Aviva is one of the largest insurance companies in the UK, providing a range of financial services including pensions. If you're an Aviva pension holder looking to withdraw funds from your pension pot, you'll need to complete the Aviva pension withdrawal form. In this article, we'll guide you through the step-by-step process of filling out the form and provide essential information to help you make informed decisions about your pension.

Aviva pension withdrawal is a significant financial decision that can impact your retirement income. It's crucial to understand the rules and regulations surrounding pension withdrawals and the potential tax implications. Before we dive into the form-filling process, let's explore the basics of Aviva pension withdrawal.

Understanding Aviva Pension Withdrawal

Aviva pension withdrawal allows you to access your pension funds from the age of 55. You can withdraw up to 25% of your pension pot tax-free, and the remaining amount will be subject to income tax. There are different types of pension withdrawal options available, including:

- Tax-free lump sum: You can withdraw up to 25% of your pension pot tax-free.

- Income drawdown: You can withdraw a regular income from your pension pot while leaving the remaining funds invested.

- Annuity: You can purchase an annuity, which provides a guaranteed income for life in exchange for your pension pot.

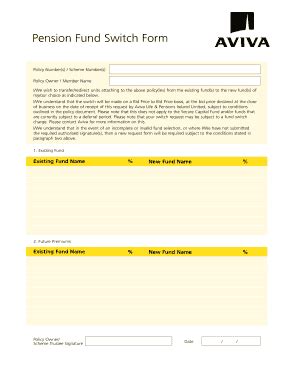

Aviva Pension Withdrawal Form: A Step-By-Step Guide

To withdraw funds from your Aviva pension, you'll need to complete the Aviva pension withdrawal form. Here's a step-by-step guide to help you fill out the form:

- Section 1: Personal Details

- Provide your personal details, including your name, date of birth, and National Insurance number.

- Ensure you have your Aviva pension policy number and account details to hand.

- Section 2: Withdrawal Options

- Choose the type of withdrawal you want to make: tax-free lump sum, income drawdown, or annuity.

- Specify the amount you want to withdraw or the income you want to receive.

- Section 3: Tax Information

- Provide your tax details, including your tax residence and National Insurance number.

- Aviva will use this information to determine the tax implications of your withdrawal.

- Section 4: Investment Options

- If you're opting for income drawdown, you'll need to choose how you want to invest your remaining pension funds.

- Aviva offers a range of investment options, including managed funds and self-invested personal pensions (SIPPs).

- Section 5: Payment Details

- Provide your bank account details to receive your pension withdrawal.

- Ensure you have the correct account details to avoid any delays or errors.

Additional Information and Requirements

In addition to completing the Aviva pension withdrawal form, you may need to provide additional information and supporting documentation. This can include:

- Proof of identity and address

- Tax returns and P60 forms

- Pension statements and policy documents

It's essential to carefully review the form and ensure you've provided all the required information to avoid any delays or errors.

Aviva Pension Withdrawal Rules and Regulations

Aviva pension withdrawal is subject to various rules and regulations. Here are some key things to consider:

- Tax implications: Pension withdrawals are subject to income tax, and you may need to pay tax on the amount you withdraw.

- Pension freedoms: You can withdraw up to 25% of your pension pot tax-free from the age of 55.

- State pension: Your state pension entitlement may be affected by your pension withdrawal.

It's essential to understand the rules and regulations surrounding Aviva pension withdrawal to make informed decisions about your retirement income.

Conclusion: Taking Control of Your Aviva Pension

Withdrawing funds from your Aviva pension can be a complex process, but by following this step-by-step guide, you can ensure you're making the most of your retirement income. Remember to carefully review the Aviva pension withdrawal form and provide all the required information to avoid any delays or errors.

If you're unsure about any aspect of the form or the withdrawal process, it's recommended that you consult with a financial advisor or seek guidance from Aviva's customer support team.

Take control of your Aviva pension today and start planning for a secure and comfortable retirement.

Call to Action: Share your experiences or ask questions about Aviva pension withdrawal in the comments section below.