Filing taxes can be a daunting task, especially for non-residents who need to navigate the complexities of California's tax laws. As a non-resident, you may be wondering how to accurately complete the California Non-Resident Tax Form 540NR. In this comprehensive guide, we will walk you through the instructions and provide valuable insights to ensure you comply with the state's tax requirements.

Understanding the California Non-Resident Tax Form 540NR

The California Non-Resident Tax Form 540NR is used by non-resident individuals who have income sourced from California. This includes individuals who are not residents of California but have income from California sources, such as:

- Renting out a California property

- Selling California real estate

- Receiving California-sourced income from a partnership or S corporation

- Having a job or business in California

Gathering Required Documents

Before starting the filing process, make sure you have the necessary documents:

- A copy of your federal income tax return (Form 1040)

- W-2 forms from California employers

- 1099 forms for California-sourced income

- K-1 forms for partnership or S corporation income

- Any other relevant tax documents

Completing the California Non-Resident Tax Form 540NR

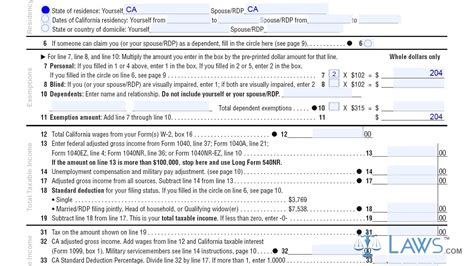

The Form 540NR consists of several sections, which we will outline below:

Section 1: Personal Information

- Provide your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN)

- Check the box indicating you are a non-resident

Section 2: Income

- Report your California-sourced income from W-2 forms, 1099 forms, and K-1 forms

- Calculate your total California income

Section 3: Adjustments to Income

- Claim any adjustments to income, such as alimony paid or educator expenses

Section 4: Deductions

- Claim standard deductions or itemize deductions

- Calculate your total deductions

Section 5: Credits

- Claim any credits, such as the California Earned Income Tax Credit (CalEITC)

Section 6: Tax Computation

- Calculate your California tax liability

- Apply any credits or deductions

Additional Requirements and Forms

Depending on your specific situation, you may need to complete additional forms or schedules, such as:

- Schedule CA (540NR): California Adjustments

- Schedule D (540NR): Capital Gains and Losses

- Form 3519: Payment Voucher for Individual e-filed Returns

Submission and Payment Options

You can submit your Form 540NR electronically or by mail. If you owe taxes, you can pay online, by phone, or by check.

E-File Options

- E-file through the California Franchise Tax Board (FTB) website

- Use tax preparation software, such as TurboTax or H&R Block

Mail Options

- Mail your completed Form 540NR to the FTB address listed on the form

Payment Options

- Pay online through the FTB website

- Call the FTB payment hotline

- Mail a check with your payment voucher

Tips and Reminders

- Make sure to file your Form 540NR by the tax filing deadline to avoid penalties and interest

- Keep accurate records of your California-sourced income and expenses

- Consult a tax professional if you have complex tax situations or questions

Conclusion

Filing the California Non-Resident Tax Form 540NR requires attention to detail and accuracy. By following this guide, you'll be well-equipped to navigate the process and ensure compliance with California's tax laws. Remember to gather all necessary documents, complete the form accurately, and submit it by the deadline. If you have any questions or concerns, don't hesitate to reach out to a tax professional or the FTB.

FAQ Section

What is the deadline for filing Form 540NR?

+The deadline for filing Form 540NR is typically April 15th, but it may vary depending on your specific situation. Check the FTB website for the most up-to-date information.

Do I need to file Form 540NR if I don't owe taxes?

+Yes, you still need to file Form 540NR even if you don't owe taxes. This ensures you report your California-sourced income and comply with state tax laws.

Can I e-file Form 540NR?

+Yes, you can e-file Form 540NR through the FTB website or using tax preparation software. E-filing is a convenient and efficient way to submit your tax return.