The complexities of insurance policies and retirement plans can be overwhelming, especially when it comes to making important decisions about your financial future. One crucial aspect of managing your retirement savings is understanding how to withdraw from your Corebridge account. Completing a Corebridge withdrawal form is a significant step in accessing your hard-earned savings. In this article, we will guide you through the process with clarity and precision, ensuring you are well-equipped to navigate this critical financial decision.

Understanding the Importance of Corebridge Withdrawal

Before we delve into the steps of completing a Corebridge withdrawal form, it's essential to grasp the significance of this process. Withdrawing from your Corebridge account allows you to access funds you've contributed over the years, providing financial support during retirement or in times of need. However, it's crucial to understand the implications of withdrawal, including any potential penalties or tax implications.

5 Steps to Complete Corebridge Withdrawal Form

Step 1: Review Your Account Details

Begin by reviewing your Corebridge account details to ensure you have a clear understanding of your current balance, investment options, and any associated fees. This step is crucial in making informed decisions about your withdrawal.

- Verify your account balance: Log in to your Corebridge account online or contact their customer service to confirm your current balance.

- Understand your investment options: Familiarize yourself with the investment options within your account, as this will impact your withdrawal decisions.

- Be aware of fees: Note any fees associated with your account, including management fees, administrative fees, and potential withdrawal penalties.

Step 2: Determine Your Withdrawal Amount

Decide on the amount you wish to withdraw from your Corebridge account. This decision should be based on your financial needs and goals, taking into account any potential tax implications and penalties.

- Assess your financial needs: Consider why you need to withdraw funds and how much you require to meet your financial obligations or goals.

- Consider tax implications: Understand the tax implications of your withdrawal. You may need to consult with a financial advisor or tax professional to make an informed decision.

- Evaluate penalties: Be aware of any potential penalties for early withdrawal, especially if you are under a certain age.

Step 3: Choose Your Withdrawal Options

Corebridge may offer various withdrawal options, including lump-sum payments, periodic payments, or annuity options. Select the option that best aligns with your financial goals and needs.

- Lump-sum payments: Receiving your withdrawal in a single payment.

- Periodic payments: Withdrawing funds at regular intervals over a set period.

- Annuity options: Purchasing an annuity to provide a guaranteed income stream.

Step 4: Complete the Withdrawal Form

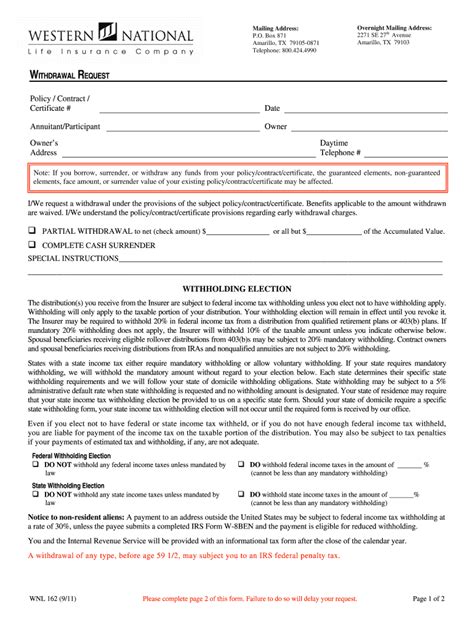

Once you've decided on the amount and type of withdrawal, you'll need to complete the Corebridge withdrawal form. This form will require detailed information about your withdrawal preferences and may need to be accompanied by additional documentation.

- Gather required documents: Ensure you have all necessary documents, such as identification and proof of age.

- Fill out the form accurately: Carefully complete the withdrawal form, ensuring all information is accurate and complete.

- Submit the form: Return the form to Corebridge according to their instructions, which may include online submission, mail, or fax.

Step 5: Review and Confirm Your Withdrawal

After submitting your withdrawal form, review the details of your withdrawal request to ensure everything is correct. Confirm your withdrawal with Corebridge and await the processing of your request.

- Review your request: Double-check the amount, type of withdrawal, and any other details to ensure accuracy.

- Confirm with Corebridge: Verify that Corebridge has received your request and understand the timeline for processing.

- Await processing: Wait for Corebridge to process your withdrawal request, which may take several weeks.

Tips for a Smooth Withdrawal Process

- Plan ahead: Allow sufficient time for the withdrawal process to avoid any delays or complications.

- Seek professional advice: If unsure about any aspect of the withdrawal process, consider consulting a financial advisor.

- Keep records: Maintain a record of your withdrawal request and any subsequent communications with Corebridge.

Preparing for the Future

Completing a Corebridge withdrawal form is a significant step in managing your retirement savings. By understanding the importance of this process and following the outlined steps, you can ensure a smooth transition and secure your financial future.

Now that you've completed the Corebridge withdrawal form, take a moment to reflect on your financial goals and how this withdrawal aligns with your overall strategy. Consider seeking the advice of a financial professional to optimize your retirement planning.

Encouraging Engagement

We hope this comprehensive guide has provided you with the necessary insights to navigate the Corebridge withdrawal process with confidence. Share your experiences or ask questions in the comments section below. Your feedback is invaluable in helping others make informed decisions about their financial futures.

What is the typical processing time for a Corebridge withdrawal?

+The processing time for a Corebridge withdrawal can vary, but it typically takes several weeks. It's essential to plan ahead and allow sufficient time for the withdrawal process to avoid any delays or complications.

Can I withdraw from my Corebridge account at any time?

+While it's possible to withdraw from your Corebridge account, there may be penalties for early withdrawal, especially if you are under a certain age. It's crucial to understand these implications before making a withdrawal decision.

Do I need to consult a financial advisor before withdrawing from my Corebridge account?

+While not mandatory, consulting a financial advisor can provide valuable insights and help you make an informed decision about your withdrawal. They can assist in understanding the tax implications, potential penalties, and how the withdrawal aligns with your overall financial goals.