Financial planning and management can be a daunting task, especially when it comes to making decisions about your money and assets. One of the tools that financial expert Dave Ramsey recommends using is a Power of Attorney (POA) form. In this article, we will explore five ways that Dave Ramsey uses Power of Attorney forms to help individuals manage their finances and achieve their financial goals.

Understanding Power of Attorney Forms

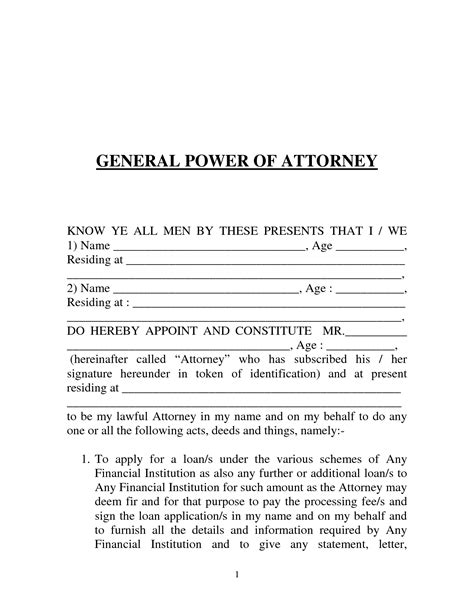

Before we dive into the five ways that Dave Ramsey uses Power of Attorney forms, let's take a moment to understand what a POA form is and how it works. A Power of Attorney form is a legal document that allows you to appoint someone to make decisions on your behalf. This person, known as your agent or attorney-in-fact, can manage your financial affairs, make medical decisions, and even handle your business transactions.

Why Dave Ramsey Recommends Using Power of Attorney Forms

Dave Ramsey recommends using Power of Attorney forms for several reasons. First, it allows you to plan for the unexpected. Life is full of surprises, and a POA form ensures that someone you trust can make decisions on your behalf if you are unable to do so. Second, it provides peace of mind. Knowing that someone is looking out for your best interests can be a huge relief. Finally, it helps to avoid court intervention. If you become incapacitated and don't have a POA form in place, the court may need to intervene, which can be time-consuming and costly.

5 Ways Dave Ramsey Uses Power of Attorney Forms

Now that we understand the benefits of using Power of Attorney forms, let's take a look at five ways that Dave Ramsey uses them to help individuals manage their finances.

1. Financial Planning

One of the ways that Dave Ramsey uses Power of Attorney forms is to help individuals plan for their financial futures. By appointing a trusted agent, you can ensure that your financial wishes are carried out even if you are unable to make decisions. This can include managing investments, paying bills, and making financial decisions.

- Creating a comprehensive financial plan

- Identifying financial goals and objectives

- Assigning a trusted agent to carry out financial wishes

2. Emergency Preparedness

Dave Ramsey also recommends using Power of Attorney forms as part of an emergency preparedness plan. By having a POA form in place, you can ensure that someone is able to make decisions on your behalf in the event of an emergency. This can include accessing medical records, making financial decisions, and even handling business transactions.

- Creating an emergency fund

- Identifying potential emergencies

- Assigning a trusted agent to make decisions in the event of an emergency

3. Estate Planning

Power of Attorney forms can also be used as part of an estate planning strategy. By appointing a trusted agent, you can ensure that your estate is managed according to your wishes. This can include managing assets, paying taxes, and distributing inheritance.

- Creating a comprehensive estate plan

- Identifying assets and debts

- Assigning a trusted agent to manage the estate

4. Business Planning

Dave Ramsey also recommends using Power of Attorney forms as part of a business planning strategy. By appointing a trusted agent, you can ensure that your business is managed according to your wishes. This can include making financial decisions, handling business transactions, and even managing employees.

- Creating a comprehensive business plan

- Identifying business goals and objectives

- Assigning a trusted agent to manage the business

5. Disability Planning

Finally, Power of Attorney forms can be used as part of a disability planning strategy. By appointing a trusted agent, you can ensure that someone is able to make decisions on your behalf if you become disabled. This can include managing finances, accessing medical records, and even handling business transactions.

- Creating a comprehensive disability plan

- Identifying potential disabilities

- Assigning a trusted agent to make decisions in the event of a disability

Take Action

In conclusion, Power of Attorney forms are an important tool for managing your finances and achieving your financial goals. By understanding the benefits of using POA forms and following the five ways that Dave Ramsey uses them, you can ensure that your financial wishes are carried out even if you are unable to make decisions.

We encourage you to take action today and start planning for the unexpected. Consider creating a comprehensive financial plan, identifying potential emergencies, and assigning a trusted agent to make decisions on your behalf.

Don't wait until it's too late. Take control of your finances and start building a brighter financial future.

Share Your Thoughts

We would love to hear from you. Have you used a Power of Attorney form in the past? Do you have any questions about how to use POA forms? Share your thoughts and experiences in the comments below.

Get Started

Ready to get started with creating a Power of Attorney form? Check out our resources page for more information and tips on how to create a comprehensive POA form.

FAQ Section

What is a Power of Attorney form?

+A Power of Attorney form is a legal document that allows you to appoint someone to make decisions on your behalf.

Why do I need a Power of Attorney form?

+A Power of Attorney form provides peace of mind, allows you to plan for the unexpected, and helps to avoid court intervention.

How do I create a Power of Attorney form?

+Check out our resources page for more information and tips on how to create a comprehensive POA form.