Filing taxes can be a daunting task, especially for West Virginia residents who are required to file the IT-140 form. The IT-140 is the West Virginia Individual Income Tax Return, and it's used to report an individual's income, deductions, and credits. To ensure a smooth and successful filing process, here are five tips to keep in mind.

Understand Your Filing Status

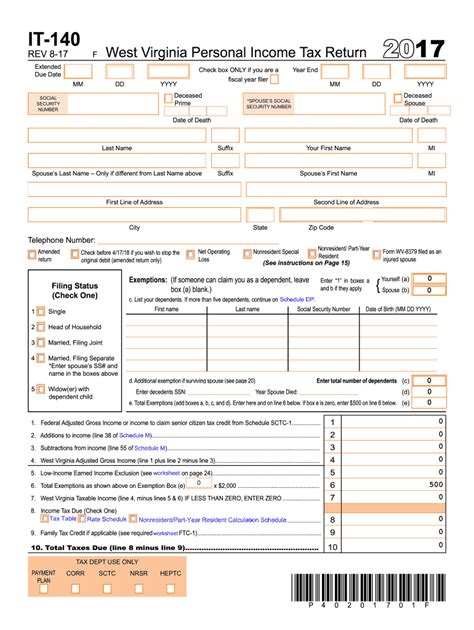

Before you start filling out the IT-140 form, it's essential to understand your filing status. Your filing status determines which deductions and credits you're eligible for, as well as the tax rates that apply to your income. The most common filing statuses for the IT-140 form are single, married filing jointly, married filing separately, head of household, and qualifying widow(er).

Filing Status Options

- Single: You're unmarried or considered unmarried on the last day of the tax year.

- Married filing jointly: You're married and filing a joint return with your spouse.

- Married filing separately: You're married but filing separate returns.

- Head of household: You're unmarried or considered unmarried on the last day of the tax year and have paid more than half the cost of keeping up a home for the year.

- Qualifying widow(er): You're a widow or widower with dependent children and meet specific requirements.

Gather Required Documents

To complete the IT-140 form accurately, you'll need to gather various documents, including:

- W-2 forms from your employer(s)

- 1099 forms for freelance work, interest, dividends, and capital gains

- Receipts for itemized deductions, such as medical expenses, mortgage interest, and charitable donations

- Records of West Virginia state income tax withheld

- Social Security number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and dependents

Additional Documents

- If you're claiming the Earned Income Tax Credit (EITC), you'll need to provide proof of income and expenses.

- If you're claiming the Child Tax Credit, you'll need to provide the Social Security number or ITIN for each qualifying child.

- If you're claiming itemized deductions, you'll need to provide receipts and records to support your claims.

Choose the Right Filing Method

You can file the IT-140 form electronically or by mail. Electronic filing is faster and more convenient, but you'll need to use tax preparation software that's approved by the West Virginia State Tax Department.

E-Filing Options

- Use tax preparation software, such as TurboTax or H&R Block, to prepare and e-file your IT-140 form.

- Use the West Virginia State Tax Department's free e-file option, if you're eligible.

Mailing Your Return

- Make sure to sign and date your return.

- Attach all required documents and schedules.

- Use the correct mailing address: West Virginia State Tax Department, PO Box 3781, Charleston, WV 25337.

Take Advantage of Tax Credits and Deductions

West Virginia offers various tax credits and deductions to reduce your tax liability. Some of the most common credits and deductions include:

- West Virginia Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education Savings Incentive Credit

- Mortgage Interest Credit

- Charitable Contributions Deduction

Other Credits and Deductions

- Adopted Child Tax Credit

- Education Expenses Deduction

- Medical Expenses Deduction

- Home Office Deduction

Seek Professional Help, If Needed

If you're unsure about how to complete the IT-140 form or need help with tax preparation, consider seeking professional help. You can hire a tax professional or use tax preparation software that offers guidance and support.

Free Resources

- West Virginia State Tax Department's website:

- IRS website:

- Tax preparation software, such as TurboTax or H&R Block, offer free resources and guidance.

By following these five tips, you can ensure a successful and stress-free IT-140 filing experience.

What is the deadline for filing the IT-140 form?

+The deadline for filing the IT-140 form is April 15th of each year.

Can I e-file my IT-140 form?

+What is the penalty for late filing?

+The penalty for late filing is 5% of the unpaid tax due for each month or part of a month, up to a maximum of 25%.