E-filing taxes has become the norm for many individuals and businesses, and for good reason. It's faster, more accurate, and often more convenient than traditional paper filing. However, navigating the e-filing process can be daunting, especially for those who are new to it. That's where Form 8453 comes in – a crucial component of the e-filing process that can help ensure your tax return is filed correctly and efficiently.

The importance of e-filing cannot be overstated. Not only does it save time and reduce errors, but it also provides faster refunds and better record-keeping. In fact, according to the IRS, e-filing can reduce errors by up to 20% and provide refunds in as little as 8 days. Moreover, with the increasing complexity of tax laws and regulations, e-filing can help ensure compliance and reduce the risk of audits.

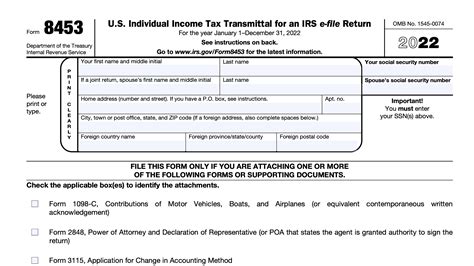

What is Form 8453?

Form 8453, also known as the Declaration for an IRS e-file Return, is a document that accompanies your e-filed tax return. It serves as a declaration that you, the taxpayer, have reviewed and approved the contents of your tax return before submitting it electronically. The form is typically prepared and signed by your tax professional or software provider, but it's essential to understand its contents and significance.

Why is Form 8453 necessary?

Form 8453 is necessary for several reasons:

- It verifies your identity and confirms that you have authorized the e-filing of your tax return.

- It ensures that you have reviewed and approved the contents of your tax return, reducing errors and discrepancies.

- It provides a paper trail, in case of an audit or review, to demonstrate that you have complied with tax laws and regulations.

How to Complete Form 8453

Completing Form 8453 is relatively straightforward. Here's a step-by-step guide:

- Gather required information, including your name, address, Social Security number or Employer Identification Number (EIN), and tax return information.

- Review your tax return carefully, ensuring accuracy and completeness.

- Sign and date the form, acknowledging that you have reviewed and approved the contents of your tax return.

- Attach any required supporting documentation, such as W-2s or 1099s.

E-Filing with Form 8453: Benefits and Advantages

E-filing with Form 8453 offers numerous benefits and advantages, including:

- Faster refunds: E-filing can provide refunds in as little as 8 days, compared to 6-8 weeks for paper filing.

- Reduced errors: E-filing can reduce errors by up to 20%, minimizing the risk of delays or audits.

- Increased security: E-filing is a secure process, reducing the risk of identity theft or data breaches.

- Environmental benefits: E-filing reduces paper waste and minimizes the carbon footprint of the tax filing process.

Common Mistakes to Avoid

When completing Form 8453, it's essential to avoid common mistakes, including:

- Inaccurate or incomplete information

- Failure to sign or date the form

- Insufficient supporting documentation

- Failure to review and approve the tax return contents

Conclusion: Simplifying the E-Filing Process with Form 8453

Form 8453 is a critical component of the e-filing process, ensuring accuracy, security, and compliance. By understanding the importance of Form 8453 and following the instructions outlined above, you can simplify the e-filing process and enjoy the benefits of faster refunds, reduced errors, and increased security.

We invite you to share your experiences with Form 8453 and e-filing in the comments below. If you have any questions or concerns, please don't hesitate to reach out. By working together, we can make the tax filing process easier, faster, and more efficient for everyone.

What is Form 8453 used for?

+Form 8453 is used to declare that you, the taxpayer, have reviewed and approved the contents of your e-filed tax return.

Who prepares and signs Form 8453?

+Form 8453 is typically prepared and signed by your tax professional or software provider.

What are the benefits of e-filing with Form 8453?

+E-filing with Form 8453 offers faster refunds, reduced errors, increased security, and environmental benefits.