In today's world, charitable organizations play a vital role in addressing various social issues, from poverty and education to human rights and environmental conservation. One such organization that has gained significant attention in recent years is Operation Underground Railroad (O.U.R.). Founded in 2013 by Tim Ballard, O.U.R. is a non-profit organization that aims to combat human trafficking and provide support to its victims. Like all non-profit organizations in the United States, O.U.R. is required to file an annual Form 990 with the Internal Revenue Service (IRS). This form provides valuable insights into the organization's financial transparency, governance, and operational efficiency.

Understanding Form 990

Form 990 is an annual information return that most tax-exempt organizations, including charities and non-profits, are required to file with the IRS. The form provides information about the organization's financial activities, governance, and compliance with tax laws. It is an essential tool for donors, researchers, and the general public to assess an organization's transparency, accountability, and effectiveness.

What Information Does Form 990 Provide?

Form 990 provides a wealth of information about a non-profit organization, including:

- Financial information: income, expenses, assets, liabilities, and fundraising activities

- Governance: board composition, compensation, and governance policies

- Program activities: descriptions of the organization's programs, services, and accomplishments

- Compliance: disclosure of any non-compliance issues, such as unrelated business income or excess benefit transactions

Operation Underground Railroad's Form 990: Key Takeaways

O.U.R.'s Form 990 filings provide valuable insights into the organization's financial transparency, governance, and program activities. Here are some key takeaways from their most recent filings:

- Financial growth: O.U.R.'s total revenue has grown significantly over the years, from $1.4 million in 2014 to $34.5 million in 2020.

- Program expenses: The majority of O.U.R.'s expenses are allocated towards program activities, including rescue operations, victim support, and education and awareness initiatives.

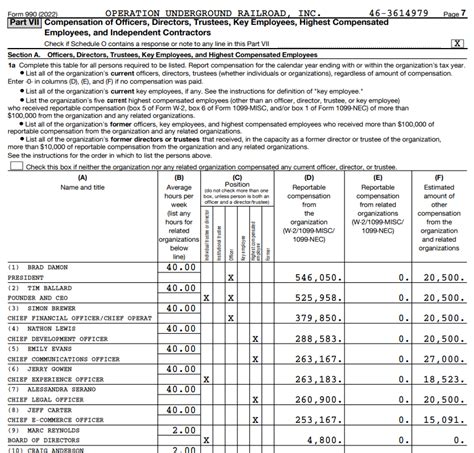

- Governance: O.U.R.'s board of directors consists of experienced professionals with expertise in law enforcement, human trafficking, and non-profit management.

- Compensation: O.U.R.'s CEO, Tim Ballard, received a total compensation package of $235,000 in 2020, which is relatively modest compared to other non-profit CEOs.

Transparency and Accountability

O.U.R.'s Form 990 filings demonstrate a high level of transparency and accountability. The organization provides detailed information about its financial activities, governance, and program activities, making it easier for donors and stakeholders to assess its effectiveness.

However, like any non-profit organization, O.U.R. is not immune to criticism. Some have raised concerns about the organization's fundraising practices, governance, and lack of transparency regarding its rescue operations.

Best Practices for Non-Profit Transparency

Non-profit organizations can learn from O.U.R.'s example by adopting best practices for transparency and accountability. Here are some key takeaways:

- Clear and concise financial reporting: Provide detailed information about financial activities, including income, expenses, and fundraising activities.

- Governance transparency: Disclose information about board composition, compensation, and governance policies.

- Program transparency: Provide detailed information about program activities, including descriptions of services, accomplishments, and challenges.

- Regular auditing and evaluation: Conduct regular audits and evaluations to ensure compliance with tax laws and best practices.

Conclusion

Operation Underground Railroad's Form 990 filings provide valuable insights into the organization's financial transparency, governance, and program activities. While O.U.R. has demonstrated a high level of transparency and accountability, there is always room for improvement. By adopting best practices for non-profit transparency, organizations can build trust with donors and stakeholders, ultimately achieving greater impact and effectiveness.

We invite you to share your thoughts on non-profit transparency and accountability. How do you assess an organization's transparency and effectiveness? What best practices do you think non-profits should adopt to build trust with donors and stakeholders?

What is Form 990?

+Form 990 is an annual information return that most tax-exempt organizations, including charities and non-profits, are required to file with the IRS.

What information does Form 990 provide?

+Form 990 provides information about an organization's financial activities, governance, and compliance with tax laws.

How can I access Operation Underground Railroad's Form 990 filings?

+O.U.R.'s Form 990 filings are publicly available on the IRS website or through third-party databases such as GuideStar or Charity Navigator.