Use a template or form to create the beneficiary deed. You can find forms online or work with an attorney to draft a custom form.

-

Fill Out the Form: Fill out the form with the required information, including the property description, beneficiary names, and percentage of ownership.

-

Sign and Notarize: Sign the form in the presence of a notary public.

-

Record the Deed: Record the deed with the county recorder's office in the county where the property is located.

Common Mistakes to Avoid

When creating a Colorado beneficiary deed form, there are several common mistakes to avoid. Some of the most significant errors include:

• Failing to Record the Deed: Failing to record the deed with the county recorder's office can render the deed invalid.

• Incorrect Property Description: Failing to accurately describe the property can lead to disputes over ownership.

• Incorrect Beneficiary Information: Failing to accurately identify the beneficiaries or their percentage of ownership can lead to disputes over inheritance.

• Failing to Sign and Notarize: Failing to sign the deed in the presence of a notary public can render the deed invalid.

Conclusion

A Colorado beneficiary deed form is a powerful tool for transferring property to beneficiaries without the need for probate. By using this type of deed, you can maintain control over your property during your lifetime, avoid the costs and delays associated with probate, and ensure that your property is distributed according to your wishes. By following the steps outlined above and avoiding common mistakes, you can create a valid and effective beneficiary deed form.

If you have any questions or concerns about creating a Colorado beneficiary deed form, we encourage you to share them in the comments below.

What is a Colorado beneficiary deed form?

+A Colorado beneficiary deed form is a type of deed that allows you to transfer your real estate to beneficiaries without the need for probate.

How does a Colorado beneficiary deed form work?

+A Colorado beneficiary deed form works by allowing you to transfer your property to beneficiaries while maintaining control over the property during your lifetime.

What are the benefits of using a Colorado beneficiary deed form?

+The benefits of using a Colorado beneficiary deed form include avoiding probate, maintaining control over the property, flexibility, and reducing taxes.