Direct deposit is a convenient way to receive payments, including paychecks, tax refunds, and government benefits, directly into your bank account. Wells Fargo, one of the largest banks in the United States, offers direct deposit services to its customers. To set up direct deposit, you'll need to complete a Wells Fargo Direct Deposit Authorization Form. In this article, we'll guide you through the process of filling out the form and answer some frequently asked questions.

What is the Wells Fargo Direct Deposit Authorization Form?

The Wells Fargo Direct Deposit Authorization Form is a document that allows you to authorize your employer or a government agency to deposit payments directly into your Wells Fargo account. The form typically requires your personal and account information, as well as the details of the deposit you're authorizing.

Benefits of Direct Deposit

Direct deposit offers several benefits, including:

- Convenience: Direct deposit saves you the hassle of physically depositing a check or waiting in line to cash it.

- Speed: Direct deposit is usually faster than traditional check deposit methods.

- Security: Direct deposit reduces the risk of lost or stolen checks.

- Flexibility: You can choose to have your payments deposited into different accounts, such as a checking or savings account.

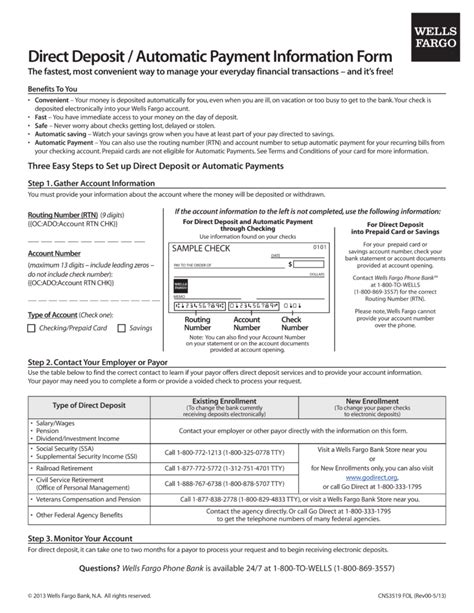

How to Fill Out the Wells Fargo Direct Deposit Authorization Form

To fill out the Wells Fargo Direct Deposit Authorization Form, follow these steps:

- Download the form from the Wells Fargo website or obtain a copy from your employer or a government agency.

- Fill out the form with your personal information, including your name, address, and Social Security number.

- Provide your Wells Fargo account information, including your account number and routing number.

- Specify the type of deposit you're authorizing, such as payroll or government benefits.

- Choose the account you want the deposit to go into, such as a checking or savings account.

- Sign and date the form.

Required Information

To complete the form, you'll need to provide the following information:

- Your name and address

- Your Social Security number

- Your Wells Fargo account number and routing number

- The type of deposit you're authorizing

- The account you want the deposit to go into

Common Questions About the Wells Fargo Direct Deposit Authorization Form

Here are some common questions about the Wells Fargo Direct Deposit Authorization Form:

- Q: Do I need to fill out a separate form for each type of deposit? A: No, you can authorize multiple types of deposits on a single form.

- Q: Can I change my account information after I've submitted the form? A: Yes, you can update your account information by contacting Wells Fargo or your employer.

- Q: Is direct deposit available for all types of payments? A: No, direct deposit is not available for all types of payments. Check with your employer or a government agency to see if direct deposit is an option.

Tips for Filling Out the Form

Here are some tips for filling out the Wells Fargo Direct Deposit Authorization Form:

- Make sure to fill out the form completely and accurately.

- Use a pen to sign the form, as this is a requirement.

- Keep a copy of the form for your records.

- If you have any questions, contact Wells Fargo or your employer for assistance.

Conclusion

The Wells Fargo Direct Deposit Authorization Form is a straightforward document that allows you to authorize direct deposit payments into your Wells Fargo account. By following the steps outlined above and providing the required information, you can complete the form and start enjoying the benefits of direct deposit.

What is the benefit of using direct deposit?

+Direct deposit offers several benefits, including convenience, speed, security, and flexibility.

How do I obtain a Wells Fargo Direct Deposit Authorization Form?

+You can download the form from the Wells Fargo website or obtain a copy from your employer or a government agency.

Can I change my account information after I've submitted the form?

+Yes, you can update your account information by contacting Wells Fargo or your employer.