Filing an accident claim can be a daunting task, especially when dealing with the aftermath of an unexpected event. However, having the right guidance can make all the difference in ensuring a smooth and successful claims process. If you're a Trustmark policyholder, understanding how to complete the Trustmark accident claim form is crucial in getting the compensation you deserve. In this article, we'll walk you through a step-by-step guide on how to fill out the Trustmark accident claim form, highlighting key sections, requirements, and tips to keep in mind.

What is the Trustmark Accident Claim Form?

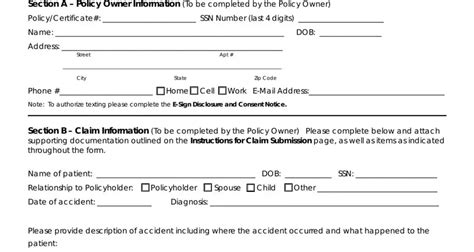

The Trustmark accident claim form is a document required by Trustmark to process claims related to accidents or injuries. The form collects essential information about the incident, including details about the policyholder, the accident, and the resulting damages or injuries. It's crucial to fill out the form accurately and thoroughly to ensure a fair and efficient claims process.

Preparation is Key

Before starting the claims process, gather all necessary documents and information related to the accident. This may include:

- Policy documents and details

- Accident reports or police reports

- Medical records and bills

- Witness statements or contact information

- Photos or videos of the accident scene or damages

Having these documents ready will save you time and reduce the likelihood of delays in the claims process.

Step 1: Policyholder Information

The first section of the Trustmark accident claim form requires policyholder information. This includes:

- Name and contact details

- Policy number and type

- Address and date of birth

Ensure all information is accurate and up-to-date to avoid any potential issues with the claims process.

Step 2: Accident Details

This section requires a detailed description of the accident, including:

- Date, time, and location of the incident

- Description of the accident or injury

- List of parties involved (including witnesses)

- Details of any property damage or loss

Be as thorough as possible when describing the accident, and include any relevant supporting documentation.

Step 3: Damages or Injuries

In this section, you'll need to provide information about the damages or injuries sustained as a result of the accident. This may include:

- Medical records and bills

- Details of any property damage or loss

- List of any ongoing medical treatment or therapy

Ensure you provide accurate and detailed information to support your claim.

Step 4: Supporting Documentation

This section requires you to attach supporting documentation to your claim form. This may include:

- Medical records and bills

- Police reports or accident reports

- Witness statements or contact information

- Photos or videos of the accident scene or damages

Ensure all documentation is complete, accurate, and relevant to your claim.

Step 5: Submission and Follow-Up

Once you've completed the Trustmark accident claim form, submit it to Trustmark along with all supporting documentation. Ensure you keep a copy of the form and supporting documents for your records.

After submitting your claim, Trustmark will review and process your application. You may be contacted for additional information or to clarify certain details. Keep track of your claim's progress and follow up with Trustmark if you have any questions or concerns.

Conclusion: Take Control of Your Claim

Filing an accident claim can be a complex and time-consuming process, but with the right guidance, you can take control of your claim and ensure a successful outcome. By following this step-by-step guide to completing the Trustmark accident claim form, you'll be well on your way to getting the compensation you deserve.

Remember to stay organized, provide accurate and detailed information, and follow up with Trustmark to ensure a smooth claims process.

We encourage you to share your experiences, tips, or questions related to the Trustmark accident claim form in the comments below. Your feedback can help others navigate the claims process and ensure a more efficient and successful outcome.

What is the purpose of the Trustmark accident claim form?

+The Trustmark accident claim form is used to collect essential information about an accident or injury, including details about the policyholder, the accident, and the resulting damages or injuries.

What documents do I need to support my claim?

+You'll need to provide supporting documentation, such as medical records and bills, police reports or accident reports, witness statements or contact information, and photos or videos of the accident scene or damages.

How long does the claims process typically take?

+The length of the claims process can vary depending on the complexity of the claim and the availability of supporting documentation. Trustmark will review and process your application as efficiently as possible.